AT & S Austria Technologie & Systemtechnik Aktiengesellschaft / AT&S plans investment of up to € 1.7 billion in additional capacities for IC substrates in Southeast Asia

01.06.2021, 3709 Zeichen

Disclosed inside information pursuant to article 17 Market Abuse Regulation (MAR) transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

No Keyword 01.06.2021

Leoben -

Subject to the approval of the Supervisory Board\nInvestment project is based on planned collaboration with major semiconductor manufacturers\nSignificant part of project financing is based on agreements with customers -no capital market transaction required\nGuidance for 2025/26 in case of the investment: revenue of approximately EUR 3 billion and EBITDA margin of 27-32%\nAT&S AG, one of the leading manufacturers of high-end printed circuit boards and IC substrates, plans to build a new production site for IC substrates in Southeast Asia, subject to the approval of the Supervisory Board.

The planned investment will total up to EUR 1.7 billion for the construction of a new production complex for high-end substrates between 2021 and 2026. This would be the largest investment to date in the history of AT&S.

The project is based on, and subject to, a planned collaboration with two leading manufacturers of high-performance-computing semiconductors, with whom long-term contracts are to be concluded. These contracts are expected to be signed shortly.

About half of the investment volume is to be provided by the customers' contributions to financing. The balance sheet presentation of these contributions is yet to be clarified. In any case, a capital increase by issuing new shares will not be required to finance the project.

The plan is to produce ABF substrates for high-performance processors at the location in Southeast Asia. These processors are applied in areas such as high- performance computers, data centres, gaming, 5G, automotive and AI. The planned production site will total approximately 200,000 m² in size. Construction is scheduled to start in the second half of 2021, and high volume production at the end of 2024. The currently planned capacity can generate additional revenue potential of up to EUR 1 billion p.a. when fully utilised. The Management Board emphasises the importance of this project. It contributes significantly to the future diversification of the customer portfolio, broadening the regional footprint and the company's positioning in the rapidly growing market for ABF substrates.

In case of this investment and given the development in the other business segments as part of the "More than AT&S" strategy, the Management Board expects a business development with revenue of approximately EUR 3 billion in the financial year 2025/26 (2023/24: more than EUR 2 billion). This would correspond to a compound annual growth rate (CAGR) of approximately 20% through to 2025/26. Due to the increased focus on high-end applications in all business segments, an EBITDA margin in the range of 27 to 32% can be achieved (2023/24: 25 to 30%). Depending on the balance sheet presentation, the net debt-to-EBITDA ratio could temporarily exceed the medium-term target of <3 and the equity ratio could fall short of the internal target of >30% during the project phase until the capacities are utilised. The Group's medium-term ROCE target would continue to be >12%; this target should be achieved with the ramp-up of production.

end of announcement euro adhoc

issuer: AT & S Austria Technologie & Systemtechnik Aktiengesellschaft Fabriksgasse 13 A-8700 Leoben phone: 03842 200-0 FAX: mail: ir@ats.net WWW: www.ats.net ISIN: AT0000969985 indexes: ATX, ATX GP, WBI, VÖNIX stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/18136/aom

Wiener Börse Party #719: Flughafen Wien auf All-time-High mit Event für AktionärInnen, Marinomed still alive, Chapter 11 als Vorbild

AT&S

Uhrzeit: 22:59:55

Veränderung zu letztem SK: 0.00%

Letzter SK: 16.06 ( -1.17%)

Bildnachweis

1.

