wikifolio whispers a.m. Vonovia SE, Nvidia, Netflix, Meta und SMA Solar

wikifolio whispers a.m. Vonovia SE, Nvidia, Netflix, Meta und SMA Solar

02.06.2023, 4904 Zeichen

JochenGehlert (ERS2018): Heute wurde die Position geschlossen in: Vonovia + 4,07 % Ertrag (02.06. 08:42)

DavidePecorari (MRKTLDRS): The case for the total unpredictability of the financial markets: the 2023 lesson This year has been marked by an interesting phenomenon in the financial markets, where the expectations set by many financial analysts at the beginning of the year have been challenged. Specifically, there was a prevailing sentiment among analysts that small/mid-cap and value stocks would have delivered exceptional performance throughout the year and the years to come, due to their attractive valuations in the monetary contest of high interest rates. The expectation was driven by the financial markets historic statistic, so was seemed to be well founded to the analysts and to the practitioners. However, as we approach June 2023, it becomes evident that technological stocks have taken the spotlight instead, surpassing expectations and outperforming other sectors. In fact, in these months, the financial landscape took an unexpected turn. Technological stocks, particularly those in sectors like cloud computing, e-commerce, artificial intelligence, and electric vehicles, demonstrated remarkable resilience and continued to soar to new heights. These companies, often characterized by their innovative products, disruptive business models, and strong growth potential, captivated investors' attention and delivered exceptional returns. At the present date (29/05/23), the Year To Date (YTD) returns of stocks like Nvidia (+ 116,50%) and Meta (+ 117,75%) make a case for themselves, leaving a reminder that financial markets are inherently unpredictable and subject to various factors that can influence their trajectory. Despite the extensive research, analysis, and predictions made by financial experts, market dynamics can rapidly shift, influenced by a myriad of factors such as geopolitical events, macroeconomic conditions, technological advancements, and investor sentiment. The interplay of these elements can lead to surprising outcomes, defying even the most well-founded forecasts. The market unpredictability, in my opinion, only confirm the importance to have a well-diversified exposure, trying to capitalize the best opportunities in different sectors and asset class. In our Market Leaders Stocks we were exposed to Nvidia and Meta since March 2023. We didn’t know these companies were going to have a future exploit, but we knew these were stocks showing clear sign of potential upside, according to our algorithms. So, in the end, even the year 2023 has refreshed us a lesson just few months after its beginning: never believe to been able to anticipate market moves based on short analyses, the public narrative or relying only on financial history, financial markets are way more complex, so never give them for granted. (02.06. 08:37)

10BLN (TFCS2100): SMA mit einer Perfomance von aktuell > 110% und einem Depotanteil von > 12% der Top-Performer - neben NVIDIA, Netflix und Meta. (02.06. 08:16)

10BLN (TFCS2100): SMA mit einer Perfomance von aktuell > 110% und einem Depotanteil von > 12% der Top-Performer - neben NVIDIA, Netflix und Meta. (02.06. 08:16)

10BLN (TFCS2100): SMA mit einer Perfomance von aktuell > 110% und einem Depotanteil von > 12% der Top-Performer - neben NVIDIA, Netflix und Meta. (02.06. 08:16)

10BLN (TFCS2100): SMA mit einer Perfomance von aktuell > 110% und einem Depotanteil von > 12% der Top-Performer - neben NVIDIA, Netflix und Meta. (02.06. 08:15)

10BLN (TFCS2100): Netflix weiterhin als einer der Top-Performer. Dass gegen das Accountsharing vorgegangen wird mag privat stören - als Aktionär ist dieses Vorgehen zu begrüßen. ;) (02.06. 08:13)

10BLN (TRAD1000): SMA weiterhin stabil, Depotanteil 9%, Performance über 70%. (02.06. 08:12)

10BLN (TRAD1000): NVIDIA mit aktuell 9% Depotanteil und über 70% Perfomance. (02.06. 08:11)

10BLN (TRAD1000): Mit aktuell mehr als 110% Performance bei >20% Depotanteil der Top-Performer. (02.06. 08:10)

Was noch interessant sein dürfte:

kapitalmarkt-stimme.at daily voice 105/365: Top für unsere Wirtschaft ist, dass die Politik bürokratische Prokrastination aufgeben muss

Bildnachweis

1.

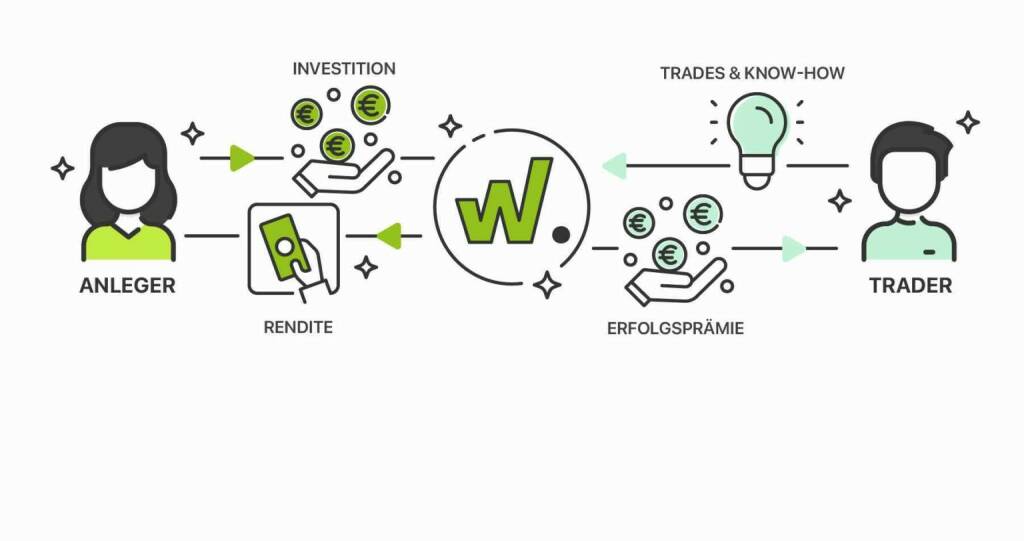

Das wikifolio Prinzip - Smarter handeln - Mach die Handelsstrategien anderer zu deiner eigenen. Mit wikifolio-Zertifikaten holst du die Performance privater und professioneller Investoren direkt in dein Depot.

Aktien auf dem Radar:Frequentis, Porr, VIG, Addiko Bank, Pierer Mobility, RHI Magnesita, ATX Prime, Strabag, Mayr-Melnhof, SBO, Lenzing, CPI Europe AG, EVN, CA Immo, AT&S, Andritz, Wienerberger, Verbund, ATX TR, ATX, voestalpine, Österreichische Post, Marinomed Biotech, Erste Group, FACC, Polytec Group, Rosenbauer, UBM, Bawag, DO&CO, Kapsch TrafficCom.

Random Partner

Buwog

Die Buwog Group ist deutsch-österreichischer Komplettanbieter im Wohnimmobilienbereich. Insgesamt verfügt die Buwog Group über ein Portfolio mit rd. 51.000 Wohnungen. Mit einem Neubauvolumen von jährlich rund 700 Wohnungen im Großraum Wien ist die Buwog Group einer der aktivsten Wohnbauträger und Immobilienentwickler in Deutschland und Österreich.

>> Besuchen Sie 60 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse: ATX legt am Dienstag 1,97 Prozent zu

- Wiener Börse Nebenwerte-Blick: Strabag legt fast ...

- FACC von Embraer mit Supplier Award 2025 ausgezei...

- AMAG - Am 23. April ist Dividenden-Zahltag

- Wie Strabag, Porr, Marinomed Biotech, Rosenbauer,...

- Wie CA Immo, Lenzing, SBO, VIG, Telekom Austria u...

Featured Partner Video

kapitalmarkt-stimme.at daily voice 80/365: Glauben Sie, dass eine weitere WP-KESt-Erhöhung droht, Christoph Boschan?

kapitalmarkt-stimme.at daily voice 80/365: Im Rahmen der Aktienbarometer 2025-Präsentation wurde das Panel gefragt, ob aufgrund der aktuellen Konstellation vielleicht sogar ev. eine weitere Erhöhun...

Books josefchladek.com

Cologne intime

1957

Greven

Maledetto Cane #1

2024

Self published

Gytis Skudzinskas

Gytis Skudzinskas Joachim Brohm

Joachim Brohm Yorgos Lanthimos

Yorgos Lanthimos Bryan Schutmaat & Ashlyn Davis

Bryan Schutmaat & Ashlyn Davis Bryan Schutmaat

Bryan Schutmaat Vic Bakin

Vic Bakin Paul Guilmoth

Paul Guilmoth Nikita Teryoshin

Nikita Teryoshin

DavidePecorari (MRKTLDRS): The case for the total unpredictability of the financial markets: the 2023 lesson This year has been marked by an interesting phenomenon in the financial markets, where the expectations set by many financial analysts at the beginning of the year have been challenged. Specifically, there was a prevailing sentiment among analysts that small/mid-cap and value stocks would have delivered exceptional performance throughout the year and the years to come, due to their attractive valuations in the monetary contest of high interest rates. The expectation was driven by the financial markets historic statistic, so was seemed to be well founded to the analysts and to the practitioners. However, as we approach June 2023, it becomes evident that technological stocks have taken the spotlight instead, surpassing expectations and outperforming other sectors. In fact, in these months, the financial landscape took an unexpected turn. Technological stocks, particularly those in sectors like cloud computing, e-commerce, artificial intelligence, and electric vehicles, demonstrated remarkable resilience and continued to soar to new heights. These companies, often characterized by their innovative products, disruptive business models, and strong growth potential, captivated investors' attention and delivered exceptional returns. At the present date (29/05/23), the Year To Date (YTD) returns of stocks like Nvidia (+ 116,50%) and Meta (+ 117,75%) make a case for themselves, leaving a reminder that financial markets are inherently unpredictable and subject to various factors that can influence their trajectory. Despite the extensive research, analysis, and predictions made by financial experts, market dynamics can rapidly shift, influenced by a myriad of factors such as geopolitical events, macroeconomic conditions, technological advancements, and investor sentiment. The interplay of these elements can lead to surprising outcomes, defying even the most well-founded forecasts. The market unpredictability, in my opinion, only confirm the importance to have a well-diversified exposure, trying to capitalize the best opportunities in different sectors and asset class. In our Market Leaders Stocks we were exposed to Nvidia and Meta since March 2023. We didn’t know these companies were going to have a future exploit, but we knew these were stocks showing clear sign of potential upside, according to our algorithms. So, in the end, even the year 2023 has refreshed us a lesson just few months after its beginning: never believe to been able to anticipate market moves based on short analyses, the public narrative or relying only on financial history, financial markets are way more complex, so never give them for granted. (02.06. 08:37)

10BLN (TFCS2100): SMA mit einer Perfomance von aktuell > 110% und einem Depotanteil von > 12% der Top-Performer - neben NVIDIA, Netflix und Meta. (02.06. 08:16)

10BLN (TFCS2100): SMA mit einer Perfomance von aktuell > 110% und einem Depotanteil von > 12% der Top-Performer - neben NVIDIA, Netflix und Meta. (02.06. 08:16)

10BLN (TFCS2100): SMA mit einer Perfomance von aktuell > 110% und einem Depotanteil von > 12% der Top-Performer - neben NVIDIA, Netflix und Meta. (02.06. 08:16)

10BLN (TFCS2100): SMA mit einer Perfomance von aktuell > 110% und einem Depotanteil von > 12% der Top-Performer - neben NVIDIA, Netflix und Meta. (02.06. 08:15)

10BLN (TFCS2100): Netflix weiterhin als einer der Top-Performer. Dass gegen das Accountsharing vorgegangen wird mag privat stören - als Aktionär ist dieses Vorgehen zu begrüßen. ;) (02.06. 08:13)

10BLN (TRAD1000): SMA weiterhin stabil, Depotanteil 9%, Performance über 70%. (02.06. 08:12)

10BLN (TRAD1000): NVIDIA mit aktuell 9% Depotanteil und über 70% Perfomance. (02.06. 08:11)

10BLN (TRAD1000): Mit aktuell mehr als 110% Performance bei >20% Depotanteil der Top-Performer. (02.06. 08:10)