S IMMO AG / Q3 results right on track

26.11.2015, 8588 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

9-month report

S IMMO AG: Q3 results right on track

· Profit for the period increases to EUR 28.2m · Considerable improvement in financing result · Investment volume of over EUR 140m in Germany and Austria so far this year · Goal: doubling FFO

With the results for the third quarter of 2015, stock exchange listed real estate company S IMMO AG (Bloomberg: SPI:AV, Reuters: SIAG.VI) is confirming its positive trend for the current year. Ernst Vejdovszky, CEO of S IMMO AG: "S IMMO is completely on track with its ambitious plans for 2015, and all of our key figures are in line with the targets for the year as a whole. The historically low interest rate level offers particularly favourable conditions for real estate companies. Our markets have recovered well and are stable. Our strategy - capital cities within the European Union with a current focus on Berlin - is proving effective and is very successful."

In the first nine months of 2015, S IMMO increased its profit for the period by more than 27% to EUR 28.2m. Earnings per share improved accordingly and came to EUR 0.40 - a gain of over 33%. In the second and third quarters of 2015, the company closed out derivatives that had been concluded in the past when interest rates were much higher, and at the same time negotiated new agreements, thus securing the current, historically low interest rate level for the future. The positive effects of these measures on cash flow and FFO will become fully apparent in the 2016 financial year.

Development of earnings In the reporting period, S IMMO AG's total revenues amounted to EUR 141.6m (Q3 2014: EUR 140.5m), slightly higher than the prior-year figure. The rental income included in this figure came to EUR 83.2m (Q3 2014: EUR 84.5m) and reflects the property sales completed since the beginning of 2014.

In the first three quarters of 2015, S IMMO sold six properties in Germany and Austria with a total book value of EUR 45.9m (Q3 2014: EUR 48.4m). At the same time, S IMMO bought properties in Germany and Austria at a total purchasing price of EUR 72.6m during the first three quarters. In addition, purchases amounting to EUR 70.5m for which S IMMO AG will not obtain ownership until after 30 September 2015 were contractually agreed. This brings the total investment volume in Germany and Austria to over EUR 140m so far this year.

EBITDA came to EUR 65.2m in the first three quarters of 2015 (Q3 2014: EUR 67.6m). The decline reflects lower rental income as a result of disposals and increased costs that can largely be attributed to non-recurring effects. Revaluation gains developed very positively, amounting to EUR 16.8m as at 30 September 2015 (Q3 2014: EUR 12.8m). This was due to both the asset management activities aimed at raising the value of the properties and the steadily improving sentiment in S IMMO's markets. The portfolio in Germany made a particularly significant contribution to the increase in revaluation gains.

Overall, EBIT was higher than in the previous year at EUR 76.1m (Q3 2014: EUR 74.9m). EBT came in at EUR 34.6m (Q3 2014: EUR 27.3m), an increase of 26.7% over the previous year. The profit for the period rose by 27.1% to EUR 28.2m (Q3 2014: EUR 22.2m). Earnings per share improved again to EUR 0.40 (Q3 2014: EUR 0.30), corresponding to an increase of 33.3%.

Capital market As in the previous quarters, the S IMMO share significantly outperformed the ATX and the IATX during the reporting period. At the end of the quarter, the share price stood at EUR 7.60 - a gain of more than 23% since the beginning of the year. Since 30 September 2015 the share price further increased and currently stands at a level of around EUR 8.00. The company's clear goal is and remains to position the S IMMO share as a consistently dividend-paying stock.

Both book value per share and EPRA NAV per share increased once again in the first three quarters of 2015, with the book value of equity per share improving to EUR 8.52 as at 30 September 2015 (30 September 2014: EUR 7.97) and EPRA NAV advancing to EUR 10.43 (30 September 2014: EUR 9.89) per share.

Outlook for 2015: Investments and a further increase in consolidated net income After three highly successful quarters of the 2015 financial year, S IMMO expects a positive performance for the final quarter as well. Accordingly, the company is reaffirming its target of further increasing consolidated net income and other key figures such as cash flow and FFO. The company aims to increase FFO, raising it from EUR 21.3m for the 2014 financial year to over EUR 40m by the end of 2018.

Friedrich Wachernig, Member of the Management Board at S IMMO AG: "The fact that we secured the low interest rate level will have an extremely positive impact on our key figures. But we will also continue to create value with our investment activities. We currently see the greatest potential in Germany, particularly among commercial properties in Berlin offering attractive development opportunities."

S IMMO AG As Austria's first stock exchange listed real estate investment company, S IMMO AG has stood for expertise, a strong portfolio, and profitable growth since 1987. The company invests in commercial property (office, retail, and hotel) as well as residential property in four regions (Austria, Germany, and Central and Southeastern Europe). S IMMO AG's strategic core shareholders are Erste Group and Vienna Insurance Group.

Consolidated income statement for the period 01 January 2015-30 September 2015 in EUR m / fair value method

01-09/2015 01-09/2014 Revenues 141.6 140.5 thereof rental income 83.2 84.5 thereof revenues from operating costs 25.4 25.9

thereof revenues from hotel operations 33.0 30.2 Other operating income 2.3 3.5 Expenses directly attributable to properties -42.6 -41.0 Hotel operating expenses -23.9 -23.2 Gross profit 77.4 79.7 Income from property disposals 15.9 48.4 Carrying amount of sold assets -15.9 -48.4 Gains or losses on property disposals 0 0 Management expenses -12.2 -12.1

Results before tax,property valuation, depreciation and amortisation, and 65.2 67.6 financing result (EBITDA)

Depreciation and Amortisation -5.8 -5.5 Results on property valuation 16.8 12.8 Operating result (EBIT) 76.1 74.9 Financing costs -41.1 -45.6 Financing income 0.9 1.7

Results from companies recognised

according to the equity method 0.8 0.4 Participating certificates result -2.2 -4.1 Net income before tax (EBT) 34.6 27.3 Taxes on income -6.4 -5.1 Profit for the period 28.2 22.2

thereof attributable to shareholders in parent company 26.5 20.2 thereof attributable to non- controlling interests 1.6 2.0

Earnings per share (in 0.40 0.30 EUR)

Key data on properties 30 September 2015 Portfolio properties number 205 Total useable space million m2 1.2 Gross rental yield % 7.0 Occupancy rate % 91.5

end of announcement euro adhoc

company: S IMMO AG Friedrichstraße 10 A-1010 Wien phone: +43(0)50100-27550 FAX: +43(0)050100-927559 mail: office@simmoag.at WWW: www.simmoag.at sector: Real Estate ISIN: AT0000652250 indexes: ATX Prime, IATX stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/3109/aom

kapitalmarkt-stimme.at daily voice: Wie geht es Ihnen heute? (oder: jetzt wird man auch schon auf LinkedIn genervt)

S Immo Letzter SK: 0.00 ( 0.00%)

Bildnachweis

1.

S Immo Anhang

>> Öffnen auf photaq.com

Aktien auf dem Radar:Zumtobel, Kapsch TrafficCom, Polytec Group, EuroTeleSites AG, Rosenbauer, Erste Group, voestalpine, SBO, Rosgix, Frequentis, VIG, Uniqa, Agrana, AT&S, Bawag, DO&CO, Gurktaler AG VZ, Rath AG, RBI, Strabag, Telekom Austria, Verbund, RHI Magnesita, BKS Bank Stamm, Athos Immobilien, Oberbank AG Stamm, Austriacard Holdings AG, Amag, CA Immo, EVN, CPI Europe AG.

Random Partner

Schwabe, Ley & Greiner (SLG)

Das Unternehmen SLG wurde 1988 gegründet und ist spezialisiert auf die Beratung im Bereich Finanz- und Treasury-Management.

Wir sind Marktführer im gesamten deutschsprachigen Raum und verfügen über einen soliden Partnerkreis. Diesen haben wir zur Stärkung des Unternehmens kontinuierlich erweitert.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Analysten weiter bullish auf DO & CO

- Carl Zeiss, Aixtron am besten (Peer Group Watch D...

- ATX TR-Frühmover: DO&CO, voestalpine, Wienerberge...

- DAX-Frühmover: MTU Aero Engines, Siemens, Brennta...

- wikifolio Champion per ..: Paul Pleus mit PPinves...

- Bestätigtes "Buy" für Bawag

Featured Partner Video

Wiener Börse Party #1086: ATX weiter rekordig, AT&S und Frequentis top, warum bei Frequentis dividiert durch SBO die 2,87 wichtig ist

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse. Inh...

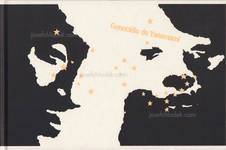

Books josefchladek.com

Köpfe des Alltags

1931

Hermann Reckendorf

Home is where work is

2024

Self published

As Long as the Sun Lasts

2025

Void

Remedy

2025

Nearest Truth

Fishworm

2025

Void

Claudia Andujar

Claudia Andujar Pedro J. Saavedra

Pedro J. Saavedra Ludwig Kozma

Ludwig Kozma Henrik Spohler

Henrik Spohler Jacques Fivel

Jacques Fivel