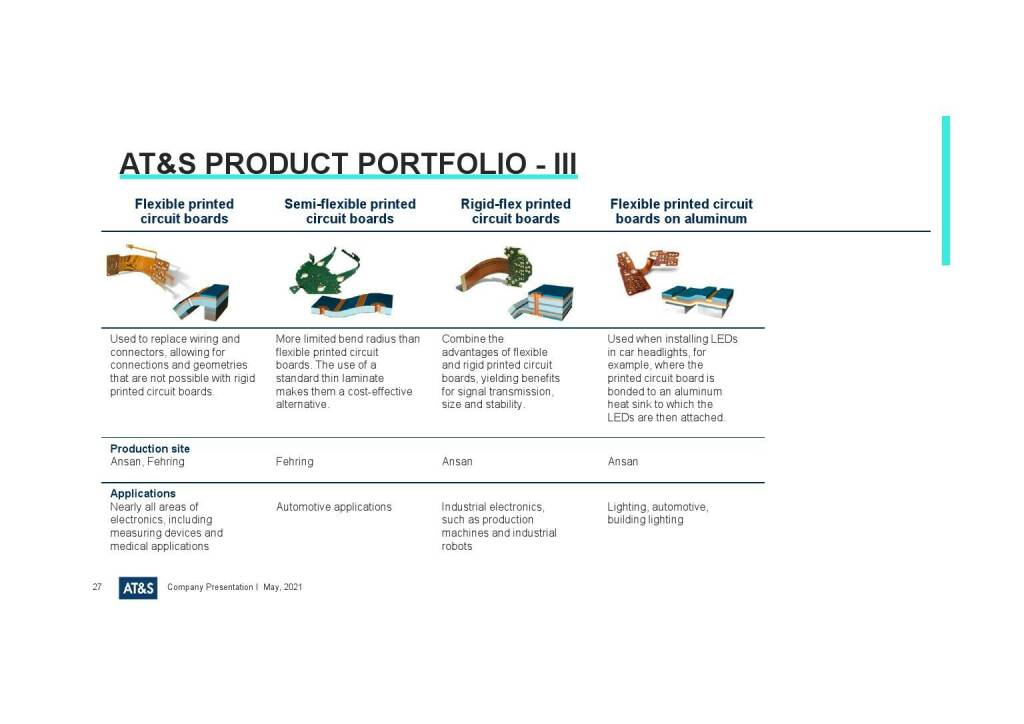

AT&S - Product portfolio III

>> Öffnen auf photaq.com

Aktien auf dem Radar:Rosenbauer, FACC, CA Immo, Addiko Bank, S Immo, UBM, Immofinanz, EuroTeleSites AG, Porr, ams-Osram, Cleen Energy, Marinomed Biotech, RWT AG, Oberbank AG Stamm, Flughafen Wien, Zumtobel, Agrana, Amag, Erste Group, EVN, Österreichische Post, RHI Magnesita, Telekom Austria, Uniqa, VIG, Wienerberger, Warimpex.

Random Partner

AVENTA AG

Die AVENTA AG ist ein Immobilienunternehmen mit Sitz in Graz, das von den Hauptaktionären Christoph Lerner und Bernhard Schuller geführt wird. Geschäftsschwerpunkt ist die Entwicklung von Wohnimmobilien von der Projektentwicklung über die technische Projektierung bis hin zu den fertigen Objekten.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A3C5E0 | |

| AT0000A382G1 | |

| AT0000A3DTK7 |

- NLB kommt bei Addiko nicht zum Ziel

- Marinomed gewährt Einblick in das 1. Halbjahr - S...

- Wie Cleen Energy, RWT AG, ams-Osram, Marinomed Bi...

- Wie Lenzing, SBO, DO&CO, Immofinanz, EVN und Öste...

- Österreich-Depots: Fester (Depot Kommentar)

- Börsegeschichte 20.8.: Lenzing (Börse Geschichte)...

Featured Partner Video

139. Laufheld Online Workout für Läufer

0:00 - Start des Workouts / start of workout -------------------------------------------------------------------------------------------------------------- Mehr Infos und Einblicke findet ihr auf...

Books josefchladek.com

Brilliant Scenes: Shoji Ueda Photo Album

1981

Nippon Camera

Liebe in Saint Germain des Pres

1956

Rowohlt

Spurensuche 2023

2023

Self published

Nothing Personal

2024

GOST

27000 Kilometer im Auto durch die USA

1953

Conzett & Huber

Federico Renzaglia

Federico Renzaglia Andreas Gehrke

Andreas Gehrke Adolf Čejchan

Adolf Čejchan Stefania Rössl & Massimo Sordi (eds.)

Stefania Rössl & Massimo Sordi (eds.)