Semperit AG Holding / Semperit continues successful implementation of turnaround in the first quarter of 2019 and improves profitability

Semperit AG Holding / Semperit continues successful implementation of turnaround in the first quarter of 2019 and improves profitability

28.05.2019, 7660 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Quarterly Report

Vienna, Austria -

EBITDA rose by 4.6% to EUR 16.5 million and EBITDA margin from 7.1% to 7.7%\nEBIT increased significantly again by 30.8% to EUR 7.8 million and EBIT margin from 2.7% to 3.7%\nPositive net result of EUR 3.2 million\nDecrease in Group's revenue by 3.6% to EUR 212.9 million\nIndustrial Sector slightly increased revenue by 0.4% to EUR 141.4 million; Medical Sector with decline in revenue of 10.7%\nIn the first quarter of 2019, the publicly listed Semperit Group was able to improve its net results significantly with increasing profitability on EBITDA and EBIT level and took a turn for the better, while revenues declined slightly: "We have increased our profitability for the fifth consecutive quarter now and are very satisfied with the start of 2019 - especially with regard to the Industrial Sector," Martin Fuellenbach, Chairman of the Management Board of Semperit AG Holding, emphasises. "Our strict and rigid focus on cost and process optimisation, quality improvement and complexity reduction translated into enhanced profitability and contributed significantly to the earnings improvement. With the consistent continuation of our transformation process, we have come much closer to the goal of a 10% EBITDA margin from 2021 onwards."

The improvement of profitability was achieved in an environment that is repeatedly influenced by macroeconomic and global political uncertainties. The raw material markets have eased slightly compared to the previous year, although some of the raw materials needed by Semperit continue to face increased competition.

In the first quarter of 2019, the Group's revenue decreased by 3.6% to EUR 212.9 million, with the Industrial Sector achieving a slight increase in revenue to EUR 141.4 million, which was offset by a decrease in revenue of 10.7% in the Medical Sector. EBITDA (earnings before interest, tax, depreciation, and amortisation) rose from EUR 15.8 million in the first quarter of 2018 to EUR 16.5 million in the first quarter of 2019. The EBITDA margin increased from 7.1% to 7.7%.

EBIT (earnings before interest and tax) was EUR 6.0 million in the first quarter of 2018 and improved to EUR 7.8 million in the first quarter of 2019. The EBIT margin increased from 2.7% to 3.7%. Earnings after tax totalled EUR +3.2 million for the first quarter of 2019 compared with EUR -2.6 million for the same period of 2018. Earnings per share amounted to EUR +0.16 in the first quarter of 2019 after EUR -0.14 in the first quarter of 2018.

At EUR 16.2 million, cash-relevant investments in tangible and intangible assets in the first quarter of 2019 were significantly below the previous year's level of EUR 24.5 million and mainly related to maintenance investments.

With an equity ratio of 41.3% (end of 2018: 42.9%), Semperit still held a solid capital base as of the balance sheet date. Cash and cash equivalents amounted to EUR 140.2 million at the end of March 2019 and were therefore above the level of the end of 2018 (EUR 122 million). At the same time, net debt was decreased by EUR 17 million to EUR 96 million during this period.

INDUSTRIAL SECTOR: STRONG INCREASE IN PROFITABILITY The Industrial Sector comprises the segments Semperflex, Sempertrans and Semperform and developed in a differentiated way: Semperflex and Semperform increased their revenues, while Sempertrans recorded a decline. In total, the sector's revenue increased by 0.4% from EUR 140.9 million to EUR 141.4 million. Due to the positive development in the segments, overall profitability in the Industrial Sector increased significantly. EBITDA improved by 30.7% to EUR 24.5 million and EBIT by 40.6% to EUR 18.4 million. The EBITDA margin improved from 13.3% to 17.3% and the EBIT margin from 9.3% to 13.0%. This was primarily attributable to the initiatives from the transformation programme.

MEDICAL SECTOR: DECLINE IN VOLUMES SOLD The development of the Sempermed segment was characterised by strong competitive and price pressures, particularly in North America. The reduction of sales of natural latex gloves led to a declining sales and revenue development. This resulted in a decrease in revenue by 10.7% to EUR 71.5 million in the first quarter of 2019. EBITDA was EUR -0.9 million in the first quarter of 2019, after EUR 1.4 million in the prior year period. EBIT amounted to EUR -2.8 million after EUR -2.2 million in the first quarter of 2018. The measures taken in the course of the restructuring and transformation process are showing a positive impact.

OUTLOOK 2019 The Management Board of Semperit will continue the transformation process that has been started with all its consequences. Continuous and potentially new measures to increase profitability remain at the top of the Management Board's agenda.

The focus of the restructuring measures will clearly be on the Sempermed segment, continuing the hard work on its turnaround. Progress is clearly visible in the Industrial Sector. Ongoing and further initiatives are being implemented systematically. Semperit will initially focus on organic growth, particularly in the Industrial Sector, and will also gradually focus on inorganic growth considerations over the course of the year.

Since Semperit currently has sufficient capacities in production and in Mixing, capital expenditures (CAPEX, including maintenance) of only around EUR 40 million are planned for 2019. This should also bring us closer to the goal of a balanced or positive free cash flow in 2019. Increased financial discipline is enforced through step-by-step cost optimisation and reduced net debt, with our focus on value management and optimisation of the working capital and free cash flow representing a key performance indicator in our financial planning.

Since the beginning of the restructuring and transformation process, the Management Board has identified significant potentials for earnings improvement and initiated appropriate implementation measures. The conclusion of the transformation of the Semperit Group is scheduled for the end of 2020. From this point of time, the Semperit Group aims to achieve an EBITDA margin of around 10% (run rate 2021) as central key performance indicator.

About Semperit The publicly listed company Semperit AG Holding is an internationally-oriented group that develops, produces, and sells in more than 100 countries highly specialised rubber products for the medical and industrial sectors: examination and surgical gloves, hydraulic and industrial hoses, conveyor belts, escalator handrails, construction profiles, cable car rings, and products for railway superstructures. The headquarters of this long-standing Austrian company, which was founded in 1824, are located in Vienna. The Semperit Group employs around 6,800 people worldwide, including about 3,500 in Asia and more than 900 in Austria (Vienna and production site in Wimpassing, Lower Austria). The Group has 14 manufacturing facilities worldwide and numerous sales offices in Europe, Asia, Australia, and America. In 2018, the group generated revenue of EUR 878.5 million and an adjusted EBITDA (without one-off effects) of EUR 50.3 million.

end of announcement euro adhoc

issuer: Semperit AG Holding Modecenterstrasse 22 A-1030 Wien phone: +43 1 79 777-213 FAX: +43 1 79 777-602 mail: agnes.springer@semperitgroup.com WWW: www.semperitgroup.com ISIN: AT0000785555 indexes: ATX PRIME, ATX GP, WBI stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2918/aom

SportWoche Podcast #123: Hans Huber und Christian Drastil über persönliche Highlights der starken Olympischen Spiele in Paris

Semperit

Uhrzeit: 22:59:24

Veränderung zu letztem SK: 0.41%

Letzter SK: 12.16 ( 0.50%)

Bildnachweis

1.

Semperit-HV 2018

>> Öffnen auf photaq.com

Aktien auf dem Radar:Rosenbauer, SBO, Polytec Group, Austriacard Holdings AG, Addiko Bank, Strabag, Zumtobel, Porr, Bawag, Rosgix, Telekom Austria, AT&S, CA Immo, Erste Group, ams-Osram, BTV AG, Marinomed Biotech, Pierer Mobility, Oberbank AG Stamm, Agrana, Amag, EVN, Flughafen Wien, Immofinanz, Palfinger, Österreichische Post, RHI Magnesita, S Immo, Uniqa, VIG, Wienerberger.

Random Partner

Porr

Die Porr ist eines der größten Bauunternehmen in Österreich und gehört zu den führenden Anbietern in Europa. Als Full-Service-Provider bietet das Unternehmen alle Leistungen im Hoch-, Tief- und Infrastrukturbau entlang der gesamten Wertschöpfungskette Bau.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2VYE4 | |

| AT0000A3C5E0 | |

| AT0000A2UVV6 |

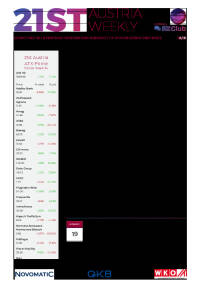

- 21st Austria weekly - ATX TR at 8599.15 - Rosenba...

- Börse-Inputs auf Spotify zu u.a. Jeff Bezos, Frit...

- Rosenbauer und Andritz vs. RHI und Polytec Group ...

- Swiss Re und Hannover Rück vs. Zurich Insurance u...

- Drillisch und Telecom Italia vs. BT Group und Vod...

- ArcelorMittal und voestalpine vs. ThyssenKrupp un...

Featured Partner Video

Sagen, was man sieht

Das Sporttagebuch mit Michael Knöppel - 4. August 2024 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch Twitter: @Sporttagebuch_

Das Sporttagebuch mit Michael Knöppel - 4. ...

Books josefchladek.com

Ústí nad Labem

1965

Severočeské krajské nakladatelství

Gruvarbetare i Wales

1977

Trydells

A Way of Seeing

1965

The Viking Press

Emil Schulthess & Hans Ulrich Meier

Emil Schulthess & Hans Ulrich Meier Martin Frey & Philipp Graf

Martin Frey & Philipp Graf Sergio Castañeira

Sergio Castañeira Shōji Ueda

Shōji Ueda Kazumi Kurigami

Kazumi Kurigami Nikita Teryoshin

Nikita Teryoshin Valie Export

Valie Export