Inbox: RCB bullish auf Andritz

Andritz

Uhrzeit: 07:20:48

Veränderung zu letztem SK: 0.04%

Letzter SK: 62.80 ( -2.26%)

voestalpine

Uhrzeit: 07:19:28

Veränderung zu letztem SK: -1.43%

Letzter SK: 38.40 ( 1.86%)

03.01.2018

Zugemailt von / gefunden bei: RCB (BSN-Hinweis: Lauftext im Original des Aussenders, Titel (immer) und Bebilderung (oft) durch boerse-social.com aus dem Fotoarchiv von photaq.com)

Andritz raised to BUY, TP EUR 54.0 - Price rally could finally end large pulp mill hiatus

- Chinese demand has fuelled last year's pulp price rally; considerable price increases could spur new pulp mill investment, especially given the drop in confirmed additions from 2019 onwards

- We believe that the large pulp mill order hiatus could finally come to an end in 2018e

- We remain cautious on Hydro and Metals

- We raise our price target to EUR 54 (from EUR 50) on a better mid-term earnings outlook and lift our recommendation to BUY from HOLD

Companies im Artikel

Show latest Report (23.12.2017)

Show latest Report (30.12.2017)

9242

rcb_bullish_auf_andritz

Aktien auf dem Radar:VIG, UBM, Zumtobel, Pierer Mobility, Flughafen Wien, Rosenbauer, ATX, ATX TR, ATX NTR, Erste Group, RBI, OMV, AT&S, CA Immo, Lenzing, Andritz, Porr, BKS Bank Stamm, Oberbank AG Stamm, Warimpex, Amag, Österreichische Post, Strabag, Telekom Austria, Münchener Rück.

(BSN-Hinweis: Lauftext im Original des Aussenders, Titel (immer) und Bebilderung (oft) durch boerse-social.com aus dem Fotoarchiv von photaq.com)193697

inbox_rcb_bullish_auf_andritz

Random Partner #goboersewien

Baader Bank

Die Baader Bank ist eine der führenden familiengeführten Investmentbanken im deutschsprachigen Raum. Die beiden Säulen des Baader Bank Geschäftsmodells sind Market Making und Investment Banking. Als Spezialist an den Börsenplätzen Deutschland, Österreich und der Schweiz handelt die Baader Bank über 800.000 Finanzinstrumente.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/goboersewien

Inbox: RCB bullish auf Andritz

03.01.2018, 5455 Zeichen

03.01.2018

Zugemailt von / gefunden bei: RCB (BSN-Hinweis: Lauftext im Original des Aussenders, Titel (immer) und Bebilderung (oft) durch boerse-social.com aus dem Fotoarchiv von photaq.com)

Andritz raised to BUY, TP EUR 54.0 - Price rally could finally end large pulp mill hiatus

- Chinese demand has fuelled last year's pulp price rally; considerable price increases could spur new pulp mill investment, especially given the drop in confirmed additions from 2019 onwards

- We believe that the large pulp mill order hiatus could finally come to an end in 2018e

- We remain cautious on Hydro and Metals

- We raise our price target to EUR 54 (from EUR 50) on a better mid-term earnings outlook and lift our recommendation to BUY from HOLD

Companies im Artikel

Show latest Report (23.12.2017)

Show latest Report (30.12.2017)

9242

rcb_bullish_auf_andritz

Was noch interessant sein dürfte:

kapitalmarkt-stimme.at daily voice: Frequentis setzt sich beim Jugendwort des Jahres gegen Andritz und Verbund durch, Schade um 6B47

Andritz

Uhrzeit: 07:20:48

Veränderung zu letztem SK: 0.04%

Letzter SK: 62.80 ( -2.26%)

voestalpine

Uhrzeit: 07:19:28

Veränderung zu letztem SK: -1.43%

Letzter SK: 38.40 ( 1.86%)

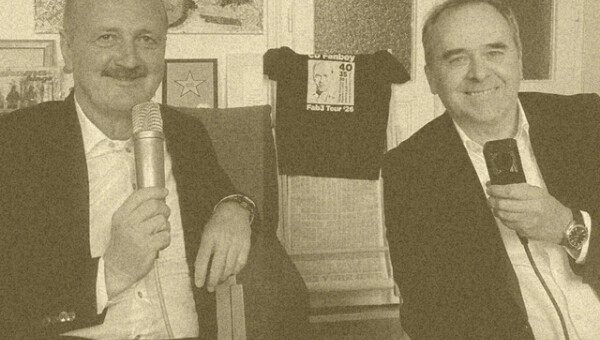

Bildnachweis

1.

Andritz

, (© finanzmarktfoto.at/Martina Draper) >> Öffnen auf photaq.com

Aktien auf dem Radar:VIG, UBM, Zumtobel, Pierer Mobility, Flughafen Wien, Rosenbauer, ATX, ATX TR, ATX NTR, Erste Group, RBI, OMV, AT&S, CA Immo, Lenzing, Andritz, Porr, BKS Bank Stamm, Oberbank AG Stamm, Warimpex, Amag, Österreichische Post, Strabag, Telekom Austria, Münchener Rück.

Random Partner

Baader Bank

Die Baader Bank ist eine der führenden familiengeführten Investmentbanken im deutschsprachigen Raum. Die beiden Säulen des Baader Bank Geschäftsmodells sind Market Making und Investment Banking. Als Spezialist an den Börsenplätzen Deutschland, Österreich und der Schweiz handelt die Baader Bank über 800.000 Finanzinstrumente.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wie Delivery Hero, Noratis, Patrizia Immobilien, ...

- Wie Wirecard, Nordex, Manz, SMA Solar, bet-at-hom...

- Wie Nike, Caterpillar, Johnson & Johnson, Boeing,...

- Wie Siemens Energy, Fresenius, Infineon, Deutsche...

- Wiener Börse: ATX geht am Mittwoch behauptet aus ...

- Wiener Börse Nebenwerte-Blick: Frequentis steigt ...

Featured Partner Video

Börsepeople im Podcast S22/01: Wolfgang Matejka vs. Alois Wögerbauer

Auf einfachste Art und Weise spielerisch Wissen zur Wiener Börse erwerben! Ab sofort steht stets ein Quiz zur Wiener Börse am Beginn einer neuen Börsepeople-Season. Die beiden Mutigsten sind Wolfga...

Books josefchladek.com

Zur neuen Wohnform

1930

Bauwelt-Verlag

Heustock

2025

Verlag der Buchhandlung Walther König

Sequenze di Fabbrica

2025

Boring Machines

First Class Portraits

1973

First National Church of the Exquisite Panic Press,

Adriano Zanni

Adriano Zanni Tomáš Chadim

Tomáš Chadim Robert Frank

Robert Frank Sasha & Cami Stone

Sasha & Cami Stone Pieter Hugo

Pieter Hugo Nikola Mihov

Nikola Mihov