21st Austria weekly - Erste Group, Palfinger, Frequentis (30/10/2023)

05.11.2023, 3549 Zeichen

Erste Group Bank: The results of Erste Group Bank AG for the first nine months of 2023 are characterized by a significant increase in operating business. Net interest income increased significantly to EUR 5,422.3 million (+23.7%; EUR 4,385.2 million), most strongly in Austria, on the back of higher market interest rates, as well as larger loan volume. Net fee and commission income rose to EUR 1,937.6 million (+5.9%; EUR 1,829.9 million). Growth was registered across all core markets, most notably in payment services but also in asset management. The net profit rose to EUR 2,309.6 million (EUR 1.647.0 million) on the back of the strong operating result and low risk costs. Total assets increased to EUR 337.2 billion (+4.1%; EUR 323.9 billion). On the asset side, cash and cash balances declined to EUR 31.9 billion (EUR 35.7 billion), loans and advances to banks rose to EUR 28.1 billion (EUR 18.4 billion), most notably in Austria and the Czech Republic. Loans and advances to customers have risen in all core markets year to date to EUR 206.2 billion (+2.0%; EUR 202.1 billion) with both retail and corporate loans volumes growing.

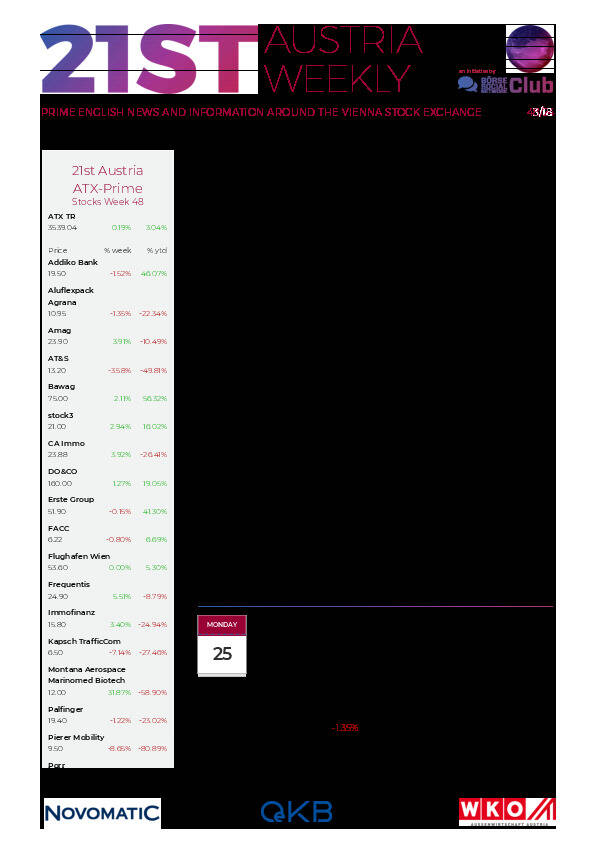

Erste Group: weekly performance:

Palfinger: In the first three quarters of 2023 lifting solutions provider Palfinger AG once again achieved record figures with EUR 1,798.9 million in revenue, EUR 165.0 million EBIT and a consolidated net result of EUR 90.9 million as a result of a very good product mix and the implemented price increases taking full effect. The reduction in costs for freight and materials began to take effect during Q3. However, a highly challenging economic environment is forecast for 2024, for which PALFINGER is already preparing today. The high demand for service cranes and truck-mounted forklifts led to growth in revenue of more than 30 percent in North America. In the future market of India, where Palfinger sees great potential for further growth. The marine sector experienced a good order intake as well. In Europe, inflation and high interest rates have had a negative impact on the economic environment, and the construction industry in particular is suffering from the negative effects with reduced order intake. Based on the current order book coverage, which lasts until the end of Q1 2024, the company expects revenue of EUR 2.4 billion and an EBIT of over EUR 200 million in 2023.

Palfinger: weekly performance:

Frequentis: NAV Canada, the Canadian Air Navigation Service Provider, has selected Frequentis to provide its standardised and interoperable X10 VCS for all Air Traffic Control & Flight Specialists communication facilities. Representing one of the largest deployments of VCS and Radio/Telephone Gateways worldwide, this project will include all of NAV CANADA’s operational facilities, and support sites, significantly improving communication across the whole Canadian airspace. "Our next-generation VCS will reinforce the coherence of airspace operations throughout Canada and will support NAV CANADA by streamlining the project roll-out as well as providing the necessary resilience and cyber security features required today and for the future,” says Michael Lang, Managing Director Frequentis Canada. “Maintaining the system across Canada’s vast landscape and remote locations, will be simplified with the X10 thin-client operator working position concept, based on central deployment and monitoring of all locations.”

Frequentis: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (30/10/2023)

SportWoche Podcast #137: Tennis-Highlights, Rankings & Rookies 2024 aus österreichischer Sicht feat. Thomas Schweda, ÖTV

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Warimpex, Wienerberger, Kapsch TrafficCom, AT&S, Frauenthal, Gurktaler AG Stamm, Polytec Group, Wolftank-Adisa, Porr, Oberbank AG Stamm, UBM, Palfinger, Zumtobel, Addiko Bank, Agrana, Erste Group, EVN, Flughafen Wien, OMV, Österreichische Post, S Immo, Telekom Austria, Uniqa.

Random Partner

CA Immo

CA Immo ist der Spezialist für Büroimmobilien in zentraleuropäischen Hauptstädten. Das Unternehmen deckt die gesamte Wertschöpfungskette im gewerblichen Immobilienbereich ab: Vermietung und Management sowie Projektentwicklung mit hoher in-house-Baukompetenz. Das 1987 gegründete Unternehmen notiert im ATX der Wiener Börse.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten