21st Austria weekly - Verbund, AMAG (25/07/2024)

28.07.2024, 2928 Zeichen

Verbund: Due to a weaker energy market environment, VERBUND posted lower results in quarters 1–2/2024 compared with the previous year. EBITDA fell by 21.9% year-on-year to €1,762.4m. The Group result was down 29.3% to €910.1m and the Group result after adjustment for non-recurring effects was down 22.9% year-on-year. Earnings were hard-hit by the sharp drop in futures prices for wholesale electricity that were relevant for the reporting period. Spot market prices likewise fell in quarters 1–2/2024. The average sales price achieved for own generation from hydropower fell by €68.8/MWh to €113.3/MWh. The water supply, which was well above average, had a positive impact on earnings. At 1.12, the hydro coefficient for the run-of-river power plants was 17 percentage points above the prior-year figure and 12 percentage points higher than the long-term average. By contrast, generation from annual storage power plants fell by 3.1% in quarters 1–2/2024 compared with the prior-year reporting period. Generation from hydropower thus increased by 2,239 GWh to 17,292 GWh. Despite higher generation from photovoltaic installations and wind power plants, particularly those that came online in Spain, the earnings contribution from the New renewables segment declined due to lower sales prices. A significantly higher earnings contribution in the Sales segment had a positive effect, partly due to lower procurement costs, while the contribution from the Grid segment suffered due to a drop in earnings at Gas Connect Austria GmbH and Austrian Power Grid AG. Earnings were also reduced by a lower contribution from flexibility products.

Verbund: weekly performance:

AMAG: The AMAG group's revenue totalled EUR 707.7 million in the first half of 2024 (H1/2023: EUR 796.4 million). At 214,100 tonnes, total shipments in tonnes were below the previous year's level (H1/2023: 221,200 tonnes), mainly reflecting the continued reduced demand for aluminium rolled products from certain industries, particularly in Europe. Eearnings before interest, taxes, depreciation and amortisation amounted to EUR 95.3 million in the first half of 2024 (H1/2023: EUR 117.8 million). The Metal Division benefited from stable production at full capacity and was thus able to take advantage of the higher aluminium price level in the second quarter of 2024. The Casting Division achieved good shipments and earnings performance despite the loss of momentum in the automotive industry. In the Rolling Division, the challenging market environment, particularly in Europe, led to a reduction in shipments overall. The broad and flexible positioning made it possible to reflect significant shifts in the product mix. The AMAG group generated net income after taxes of EUR 33.4 million in the current reporting period (H1/2023: EUR 51.0 million).

Amag: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (25/07/2024)

SportWoche ÖTV-Spitzentennis Podcast: Sebastian Ofner und Joel Schwärzler holen Turniersiege und wir haben damit Rekordwerte 2026

Bildnachweis

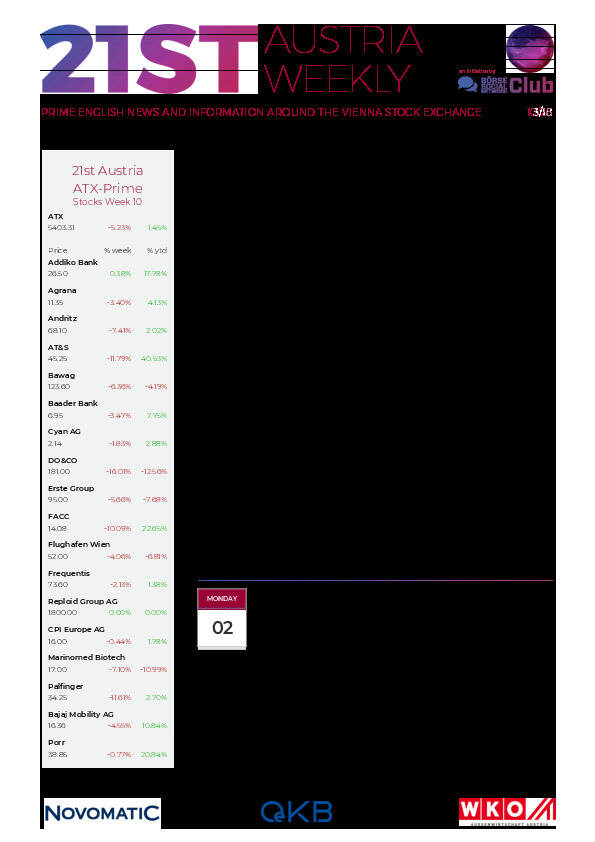

Aktien auf dem Radar:FACC, RHI Magnesita, Amag, Agrana, Austriacard Holdings AG, Kapsch TrafficCom, Wolford, UBM, AT&S, DO&CO, Rath AG, RBI, Verbund, Wienerberger, Warimpex, Zumtobel, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, CPI Europe AG, Österreichische Post, Telekom Austria, Infineon, Deutsche Boerse, Fresenius Medical Care, SAP, Scout24, Continental.

Random Partner

Freisinger

FREISINGER enterprises setzt auf Old-Economy im Bereich von technischen und industriellen Gütern. Persönlicher Kontakt mit einer guten Mischung aus E-Commerce ergeben eine optimale Vertriebsstruktur für technische Gase, Zubehör und Dienstleistungen.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten