17.12.2018, 14580 Zeichen

- Real exchange rates in CEE have appreciated strongly in the pre-crisis period, though, have mainly stagnated since then.

- Currency undervaluation has been used as an unconventional monetary policy measure in the Czech Republic.

- An estimate of the equilibrium real exchange rate shows that undervaluation was around 4 %.

- Any currency misalignments have been closed and the current economic outlook points towards a real appreciation until 2020.

Exchange rates have caught considerable attention in 2018, both in emerging markets as well as advanced economies. The Euro (EUR) has depreciated to the US Dollar (USD) by about 5 % since the beginning of the year (5.2 %, YTD). More volatility occurred in emerging markets led by a fall in the Argentine Peso (-51 % to the USD, -48 % to the EUR) and the Turkish Lira (-29 % to the USD, -25 % to the EUR). So far, contagion effects to emerging markets with more solid fundamentals, such as Central European (CE) economies, have been rather limited. The Hungarian Forint (HUF) has depreciated by 3.8 % to the EUR, the Polish Zloty (PLN) by 2.3 % and the Czech Koruna (CZK) by 1.3 % (YTD).

The Central European non-Eurozone economies adopted a flexible exchange rate regime and inflation targeting framework in the late 1990s and early 2000s (CZ: 1997, PL: 1998, HU: 2001). Since then exchange rates have been determined by the interaction between supply and demand and are subject to market volatility. The flexible exchange rate regime provides the central banks of the region with the opportunity to align monetary conditions to the economy’s needs, supporting balanced growth.[I] Currently, monetary conditions are rather loose, meaning that monetary policy is set in such a way to support growth. Together with interest rates, the exchange rate determines an economy’s monetary conditions. Conventional monetary policy, however, only sets short-term nominal interest rates.[II]

Monetary conditions need to be assessed not in nominal but in real terms. With respect to exchange rates this implies that changes in relative prices need to be considered. The concept of real effective exchange rates (REER) is used to evaluate an economy’s price and cost competitiveness. If the REER depreciates, exports become cheaper while imports become more expansive, indicating a gain in competitiveness. Computing REER for the Czech Republic, Hungary and Poland (Figure 1) shows that all three economies followed a real appreciation trend until the early 2000s. Since then, the Polish REER has broadly stagnated while REERs in the Czech Republic and Hungary appreciated further until the start of the Great Recession.[III] The trend appreciation of real exchange rates seems to have paused in non-Eurozone Central European economies since then.

In order to assess monetary conditions as being accommodative or restrictive, reference rates are needed. These need to be in line with medium-term macroeconomic fundamentals and are referred to as equilibrium values. With respect to the interest rate component of monetary conditions, the so-called natural rate of interest, or r-star, has become a widely used concept.[IV] With respect to the exchange rate component, equilibrium exchange rates have been applied to evaluate real exchange rate misalignments. In the medium run real exchange rates should move in the direction of their equilibrium, thereby annulling any currency misalignments. However, depending on the extent of nominal or structural rigidities this adjustment process can be rather slow and currency misalignments can prevail for an extended period. Currency misalignments can be linked to economic performance. Overvalued currencies can be associated with macroeconomic instability, unsustainable current account deficits and the risk of speculative attacks, while undervaluation rather facilitate growth.[V]

