21st Austria weekly - Andritz, AT&S, Verbund; S&T (04/11/2021)

08.11.2021, 5128 Zeichen

Andritz: International technology group Andritz has received a significant order from an international pulp and paper producer to supply energy-efficient and environmentally friendly pulp production technologies and key process equipment. The contract has a high triple-digit million euro order value for Andritz. The customer requests that order details be confidential at this time.

Andritz: weekly performance:

AT&S: Austrian based high tech company AT&S reports a very positive revenue development in the first half of 2021/22. Consolidated revenue rose by 29.7% to Euro 697.6 mn in the first half of 2021/22. Adjusted for currency effects, the increase in consolidated revenue even amounted to 34.8%. As expected, the additional capacity in Chongqing to cover growing demand for ABF substrates directly contributed to this growth. The broader application portfolio for mobile devices and the demand for module printed circuit boards also supported the growth trend. In the AIM segment, all three areas contributed to revenue growth, with the Industrial segment recording the sharpest increase. In the Automotive segment, the shortage of semiconductors has so far not led to any significant limitations on revenue, but the company will continue to monitor the development in this segment very closely. EBITDA increased by 17.7% to Euro 130.9 mn. While revenue growth had a positive impact on earnings, the start-up costs in Chongqing and higher material, transport and energy costs reduced earnings. In addition, AT&S significantly increased its research and development expenses, enabling the company to live up to its role as an innovation driver. Due to the good development in the first half of the financial year and the continued strong dynamics of the IC substrate market, AT&S has slightly raised the forecast for the development of revenue and now expects revenue growth of 21 to 23% (previously: 17 to 19%). The adjusted EBITDA margin is expected to range between 21 and 23%, not including approximately EUR 50 million for the start-up of the new production capacity in Chongqing and in Kulim. The outlook is based on the assumption of a euro/US dollar exchange rate of 1.20 and that there are no unexpected effects of supply shortages, material cost and energy price fluctuations. The expansion of production capacity in Chongqing, China, and in Kulim, Malaysia, is progressing more rapidly than previously anticipated despite the challenging global economic and health situation. Therefore, AT&S now assumes that revenue of EUR 3.5 billion will be generated in the financial year 2025/26 (previously: approx. Euro 3 bn). The EBITDA margin is still expected to range between 27 and 32%.

AT&S: weekly performance:

Verbund: Wholesale electricity prices in Europe are a key value driver of the business performance of Austrian utility company Verbund.The energy market environment for the development of the business continued to present a very positive picture in the reporting period. Prices for primary energy sources in particular rose sharply in quarters 1–3/2021. The results posted by Verbund for quarters 1–3/2021 were very encouraging. EBITDA increased by 16.3% to Euro 1,150.6 mn, while the Group result rose by 23.0% to Euro 587.4 mn. The adjusted Group result increased by 20.9% to Euro 566.2 mn. At 0.99, the hydro coefficient for the run-of-river power plants was 1 percentage point below the long-term average and 1 percentage point above the comparative prior-year figure. Generation from annual storage power plants fell by as much as 10.7% in quarters 1–3/2021 due to reduced turbining. Generation from hydropower thus decreased by a total of 589 GWh compared with the prior-year reporting period. However, the significant increase in short-term wholesale electricity prices gave a boost to earnings – unlike futures market prices, which declined in the period under review. Consequently, the average sales price obtained for our own generation from hydropower rose by Euro 7.4/MWh to Euro 51.3/MWh. The full consolidation of Gas Connect Austria GmbH also resulted in a positive contribution to earnings (full consolidation as at 31 May 2021).

Verbund: weekly performance:

S&T: IT group S&T reported another record order intake of Euro 410 mn in Q3 2021. Consequently, orders of around Euro 1,221 mn are offset by revenues of only Euro 913.8 mn after the first nine months. The downside is almost Euro 80 mn in orders that could not yet be recorded as revenue as of September 30, 2021, due to the microchip crisis, holding back revenue growth as well as having a negative impact on profitability. Compared to the 9 months in the last financial year, sales nevertheless increased by 9.2% to Euro 913.8 mn (PY: EUR 836.4 million). At Euro 85.6 mn, EBITDA is slightly above the previous year's figure (Euro 83.7 mn). Overall, the demand for intelligent IoT solutions from the S&T Group remains strong and is further boosted by the economic recovery following the COVID-19 crisis.

S&T: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (04/11/2021)

SportWoche Podcast #137: Tennis-Highlights, Rankings & Rookies 2024 aus österreichischer Sicht feat. Thomas Schweda, ÖTV

Bildnachweis

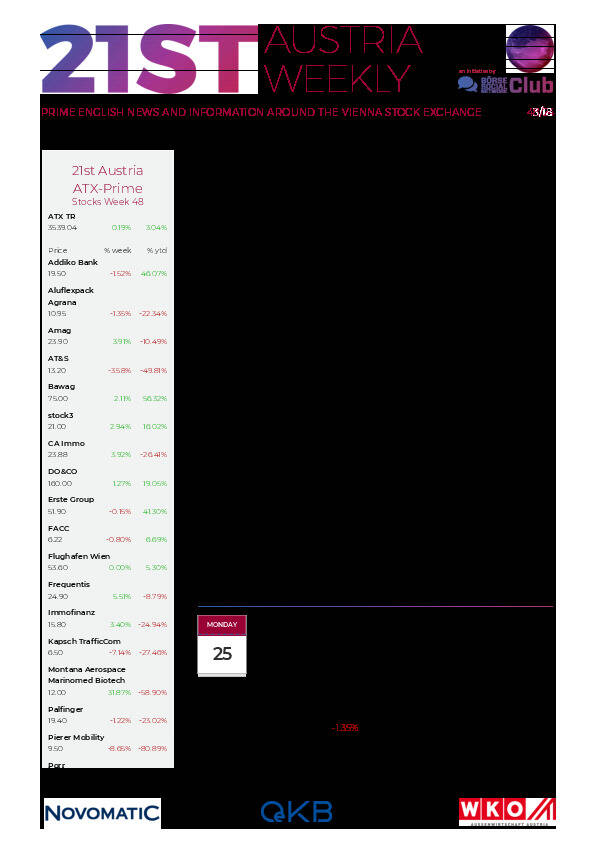

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Warimpex, Wienerberger, Kapsch TrafficCom, AT&S, Frauenthal, Gurktaler AG Stamm, Polytec Group, Wolftank-Adisa, Porr, Oberbank AG Stamm, UBM, Palfinger, Zumtobel, Addiko Bank, Agrana, Erste Group, EVN, Flughafen Wien, OMV, Österreichische Post, S Immo, Telekom Austria, Uniqa.

Random Partner

Porr

Die Porr ist eines der größten Bauunternehmen in Österreich und gehört zu den führenden Anbietern in Europa. Als Full-Service-Provider bietet das Unternehmen alle Leistungen im Hoch-, Tief- und Infrastrukturbau entlang der gesamten Wertschöpfungskette Bau.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten