28.07.2024, 2928 Zeichen

Verbund: Due to a weaker energy market environment, VERBUND posted lower results in quarters 1–2/2024 compared with the previous year. EBITDA fell by 21.9% year-on-year to €1,762.4m. The Group result was down 29.3% to €910.1m and the Group result after adjustment for non-recurring effects was down 22.9% year-on-year. Earnings were hard-hit by the sharp drop in futures prices for wholesale electricity that were relevant for the reporting period. Spot market prices likewise fell in quarters 1–2/2024. The average sales price achieved for own generation from hydropower fell by €68.8/MWh to €113.3/MWh. The water supply, which was well above average, had a positive impact on earnings. At 1.12, the hydro coefficient for the run-of-river power plants was 17 percentage points above the prior-year figure and 12 percentage points higher than the long-term average. By contrast, generation from annual storage power plants fell by 3.1% in quarters 1–2/2024 compared with the prior-year reporting period. Generation from hydropower thus increased by 2,239 GWh to 17,292 GWh. Despite higher generation from photovoltaic installations and wind power plants, particularly those that came online in Spain, the earnings contribution from the New renewables segment declined due to lower sales prices. A significantly higher earnings contribution in the Sales segment had a positive effect, partly due to lower procurement costs, while the contribution from the Grid segment suffered due to a drop in earnings at Gas Connect Austria GmbH and Austrian Power Grid AG. Earnings were also reduced by a lower contribution from flexibility products.

Verbund: weekly performance:

AMAG: The AMAG group's revenue totalled EUR 707.7 million in the first half of 2024 (H1/2023: EUR 796.4 million). At 214,100 tonnes, total shipments in tonnes were below the previous year's level (H1/2023: 221,200 tonnes), mainly reflecting the continued reduced demand for aluminium rolled products from certain industries, particularly in Europe. Eearnings before interest, taxes, depreciation and amortisation amounted to EUR 95.3 million in the first half of 2024 (H1/2023: EUR 117.8 million). The Metal Division benefited from stable production at full capacity and was thus able to take advantage of the higher aluminium price level in the second quarter of 2024. The Casting Division achieved good shipments and earnings performance despite the loss of momentum in the automotive industry. In the Rolling Division, the challenging market environment, particularly in Europe, led to a reduction in shipments overall. The broad and flexible positioning made it possible to reflect significant shifts in the product mix. The AMAG group generated net income after taxes of EUR 33.4 million in the current reporting period (H1/2023: EUR 51.0 million).

Amag: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (25/07/2024)

Song #57: Hear this! (A Duet with Podcast Guest Danja Bauer)

Bildnachweis

1.

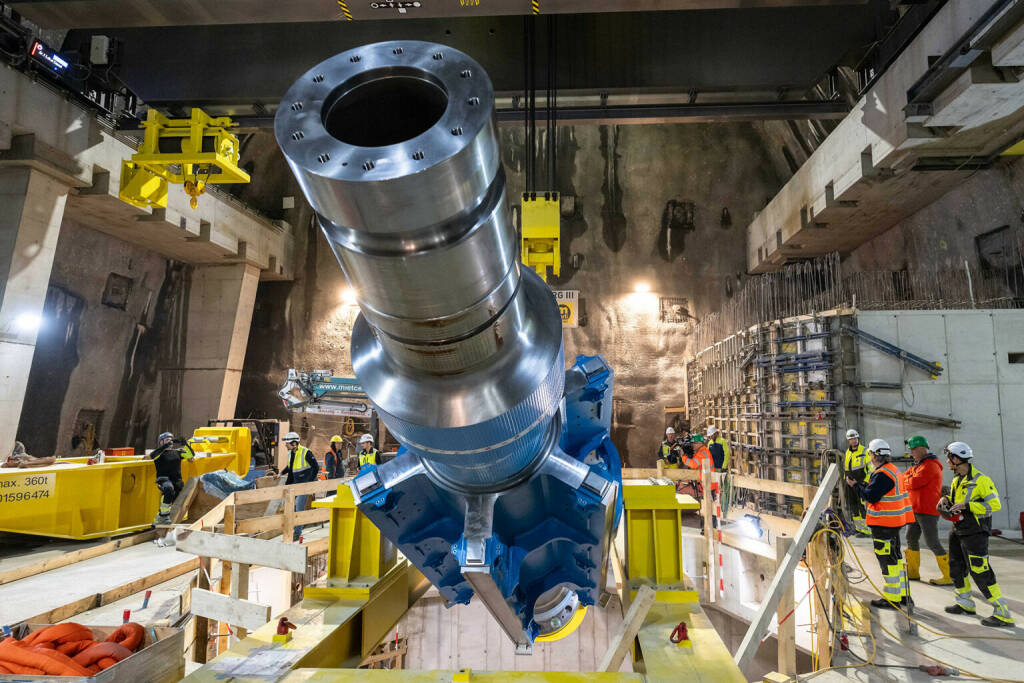

91 Tonnen schwer und 10 Meter lang ist die Welle, mit der die Kraft des Wassers auf die Turbinen von Limberg 3 übertragen werden. Der gigantische Stahlstift wurde zentimeterweise mit den Hallenkränen eingehoben. Fingerspitzengefühl, Nervenstärke und gute Abstimmung des Personals sind entscheidend. Die Rippenwelle beim Einkippen in den Turbinenschacht / VERBUND

, (© Aussender) >> Öffnen auf photaq.com

Aktien auf dem Radar:CA Immo, Immofinanz, Wienerberger, Strabag, Polytec Group, UBM, EVN, Wiener Privatbank, Palfinger, VIG, Mayr-Melnhof, Semperit, Telekom Austria, RBI, ams-Osram, AT&S, Marinomed Biotech, Wolford, Addiko Bank, Oberbank AG Stamm, Zumtobel, Agrana, Amag, Erste Group, Flughafen Wien, Kapsch TrafficCom, Österreichische Post, S Immo, Uniqa, Warimpex, Sartorius.

Random Partner

Warimpex

Die Warimpex Finanz- und Beteiligungs AG ist eine Immobilienentwicklungs- und Investmentgesellschaft. Im Fokus der Geschäftsaktivitäten stehen der Betrieb und die Errichtung von Hotels in CEE. Darüber hinaus entwickelt Warimpex auch Bürohäuser und andere Immobilien.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

-

16:00

-

15:00

-

14:00

-

26.07.

-

13:00

-

12:00

-

11:00

-

17:20

-

17:10

-

17:00

-

16:50

-

16:40

-

16:30

-

16:20

-

16:10

-

16:00

-

15:50

-

15:40

-

15:30

-

15:20

-

15:10

-

15:00

-

14:50

-

14:40

-

14:30

-

14:20

-

14:10

-

14:00

-

13:50

-

13:40

-

13:33

-

13:30

-

13:20

-

13:10

-

09:55

-

09:05

-

07:04

-

06:15

-

06:15

-

06:15

-

06:15

-

04:42

-

20:31

-

20:29

-

18:05

-

18:05