RBI: Publication of Q1 2020 results and change in outlook

14.05.2020, 4013 Zeichen

Disclosed inside information pursuant to article 17 Market Abuse Regulation (MAR) transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Quarterly Report 14.05.2020

Vienna - Vienna, 14 May 2020. Following a relatively strong first quarter operating result, there has also been an improvement in visibility with respect to the economic repercussions of COVID-19 in the markets in which Raiffeisen Bank International AG (RBI) operates. This has enabled a better assessment of the expected future impact on the business and led to an update in the outlook:

We expect modest loan growth in 2020.\nThe provisioning ratio for FY 2020 is currently expected to be around 75 basis points, depending on the length and severity of disruption.\nWe aim to achieve a cost/income ratio of around 55 per cent in the medium term and are evaluating how the current circumstances will impact the ratio in 2021.\nIn the medium term we target a consolidated return on equity of approximately 11 per cent. As of today, and based on our best estimates, we expect a consolidated return on equity in the mid-single digits for 2020.\nWe confirm our CET1 ratio target of around 13 per cent for the medium term.\nBased on this target we intend to distribute between 20 and 50 per cent of consolidated profit.\nRBI has also published its First Quarter Report 2020, which can be found online at http://qr012020.rbinternational.com.

Income Statement in Q1/2020 Q1/2019 Q4/2019 EUR million Net interest income 881 825 881 Net fee and 448 402 489 commission income Net trading income 37 (52) 70 and fair value result General administrative (755) (724) (848) expenses Other result (82) (26) (151) Operating result 650 489 794 Levies and special (128) (114) (21) governmental measures Impairment losses on (153) (9) (154) financial assets Profit before tax 286 340 468 Profit after tax 207 259 380 Consolidated profit 177 226 353

Balance Sheet in EUR 31/03/2020 31/12/2019 million Loans to customers 92,198 91,204 Deposits from customers 97,084 96,214 Total assets 155,596 152,200 Total risk-weighted assets 78,181 77,966 (RWA)

Key ratios 31/03/2020 31/12/2019 NPE ratio 2.0% 2.1% NPE coverage ratio 62.4% 61.0% CET1 ratio (fully loaded, 13.0% 13.9% incl. result) Total capital ratio (fully 16.8% 17.9% loaded, incl. result)

Key ratios Q1/2020 Q1/2019 Q4/2019 Net interest margin (average interest- 2.43% 2.43% 2.47% bearing assets) Cost/income ratio 53.8% 59.7% 51.7% Provisioning ratio (average loans to 0.66% 0.04% 0.65% customers) Consolidated return on 5.6% 7.9% 12.8% equity Earnings per share in 0.49 0.64 1.03 EUR

end of announcement euro adhoc

issuer: Raiffeisen Bank International AG Am Stadtpark 9 A-1030 Wien phone: +43 1 71707-2089 FAX: +43 1 71707-2138 mail: ir@rbinternational.com WWW: www.rbinternational.com ISIN: AT0000606306 indexes: ATX stockmarkets: Luxembourg Stock Exchange, Wien language: English

Digital press kit: http://www.ots.at/pressemappe/5366/aom

BörseGeschichte Podcast: Gerald Grohmann vor 10 Jahren zum ATX-25er

RBI

Uhrzeit: 13:02:40

Veränderung zu letztem SK: -0.13%

Letzter SK: 37.66 ( -0.05%)

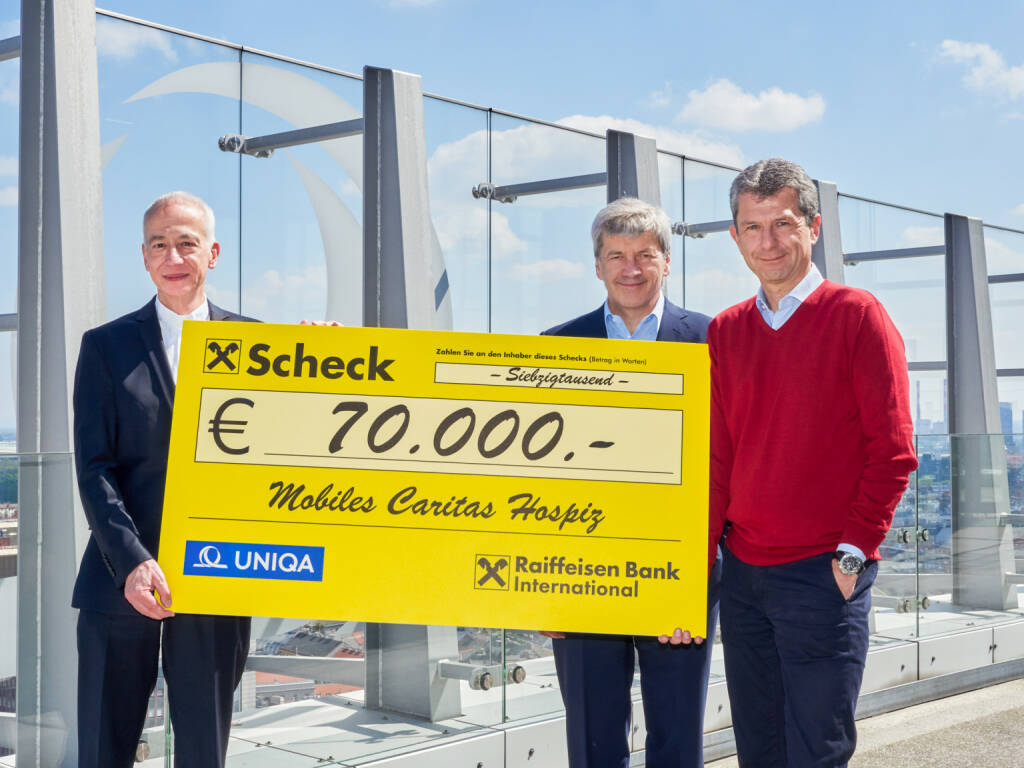

Bildnachweis

Aktien auf dem Radar:Polytec Group, Addiko Bank, UBM, RHI Magnesita, Zumtobel, Agrana, Rosgix, CA Immo, DO&CO, SBO, Gurktaler AG Stamm, Heid AG, OMV, Wolford, Palfinger, Rosenbauer, Oberbank AG Stamm, BTV AG, Flughafen Wien, BKS Bank Stamm, Josef Manner & Comp. AG, Mayr-Melnhof, Athos Immobilien, Marinomed Biotech, Amag, Österreichische Post, Verbund, Wienerberger, Merck KGaA, Continental, Fresenius Medical Care.

Random Partner

Porr

Die Porr ist eines der größten Bauunternehmen in Österreich und gehört zu den führenden Anbietern in Europa. Als Full-Service-Provider bietet das Unternehmen alle Leistungen im Hoch-, Tief- und Infrastrukturbau entlang der gesamten Wertschöpfungskette Bau.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Palfinger und Andritz vs. RHI und Wienerberger – ...

- Uniqa und Talanx vs. Swiss Re und Zurich Insuranc...

- Tele Columbus und Telecom Italia vs. AT&T und Ora...

- ArcelorMittal und ThyssenKrupp vs. Salzgitter und...

- Callaway Golf und Puma vs. World Wrestling Entert...

- Silver Standard Resources und Royal Dutch Shell v...

Featured Partner Video

Christmas Bell At Home (Kids Choir Take)

Sung bei Michael Marek, Luca & Leon.

Weihnachtssingle Audio-CD.at: http://www.audio-cd.at/christmas-bell-at-homeUnd der Lin...

Books josefchladek.com

Sequenze di Fabbrica

2025

Boring Machines

Os Americanos (first Brazilian edition)

2017

Instituto Moreira Salles

Remedy

2025

Nearest Truth

Man Ray

Man Ray Jan Holkup

Jan Holkup Joselito Verschaeve

Joselito Verschaeve Erich Einhorn

Erich Einhorn Ray K. Metzker

Ray K. Metzker  Niko Havranek

Niko Havranek