Rosenbauer International AG / Rosenbauer posts biggest-ever first-half-year sales

26.08.2014, 7929 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

6-month report/Half-year Financial Report 2014

Rosenbauer posts biggest-ever first-half-year sales Steady revenue growth of 5%, to EUR 354.3 million EBIT up 19% to EUR 20.0 million Order trend still on the rise

KEY CORPORATE FIGURES 1-6/2014 1-6/2013 in %

Revenues in EUR million 354.3 338.5 + 5% EBIT in EUR million 20.0 16.8 + 19% EBT in EUR million 19.6 17.1 + 15% Net profit for the period in EUR million 15.4 11.7 + 32% Cash flow from operating activities in EUR million (85.9) (15.5) Total assets in EUR million 525.8 474.3 + 11% Equity in % of total assets 36.2% 35.7% + 1% Investments in EUR million 4.8 11.3 + 31% Earnings per share EUR 1.7 1.4 + 21% Employees as at June 30 2,761 2,504 + 10% Order intake in EUR million 438.1 420.4 + 4% Order backlog as at June 30 in EUR million 731.8 682.5 + 7%

The markets for the fire-equipment industry are characterized once again by widely differing challenges in 2014. Overall, 2014 is not expected to bring any marked improvement, although indications of an upturn are starting to make themselves felt in certain markets. After several years of contraction, the world's biggest single market - the USA - is showing the first signs of a return to growth. The European fire-equipment market is nowhere near as homogeneous as the market in the United States, and so the picture differs depending on which country one looks at. The highly industrialized markets appear to have put the downturn behind them, and economic recovery is now in sight. For this reason, public-sector procurement behavior is expected to stabilize, thanks both to economic recovery and to a resumption of capital investments which had been deferred due to austerity policies.

Revenues In the first half of 2014, the Rosenbauer Group boosted revenues by 5% to EUR 354.3 million (1-6/2013: EUR 338.5 million). Another difference from the first half of 2013 was that the revenues of Rosenbauer Saudi Arabia and the newly acquired company Rosenbauer UK were included in the consolidated financial statements for the first time. The first six months of the year saw increased shipments in Germany, as well as from Spain and the USA to fulfill the major order from Saudi Arabia. Rosenbauer Motors was also successful in lifting revenues, with the new "Commander" US chassis and the chassis for the PANTHER aircraft rescue fire fighting vehicle.

Earnings At EUR 20.0 million, EBIT came in 19% higher than last year (1-6/2013: EUR 16.8 million). This increase is largely due to better earnings in the US segment, and to the improved result of the German segment. In the first half of the year, the EBIT margin of 5.6% (1-6/2013: 5.0%) was still below the long-term target value of over 7% - primarily as a result of the relocation of the PANTHER and AT vehicle production lines to the new Plant II, which is reflected in slightly lower EBIT in the Austrian segment.

The "Finance cost" deteriorated year-on-year to EUR -1.3 million (1-6/2013: EUR -1.1 million) owing to the higher financing needs, while the result of joint ventures fell to EUR 0.9 million (1-6/2013: EUR 1.4 million) due to reduced earnings from the joint venture in Russia. EBT for the first half of the year came to EUR 19.6 million (1-6/2013: EUR 17.1 million).

Orders Although market conditions throughout the world are still subdued, the Rosenbauer Group once again posted record figures for order intake and order-book levels. The volume of new orders taken in the first half of the year reached a record EUR 438.1 million, well above the level of recent years. This is due in part to a follow-up order from Saudi Arabia. The reserve of unfilled orders at June 30, 2014 amounted to EUR 731.8 million, 7% above last year's figure (June 30, 2013: EUR 628.5 million). This gives the Rosenbauer Group assured capacity utilization at all its manufacturing facilities, and a fairly clear view ahead for the next few months.

Financial position and asset situation For industry-specific reasons, the balance-sheet structure during the financial year is typified by a high level of working capital. This results from the turnaround times, lasting several months, for the vehicle contracts currently under manufacture. Moreover, the increase in the balance-sheet total to EUR 525.8 million (June 30, 2013: EUR 474.3 million) is attributable to the high production volumes and to the increase in fixed assets. Due to the high volume of shipments planned for the current year, inventories rose to EUR 187.3 million (June 30, 2013: EUR 184.7 million) and the production contracts to EUR 82.7 million (June 30, 2013: EUR 65.8 million). Receivables also reached a new high, of EUR 133.7 million (June 30, 2013: EUR 123.0 million), due to increased deliveries made shortly before the end of the quarter. Due to the continued increase in working capital - especially in the form of production contracts and trade receivables - the cash flow from operating activities deteriorated during the financial year to EUR -85.9 million (1-6/2013: EUR -15.5 million). The cash flow from operating activities may be expected to improve by the year-end.

Investments Capital investment outlays in this reporting period came to EUR 14.8 million (1-6/2013: EUR 11.3 million). To support fulfillment of the Group's medium-range strategy and to tackle the high volume of orders, a program of capacity enlargements is being carried out, mainly at its locations in Austria and Germany, entailing an investment volume of over EUR 20 million during the current financial year.

In addition, it is intended to purchase the premises of Plant II Leonding (which are currently being leased) from their existing owner at the end of 2014. The purchase option has already been exercised, and the purchase negotiations are likely to be concluded in the second half of the financial year. The investment total for 2014 as a whole will thus once again be at a high level, of over EUR 40 million.

Outlook Based on the overall economic outlook and the prospects for the fire-equipment sector, and on the particular growth prospects for the markets in which Rosenbauer is active, it should be possible for Rosenbauer to sustain the trend of previous years. In view of the healthy state of order books, the favorable outlook for project business and the enlarged production capacity, and thanks to the sales organization's ability to cater to the market's widely differing needs, Management's expectation for the current financial year is for revenues that are at the same high level as last year's.

However, the substantial investments being made in the future, the costs of installing the two new production lines at Plant II Leonding, and the still fierce price competition on the market, will all weigh on earnings. The additions to production space, and an optimization program launched in the main production zones in 2012, will counter this margin trend. Management is aiming for an improvement upon the EBIT margin of 5.7% attained in 2013.

end of announcement euro adhoc

company: Rosenbauer International AG Paschingerstrasse 90 A-4060 Leonding phone: +43(0)732 6794 568 FAX: +43(0)732 6794 89 mail: ir@rosenbauer.com WWW: www.rosenbauer.com sector: Machine Manufacturing ISIN: AT0000922554 indexes: WBI, ATX Prime

stockmarkets: free trade: Berlin, Stuttgart, official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2916/aom

Wiener Börse Party #1079: Kleine ATX-Korrektur am Ende einer weiteren Rekordwoche, Erste 2x über 100, Porr und AT&S vor den Vorhang

Rosenbauer

Uhrzeit: 13:04:13

Veränderung zu letztem SK: -0.63%

Letzter SK: 47.30 ( 0.00%)

Bildnachweis

Aktien auf dem Radar:EuroTeleSites AG, RHI Magnesita, Flughafen Wien, Austriacard Holdings AG, Addiko Bank, Zumtobel, FACC, Pierer Mobility, Andritz, CA Immo, Lenzing, Mayr-Melnhof, OMV, UBM, SBO, Wiener Privatbank, Frequentis, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, Amag, EVN, CPI Europe AG, Österreichische Post, Telekom Austria, Verbund, adidas, Fresenius Medical Care, Volkswagen Vz., Siemens Energy, Hannover Rück.

Random Partner

WKO

Die Wirtschaftskammer Österreich ist eine Körperschaft öffentlichen Rechts. Sie koordiniert die Tätigkeit der Landeskammern, der gesetzlichen Interessensvertretungen der gewerblichen Wirtschaftstreibenden.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- 21st Austria weekly - ATX with first close over 5...

- Börse-Inputs auf Spotify zu u.a. CSG, Colt, Erste...

- Mayr-Melnhof und voestalpine vs. RHI und Rosenbau...

- Uniqa und Swiss Re vs. Talanx und Zurich Insuranc...

- BT Group und Vodafone vs. Tele Columbus und Telec...

- ThyssenKrupp und Salzgitter vs. voestalpine und A...

Featured Partner Video

Börsepeople im Podcast S23/02: Markus Cserna

Markus Cserna ist Gründer und CTO der Cyan Security Group. Ähnlich wie in Folge 23/01 (Michael Mayer) geht es wieder um eine lässige IT- und vor allem -Cyber Security Laufbahn, die bei Markus und d...

Books josefchladek.com

Das Neue Haus

1941

Verlag Dr. H. Girsberger & Cie

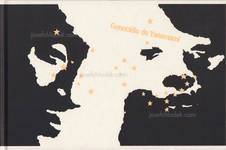

Genocídio do Yanomami

2025

Void

Joselito Verschaeve

Joselito Verschaeve Tenmei Kanoh

Tenmei Kanoh Jacques Fivel

Jacques Fivel Pia Paulina Guilmoth & Jesse Bull Saffire

Pia Paulina Guilmoth & Jesse Bull Saffire Daniele Torriglia

Daniele Torriglia Man Ray

Man Ray Sasha & Cami Stone

Sasha & Cami Stone Krass Clement

Krass Clement