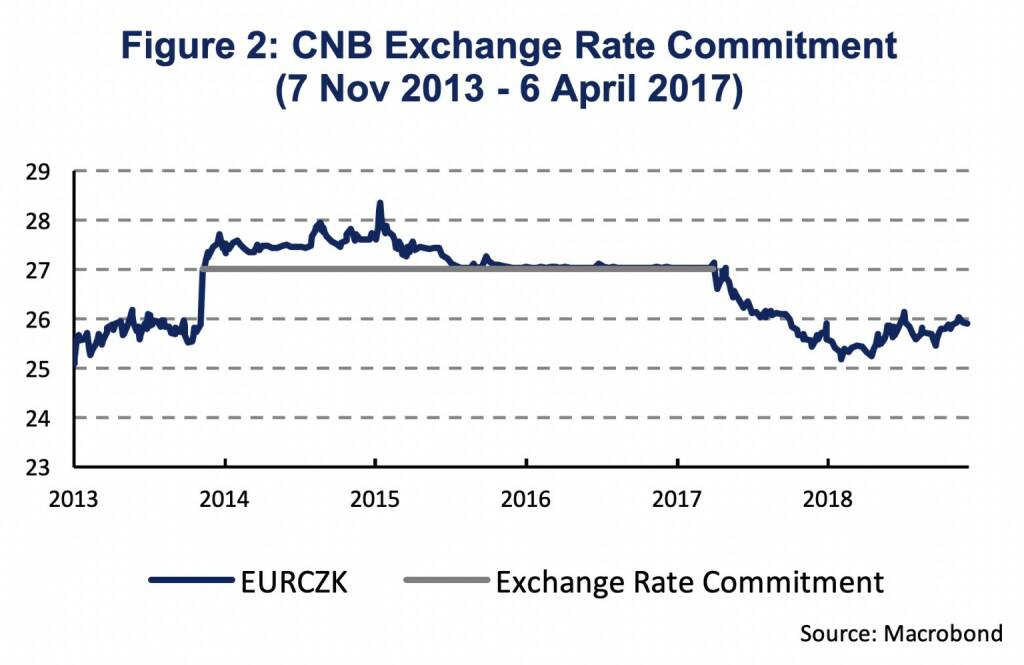

A recent example in using exchange rate undervaluation to stimulate economic growth and inflation is the Czech Republic. As a form of unconventional monetary policy, the Czech National Bank (CNB) announced an exchange rate commitment on the 7th of November 2013 stating that it would not allow the Koruna to appreciate below 27 EURCZK. The CNB managed to successfully defend the exchange rate commitment until it ended on the 6th of April 2017 (Figure 2). Besides the growth in external demand and the end of restrictive domestic fiscal policy, the weaker currency contributed to the economic recovery and a gradual rise in inflation.[VI]

Since the end of the exchange rate commitment, the Czech Republic has become the most advanced economy in Europe regarding monetary policy normalization. The CNB raised its key monetary policy rate two times in 2017 and five times in 2018. The development of the exchange rate has played a vital role for the path of interest rates. In contrast to the central bank’s projection of a gradual appreciation, the Koruna started to depreciate in Q2 2018. The loosening effect of the Koruna depreciation on monetary conditions and the strong growth momentum of the Czech economy led the CNB to accelerate its interest rate hiking cycle. Over the medium-term, however, the CNB projects the Koruna to appreciate being “driven by a distinctly positive interest rate differential vis-à-vis the Euro Area and continued real economic convergence connected with growing labor efficiency.” [VII]

The development of the equilibrium exchange rate can, therefore, be identified as a crucial aspect of monetary conditions, particularly so for small and open economies. One way to estimate equilibrium exchange rates, and as a consequence also currency misalignments, is to use the so-called behavioral approach. The concept of Behavioral Equilibrium Exchange Rates (BEER) has been pioneered by Clark and MacDonald (1998) and is based on an econometric analysis of a model of the behavior of the real effective exchange rate (REER).[VIII] The underlying theoretical concept is the uncovered interest rate parity (UIP). The UIP states that the log-difference between the expected value of the nominal exchange rate in period t+k and the nominal exchange rate in period t is equal to the domestic nominal interest rate in period t over the maturity k minus the foreign nominal interest rate with the same maturity. Hence, the expected movement in the nominal exchange rate is equal to the difference in nominal interest rates. The nominal exchange rate is defined in terms of domestic currency per unit of foreign currency, such that an increase in the nominal exchange rate implies a depreciation of the local currency. Subtracting the expected inflation differential from both sides yields the real interest parity, which allows to state the observed real exchange rate as a function of the expected value of the real exchange rate and the current real interest rate differential. Further, a time-varying risk premium is added, a rise of which is associated with a real depreciation.

The unobservable expected value of the real exchange rate is interpreted as the fundamental, or long-run, component. Clark and MacDonald (1998) suggested the following determinants of the fundamental exchange rate component: net foreign assets (NFA), relative terms of trade (TOT) and a proxy for the Balassa-Samuelson effect (BS). The Balassa-Samuelson effect connects differences in productivity performances between the tradeable and non-tradable sectors to a real appreciation.[IX] Since then many empirical specifications have been used. Government consumption (GOV) to account for a demand bias towards non-tradable goods as well as a proxy for trade liberalization (OPEN) can be found in most empirical exchange rate models.[X]

We apply the BEER approach to the Czech Republic in order to assess potential currency misalignments from central bank intervention. Methodologically, the real equilibrium exchange rate is estimated by extracting the long-run relationship using an autoregressive distributed lag (ARDL) model. The ARDL model, expressed in error-correction form, regresses the dependent variables (REER) in first differences on the lagged values of the dependent and independent variables in levels and first differences.

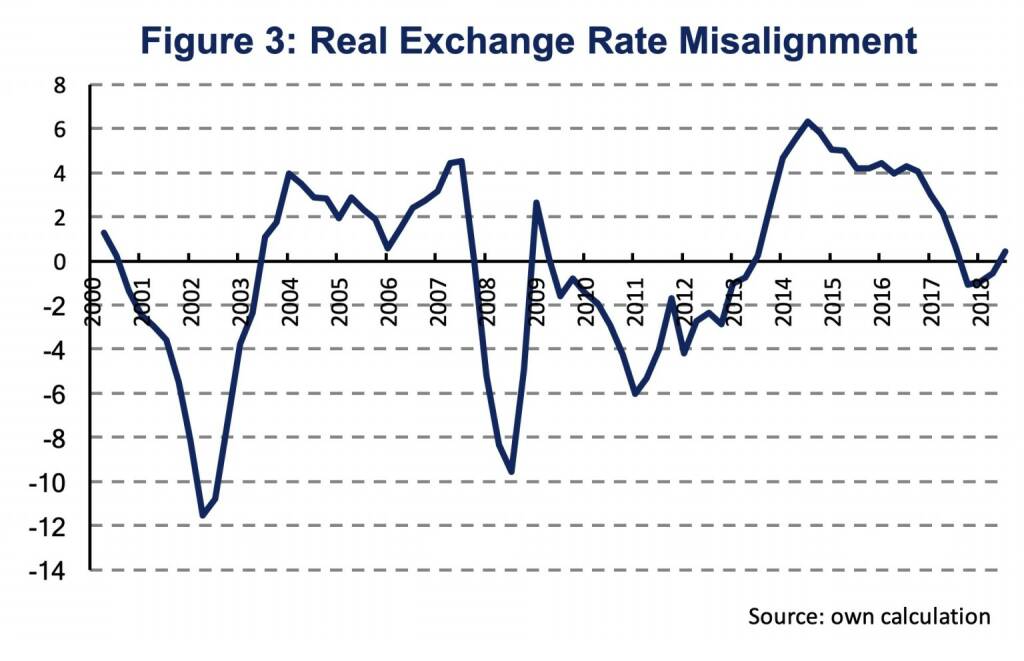

The empirical results show relative productivity to the Euro Area and the difference in real interest rates to be associated with an appreciation (decline) in the long-run real exchange rate between the Czech Republic and the Euro Area.[XI] It is important to emphasize that catch-up growth was associated with an appreciation of the real exchange rate. Government consumption and net foreign assets to GDP are associated with a real depreciation (increase) in the long-run real exchange rate.[XII] Terms of trade are weakly linked to a real appreciation and trade liberalization to a real depreciation, though, both effects are not strong enough to reach statistical significance.[XIII] the estimated coefficients with HP-filtered values of the fundamentals yields an estimate of the real equilibrium exchange rate. Figure 3 shows the difference between the observed real exchange rate and the estimated equilibrium real exchange rate. It can be seen that the period of central bank intervention was association with an undervaluation of the real exchange rate by about 4 %. Moreover, the Czech real exchange rate was slightly undervalued during the immediate pre-crisis period, followed by an overvaluation until the central bank intervened. At the moment the Czech real exchange rate seems neither over- nor undervalued.

