PALFINGER AG / PALFINGER Results 2020: A Landmark Year

25.02.2021, 4670 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Financial Figures/Balance Sheet

Bergheim -

EBIT EUR 100.3 million, despite COVID-19\nNet debt at lowest since 2013 (taking the effect of IFRS 16 into account)\nHighest free cashflow in company history\n2021 annual revenue target: over EUR 1.7 billion\n ______________________________________________________________________________ |In_EUR_million|___________2018|___________2019|___________2020|______________%| |Revenue_______|________1,615.6|________1,753.8|________1,533.9|_________-12.5%| |EBITDA________|__________196.7|__________223.6|__________188.7|_________-15,6%| |EBITDA margin | 12.2%| 12.8%| 12.3%| -| |in_%__________|_______________|_______________|_______________|_______________| |EBIT__________|__________127.0|__________149.0|__________100.3|_________-32.7%| |EBIT margin in| 7.9%| 8.5%| 6,5%| -| |%_____________|_______________|_______________|_______________|_______________| |Consolidated | 58.0| 80.0| 49.8| -37.8%| |net_result____|_______________|_______________|_______________|_______________| |Employees1____|_________10,780|_________11,126|_________10,824|______________-|

1) Reporting-date figures for consolidated Group companies exclude equity investment and contingent workers.

Today, the PALFINGER AG Supervisory Board approved the annual financial statements and, together with the Executive Board, resolved to propose a dividend of EUR 0.45 per share to the Annual General Meeting on April 7, 2021. The hybrid press conference and balance sheet presentation take place tomorrow, Friday, February 26th at 9:30 am in Lengau. The most important developments and results are presented in brief in this press release:

The global health and economic crisis is impacting sales, EBIT and net revenues. Liquidity optimization actions have resulted in historically high free cash flow, the lowest net debt since 2013 taking the effect of IFRS 16 into account and a higher equity ratio.

Revenues and Earnings Development In fiscal year 2020, the Group revenues of PALFINGER AG was EUR 1,533.9 million, down from EUR 1,753.8 million the previous year. In comparison to 2019, the EBITDA decreased by 15.6 percent to EUR 188.7 million, and at 12.3 percent, the EBITDA margin lies below 2019's 12.8 percent. The EBIT decreased to EUR 100.3 million from EUR 149.0 million in 2019. The EBIT margin decreased from 8.5 percent in 2019 to 6.5 percent in 2020. Consolidated net result in 2020 declined 37.8 percent to EUR 49.8 million in comparison to a record of EUR 80.0 million in 2019.

Outlook In 2021, PALFINGER strives for annual revenue over EUR 1.7 billion and an EBIT margin of 8 percent. For 2024 the financial targets are EUR 2.0 billion in revenue from organic growth, an average EBIT margin of 10 percent and an average ROCE of 10 percent over the business cycle.

Please click here to access the online version of PALFINGER AG's Integrated Annual Report 2020: https://www.palfinger.ag/en/news/publications

+++

ABOUT PALFINGER AG The international mechanical engineering firm of PALFINGER is the global leader for innovative crane and lifting solutions. workforce of approximately 10,800, 35 manufacturing sites and a worldwide network of dealerships and service centers at over 5,000 locations, PALFINGER is always close to the customer.

As the leader in its engineering field, the company aims to ensure its partners' business success in the long term by providing solutions and products that remain economically and ecologically viable in the future. Its broad product and model portfolio allow PALFINGER to take digitalization and the deployment of artificial intelligence to new levels.

As a global company with strong roots in its home region, PALFINGER is convinced that thinking and acting in the interest of sustainability plays a vital role in successful business operations. That is why the company assumes social, ecological and economic responsibility along the entire value chain.

PALFINGER AG has been listed on the Vienna Stock Exchange since 1999 and in 2020 achieved a revenue of EUR 1.53 billion.

end of announcement euro adhoc

issuer: Palfinger AG Lamprechtshausener Bundesstraße 8 A-5020 Salzburg phone: 0662/2281-81101 FAX: 0662/2281-81070 mail: ir@palfinger.com WWW: www.palfinger.ag ISIN: AT0000758305 indexes: stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/1659/aom

Börsepeople im Podcast S22/19: Karin Pühringer

Palfinger

Uhrzeit: 19:03:24

Veränderung zu letztem SK: 1.23%

Letzter SK: 32.65 ( -0.91%)

Bildnachweis

Aktien auf dem Radar:VIG, Kapsch TrafficCom, UBM, EuroTeleSites AG, Flughafen Wien, Palfinger, ATX, ATX Prime, ATX TR, ATX NTR, Bawag, Andritz, Mayr-Melnhof, Telekom Austria, RBI, voestalpine, SBO, Frequentis, Pierer Mobility, BKS Bank Stamm, Oberbank AG Stamm, Warimpex, Amag, EVN, CPI Europe AG, Lenzing, Österreichische Post, RHI Magnesita, Deutsche Telekom, Allianz, Fresenius.

Random Partner

Matejka & Partner

Die Matejka & Partner Asset Management GmbH ist eine auf Vermögensverwaltung konzentrierte Wertpapierfirma. Im Vordergrund der Dienstleistungen stehen maßgeschneiderte Konzepte und individuelle Lösungen. Für die Gesellschaft ist es geübte Praxis, neue Herausforderungen des Marktes frühzeitig zu erkennen und entsprechende Strategien zu entwickeln.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Mayr-Melnhof und Andritz vs. Wienerberger und RHI...

- VIG und Generali Assicuraz. vs. AXA und Zurich In...

- O2 und Drillisch vs. Tele Columbus und Swisscom –...

- ArcelorMittal und ThyssenKrupp vs. voestalpine un...

- Nike und bet-at-home.com vs. World Wrestling Ente...

- Silver Standard Resources und Rio Tinto vs. Gazpr...

Featured Partner Video

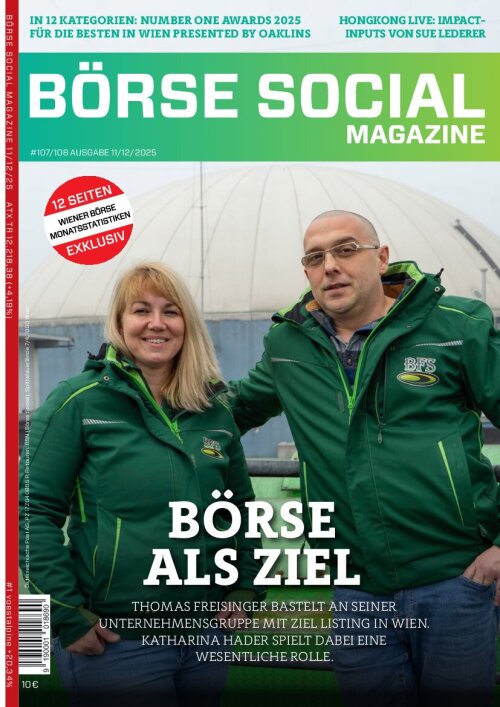

Börsepeople im Podcast S22/09: Katharina Hader

Katharina Hader macht mit Biogas aus Reststoffen Zukunft und aus Problemen Lösungen. Sie ist neuester Part der Investmentment-Story der Freisinger Holding AG von Thomas Freisinger - einem Unternehm...

Books josefchladek.com

A1: The Great North Road

1983

Grey Editions

Zur neuen Wohnform

1930

Bauwelt-Verlag

So lebt man heute in Rußland

1957

Blüchert

Sasha & Cami Stone

Sasha & Cami Stone Allied Forces

Allied Forces Krass Clement

Krass Clement Anna Fabricius

Anna Fabricius JH Engström

JH Engström Julie van der Vaart

Julie van der Vaart