Schoeller-Bleckmann Oilfield Equipment AG: Sound Q1 results in 2020 despite challenging environment

20.05.2020, 8257 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Quarterly Report

Ternitz/Vienna - 20 May 2020.

Profit after tax climbed 12 % to MEUR 8.6\nNet debt was halved to MEUR 9.1, high liquid funds of MEUR 247.5\nSchoeller-Bleckmann Oilfield Equipment Aktiengesellschaft (SBO), listed on the ATX leading index of the Vienna Stock Exchange, posted a sound first quarter of 2020. There were huge regional differences in the business performance of SBO. While the international market environment proved resilient, the negative impact on the North American market was significant. In the first three months of the year, SBO's sales came to MEUR 108.9, EBIT to MEUR 12.1 and profit after tax to MEUR 8.6. Net debt was reduced from MEUR 20.1 to MEUR 9.1, and gearing was down from 5.4 % to 2.4 %.

"We started 2020 on a positive momentum. Bookings and sales were in line with expectations. However, the COVID 19 pandemic brought about a dramatic trend reversal for us, as it did for all other industries. While we are facing challenging times, we can draw on many years of experience in crisis management. As we have a sound balance sheet and virtually no net debt, we are well prepared to navigate through these difficult times", says Gerald Grohmann, Chief Executive Officer of SBO.

Solid results In the first three months of 2020, bookings at SBO were MEUR 101.2 (1-3/2019: MEUR 128.4, minus 21.1 %). Sales arrived at MEUR 108.9 (1-3/2019: MEUR 121.1, minus 10.1 %). The order backlog totaled MEUR 116.4 at the end of March (31 December 2019: MEUR 123.0). Earnings before interest, taxes, depreciation, and amortization (EBITDA) went from MEUR 32.9 in the first quarter of 2019 to MEUR 23.4 in 2020, while the EBITDA margin was 21.5 % (1-3/2019: 27.2 %). The operating result (EBIT) arrived at MEUR 12.1 (1-3/2019: MEUR 20.2, minus 40.0 %).

SBO's profit before tax came to MEUR 11.6 (1-3/2019: MEUR 12.8, minus 9.4 %), whereas profit after tax climbed 12.1 % to MEUR 8.6 (1-3/2019: MEUR 7.7), due to lower tax expense than in the year before. Earnings per share improved in the first quarter of 2020 to EUR 0.54 (1-3/2019: EUR 0.48).

"The first quarter began in line with our expectations. COVID 19 came unexpectedly to us as to the market as a whole. Following a slowdown as investment had been curbed by exploration and production companies before, the North American market reacted immediately by further cutting back on activities. Our international business was much more resilient, but the negative effects of the prevailing crisis are emerging there as well", states CEO Gerald Grohmann.

Net debt halved, high liquid funds SBO's equity continued to rise during the first quarter of 2020, climbing to MEUR 379.2 (31 December 2019: MEUR 370.1). SBO's equity ratio improved to 43.5 % (31 December 2019: 42.3 %). Net debt was halved compared to the end of 2019, falling to MEUR 9.1 (31 December 2019: MEUR 20.1). Gearing was 2.4 % (31 December 2019: 5.4 %). Liquid funds went to MEUR 247.5 (31 December 2019: MEUR 265.2). Cashflow from operating activities in the first quarter of 2020 arrived at MEUR 14.3 (1-3/2019: MEUR 36.8). Capital expenditure for property, plant and equipment (CAPEX) decreased to MEUR 6.3 (1-3/2019: MEUR 10.1).

Extremely challenging year for global economy and oil and gas industry Global economic activity has been severely impacted by the COVID 19 pandemic and the governmental protective measures. The oil market is facing a sharp drop in demand due to restrictions in economy and public life. This was further aggravated also on the production side by a conflict among the OPEC+ countries over production volumes. After the first quarter, oil prices reached their historic lows in April. In order to support the oil price, the OPEC+ countries, after intensive negotiations, agreed in mid-April on a two-year, staggered cut in oil production. According to the current environment, global exploration and production spending is expected to decline by 28 %, 36 % of which in North America and 23 % internationally.[1]

"At this point, nobody can escape the effects of the COVID 19 pandemic on the global economy. Although the governmental restrictions are starting to be lifted, it cannot be predicted when the turning point in our industry will be reached. What is clear, however, is that in the medium term a significant catch- up effect will take place and with it also in the demand for oil and gas", says Gerald Grohmann. The long-term assessment that oil and gas will continue to cover more than 50 % of primary energy requirements in the next two decades remains unchanged.[2] SBO is well prepared to meet the prevailing challenges.

"The current market environment has come over us most abruptly. However, it is a proven strength of our company to respond very fast to changing market conditions. This also includes curtailing spending instantly and pushing ahead with cost-cutting programs. Our extremely sound balance sheet helps us to remain fully functional in these difficult times and to make farsighted decisions with a view to recovery when the time comes. We are currently bracing for an extremely challenging year 2020", closes CEO Grohmann.

SBO's key performance indicators at a glance

________________________________________________________________ | | |1-3/2020|1-3/2019| |_________________________________________|____|________|________| |Sales |MEUR|108.9 |121.1 | |_________________________________________|____|________|________| |Earnings before interest, taxes, | | | | |depreciation and amortization (EBITDA) |MEUR|23.4 |32.9 | |_________________________________________|____|________|________| |EBITDA margin |% |21.5 |27.2 | |_________________________________________|____|________|________| |Earnings before interest and taxes (EBIT)|MEUR|12.1 |20.2 | |_________________________________________|____|________|________| |EBIT margin |% |11.1 |16.7 | |_________________________________________|____|________|________| |Profit before tax |MEUR|11.6 |12.8 | |_________________________________________|____|________|________| |Profit after tax |MEUR|8.6 |7.7 | |_________________________________________|____|________|________| |Earnings per share |EUR |0.54 |0.48 | |_________________________________________|____|________|________| |Cashflow from operating activities |MEUR|14.3 |36.8 | |_________________________________________|____|________|________| |Liquid funds as of 31 March 2020 / | | | | |31 December 2019 |MEUR|247.5 |265.2 | |_________________________________________|____|________|________| |Headcount as of 31 March 2020 / | | | | |31 December 2019 | |1,406 |1,535 | |_________________________________________|____|________|________|

SBO is a globally leading supplier of products and solutions used by the oil and gas industry for directional drilling and well completion applications. SBO is the global market leader in the manufacture of high-precision components made of non-magnetic high-alloy stainless steel. The company produces the components specifically according to the requirements of customers in the oilfield service industry. As of 31 March 2020, SBO employed a workforce of 1,406 worldwide (31 December 2019: 1,535), thereof 399 in Ternitz / Austria and 637 in North America (incl. Mexico).

[1] Evercore ISI Research, The EVRISI_OFS E&P Budget Barometer: The Sky Really Is Falling, April 2020.

[2] IEA World Energy Outlook 2019, Stated Policies Scenario.

end of announcement euro adhoc

issuer: Schoeller-Bleckmann Oilfield Equipment AG Hauptstrasse 2 A-2630 Ternitz phone: 02630/315110 FAX: 02630/315101 mail: sboe@sbo.co.at WWW: http://www.sbo.at ISIN: AT0000946652 indexes: ATX, WBI stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2917/aom

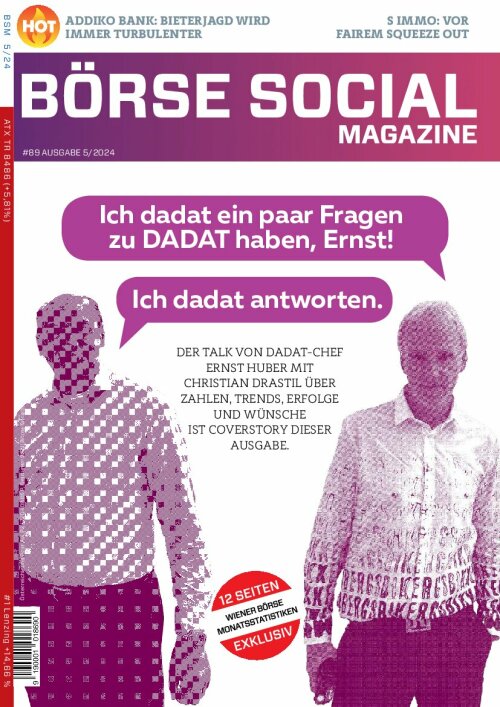

Wiener Börse Party #690: Warum FACC den SBO-Preis bekam, die Gulasch-Unsicherheit vorbei ist, Verbund 13.000, Agrana 33 ist

SBO

Uhrzeit: 14:30:18

Veränderung zu letztem SK: 0.96%

Letzter SK: 36.35 ( -2.28%)

Bildnachweis

Aktien auf dem Radar:Immofinanz, Bawag, Agrana, Austriacard Holdings AG, Addiko Bank, Flughafen Wien, Rosgix, ATX, ATX TR, voestalpine, DO&CO, SBO, OMV, Lenzing, S Immo, Oberbank AG Stamm, Amag, CA Immo, Erste Group, EVN, Österreichische Post, Telekom Austria, Uniqa, VIG, Wienerberger, Bayer, Deutsche Boerse, Deutsche Bank, Volkswagen Vz., Mercedes-Benz Group, BASF.

Random Partner

Wolftank-Adisa

Die Wolftank-Adisa Holding AG ist die Muttergesellschaft einer internationalen Unternehmensgruppe mit Fokus auf Sanierung und Überwachungen von (Groß–)Tankanlagen und Umweltschutz-Dienstleistungen bei verseuchten Böden und Einrichtungen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A3C5D2 | |

| AT0000A3BPU8 | |

| AT0000A31267 |

- PIR-News: Alle Post-LKW mit erneuerbarem Treibsto...

- Nachlese: ATX 17, Robert Machtlinger, Karin Lenha...

- Wiener Börse Party #690: Warum FACC den SBO-Preis...

- Vormittags-Mover: European Lithium, publity, Klon...

- Wiener Börse zu Mittag stärker: VIG, Polytec Grou...

- Unser Robot findet: Bayer, Deutsche Börse, Deutsc...

Featured Partner Video

Börsepeople im Podcast S13/19: Robert Machtlinger

Robert Machtlinger ist CEO der FACC AG, die vor 10 Jahren an der Wiener Börse debütierte und heuer auch das 35jährige Unternehmensjubiläum feiert. Robert ist seit FACC-Start dab...

Books josefchladek.com

Körpersplitter

1980

Veralg Droschl

Flughafen Berlin-Tegel

2023

Drittel Books

Spurensuche 2023

2023

Self published

Imperfections

2024

AnzenbergerEdition

Liebe in Saint Germain des Pres

1956

Rowohlt

Sergio Castañeira

Sergio Castañeira Walker Evans

Walker Evans Helen Levitt

Helen Levitt Kurama

Kurama