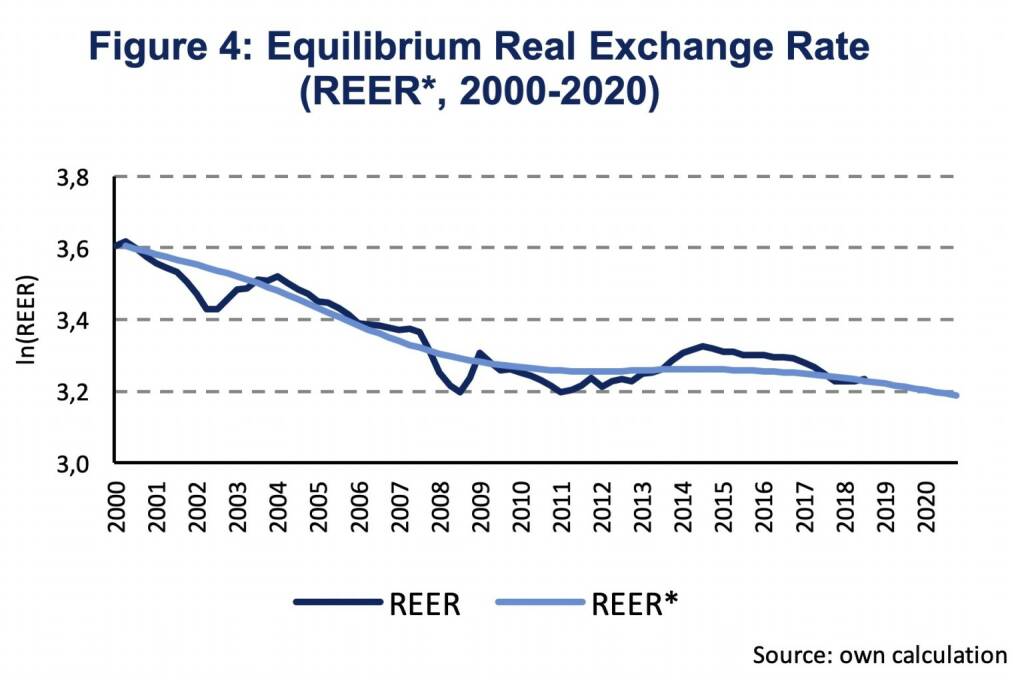

Figure 4 compares the observed and equilibrium real exchange rates since 2000. We see that the equilibrium exchange rate followed a strong appreciation trend until the financial crisis since when the equilibrium rate stagnated. Using estimates for the fundamental drivers of the equilibrium exchange rate (AMECO), to perform an out-of-sample projection suggests the Czech real exchange rate to appreciate. The resulting appreciation, when converted into nominal terms, is around 4 % until 2020, which is less substantial than the projected appreciation by the CNB of 7 % until 2020.[XIV]

To sum up, exchange rates are a vital aspect of monetary conditions in the CEE region. At the moment, this is most evident in the Czech Republic, where unexpected exchange rate depreciation has led the Czech National Bank to accelerate monetary policy tightening. Estimating a real equilibrium exchange rate for the Czech Republic, using the BEER approach, shows that past currency misalignments have faded and a pre-crisis trend in real exchange rate appreciation might be resumed.

[I] In the case of a fixed exchange rate regime the monetary stance is imported from the economy the currency is pegged to, which may not be appropriate for domestic purposes.

[II] In line with major central banks, the Czech National Bank (CNB), the National Bank of Hungary (NBH) and the National Bank of Poland (NBP) follow the objective of price stability with an inflation targets at 2 % in the Czech Republic, 2.5 % in Poland and 3 % in Hungary. The exchange rate is not a primary objective for monetary policy but is monitored very closely and considered in monetary policy decision depending on the exchange rate’s effect on the medium-term inflation outlook and on monetary conditions overall.

[III] REERs have been calculated with respect to the Euro Area using HICP as the respective price deflator. The bilateral exchange rate to the Euro (e) is multiplied by the relative price level between the Euro Area (pEA) and the home market (p): REER = e * (pEA/p). A decrease in the REER indicates a real appreciation while an increase indicates a real depreciation.

[IV] The concept of the natural rate of interest has been revitalised by the seminal article: Laubach, T., and Williams, J., (2003), Measuring the natural rate of interest, Review of Economics and Statistics,85:4, 1063-1070.

[V] Rodrik, D. (2008). The real exchange rate and economic growth. Brookings papers on economic activity, 2008:2, 365-412.

[VI] Rusnok, J., (2018), CNB monetary policy since 2012, Presentation at the Farewell Conference in Honor of Governor Karnit Flug,Jerusalem, (http://www.cnb.cz/miranda2/export/sites/www.cnb....

[VII] Holub, T., (2018), CNB’s New Forecast (Inflation Report IV/2018), Meeting with Analysts, slide 20, (http://www.cnb.cz/miranda2/export/sites/www.cnb....

[VIII] Clark, P., and MacDonald, R., (1998), Exchange Rates and Economic Fundamentals. A Methodological Comparison of BEERs and FEERs, IMF Working Paper Series, No. 98/67.

[IX] The Balassa-Samuelson effectarises when productivity growth of the tradable sector exceeds that in the non-tradable sector. In that case, productivity gains in the tradable sector lead to higher real wages in that sector without harming competitiveness. If wages equalize between the tradable and the non-tradable sectors, prices in the latter sector will rise, triggering higher overall inflation rates and eventually the real exchange rate appreciates.

[X] One of the most recent contributions to the literature is Fidora, Giordano and Schmitz (2017) which present an overview of panel-BEER models in table B1 (Fidora, M., Giordano, C., and Schmitz, M., (2017), Real exchange rate misalignments in the euro area, ECB Working Paper Series, No 2108).

[XI] Relative productivity is defined as the logarithm of the ratio between GDP per worker in the Czech Republic and GDP per worker in the Euro Area. The difference in real interest rates refers to yields on 10-year government bonds in the Czech Republic and Germany deflated by HICP inflation rates in the Czech Republic and the Euro Area. (Sources: Bloomberg and Eurostat)

[XII] Government consumption refers to final consumption of the general government in current prices as a share of gross domestic product in current prices. Net foreign assets are defined as the net international investment position as a share of GDP. (Source: Eurostat)

[XIII] Terms of trade are defined as the ratio of export prices to import prices relative the same ratio in the Euro Area (in logs). The degree of trade liberalization is proxied by the openness ratio which is defined as the sum of export and imports as a share of GDP. (Source: Eurostat)

[XIV] November projection by the Czech National Bank (https://www.cnb.cz/en/monetary_policy/forecast/).

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

ABC Audio Business Chart #134: Wieviel alle Aktien der Welt wert sind (Josef Obergantschnig)

Bildnachweis

1.

Real Effective Exchange Rates

2.

CNB Exchange Rate Commitment

3.

Real Exchange Rate Misalignment

4.

Equilibrium Real Exchange Rate

5.

Interest Rates

Aktien auf dem Radar:Flughafen Wien, Addiko Bank, DO&CO, Frequentis, Austriacard Holdings AG, Agrana, FACC, Rosgix, OMV, RBI, SBO, Erste Group, Andritz, Bawag, Porr, Wienerberger, voestalpine, VIG, ATX TR, ATX Prime, ATX, UBM, EuroTeleSites AG, Kapsch TrafficCom, CA Immo, EVN, Pierer Mobility, Polytec Group, Rosenbauer, Semperit, Telekom Austria.

Random Partner

WKO

Die Wirtschaftskammer Österreich ist eine Körperschaft öffentlichen Rechts. Sie koordiniert die Tätigkeit der Landeskammern, der gesetzlichen Interessensvertretungen der gewerblichen Wirtschaftstreibenden.

>> Besuchen Sie 60 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Österreich-Depots: Noch im ytd-Plus, viele Umschichtungen (Depot Kommentar)

» Börsegeschichte 7.4.: Extremes zu OMV (Börse Geschichte) (BörseGeschichte)

» Nachlese: Valerie Ferencic, Offline-Podcast-Premiere, Lili Tagger, Aaron...

» PIR-News: Porr, wienerberger, CA Immo, Flughafen Wien (Christine Petzwin...

» Spoiler: VIG am Österreichischen Aktientag, Statement Nina Higatzberger-...

» Wiener Börse Party #878: ATX nun year-to-date im Minus, FMA will viel Ge...

» Wiener Börse zu Mittag erneut deutlich schwächer: Alle im Minus, Verbund...

» LinkedIn-NL: Podcast-Tipp für Marathon-Fans, Soulsurfing und Kabarett

» ATX-Trends: Pierer Mobility, Erste Group, Bawag, RBI, Porr, Strabag ...

» Börsepeople im Podcast S18/09: Valerie Ferencic

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wie Sportradar Group, Ibiden Co.Ltd, Shinko Elect...

- Wie Glencore, Polytec Group, Semperit, Alibaba Gr...

- Wie Home Depot, Travelers Companies, Nike, JP Mor...

- Wie Hannover Rück, Münchener Rück, Airbus Group, ...

- Wiener Börse: ATX büßt am Montag 3,7 Prozent ein

- Wiener Börse Nebenwerte-Blick: Pierer Mobility le...

Featured Partner Video

kapitalmarkt-stimme.at daily voice 96/365: Zahlen/Fakten nach Woche 14, damit man bzgl. Wr. Börse mitreden und sie einreihen kann

Episode 96/365 der kapitalmarkt-stimme.at daily voice auf audio-cd.at. Heute wieder der Sonntag-Fixpunkt: Das Update mit Zahlen und Fakten, damit man an der Wiener Börse mitreden und sie einreihen ...

Books josefchladek.com

Islands of the Blest

2014

Twin Palms Publishers

The Color of Money and Trees

2024

Void

Herbert Schwöbel & Günther Kieser

Herbert Schwöbel & Günther Kieser Bernard Larsson

Bernard Larsson Pia-Paulina Guilmoth

Pia-Paulina Guilmoth Chargesheimer

Chargesheimer Yorgos Lanthimos

Yorgos Lanthimos Monika Faber, Hanna Schneck, Arne Reimer

Monika Faber, Hanna Schneck, Arne Reimer Robert Longo

Robert Longo Le Corbusier

Le Corbusier