Wolford Aktiengesellschaft / Positive operating earnings in 2015/16 financial year

15.07.2016, 13560 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

annual report/annual result

Revenues, also boosted by currency items, up 3.2%\nPositive operating earnings (EBIT) and earnings before tax\nEarnings after tax negative due to one-off item\nDividend of EUR 0.20 per share proposed\nTargets for 2016/17: Slight revenue growth and positive earnings\nVienna/Bregenz, July 15, 2016:Wolford AG, which is listed on the Vienna Stock Exchange, has presented its results for the 2015/16 financial year (May 2015 to April 2016). The revenues of the Wolford Group, which also benefited from positive currency items, grew by 3.2% to EUR 162.40 million, while operating earnings (EBIT) came to EUR 1.55 million, as against EUR 2.17 million in the 2014/15 financial year. However, this figure is not directly comparable with the previous year, in which EBIT benefited from other operating income of EUR 12.76 million, and thus more than EUR 10 million higher than in 2015/16. Despite this factor, the Wolford Group almost matched the previous year's level of operating earnings. Earnings before tax were also positive (EUR 0.62 million, as against EUR 1.21 million in the previous year), while earnings after tax were adversely affected by the reversal of deferred tax assets on loss carryovers. As a result of this one-off item, the company incurred non-cash-effective income taxes of EUR 6.81 million (previous year: EUR 0.18 million) and earnings after tax amounted to EUR -6.19 million, as against EUR 1.03 million one year earlier.

Positive currency items and successful online business

The 3.2% growth in revenues in the past financial year was largely driven by positive currency items, and particularly by the development in exchange rates with the US dollar, British pound, and Swiss franc. Excluding this factor, revenues would have more or less matched the previous year's figure. After a comparatively strong revenue performance in the first half of the year, the Christmas business fell short of expectations. Consistent with developments in large parts of the European fashion retail sector, revenues then declined in subsequent months. Overall, fourth-quarter revenues fell year-on-year by 7%.

The online business once again posted a highly positive full-year performance (+ 52%). Wolford's proprietary locations (boutiques, concession shop-in-shops, and factory outlets) increased their revenues by 2% overall, with like-for-like revenue growth (i.e. excluding locations newly opened or closed) also amounting to 2%. By contrast, the wholesale business (partner-operated boutiques, department stores, and specialist retailers) reported a 2% decline in revenues.

Marked regional variations in revenue Performance

The company's revenue performance varied widely from region to region in the 2015/16 financial year. Due to positive currency items, Wolford posted substantial growth in its core markets of the USA (+12%), Switzerland (+10%), and the UK (+8%). In Austria (-2%) and in Germany (-4%), revenues fell short of expectations due to the heatwave in the late summer of 2015 and disappointing Christmas business. Revenues in France suffered above all in the wake of the terrorist attacks in November 2015 and fell by 3%. Thanks to strong retail business, the Spanish (+12%) and Italian (+8%) markets reported pleasing growth. Wolford also boosted its revenues in the Netherlands (+5%), Scandinavia (+3%) and Belgium (+3%). In Asia, the company even increased its revenues by 16%, with this growth chiefly being driven by the wholesale business. By contrast, revenues in Central and Eastern Europe (-4%) were chiefly held back by the difficult situation on the Russian market.

EBIT and pre-tax earnings positive, dividend payment proposed

The growth in Wolford's proprietary online business and resultant expansion in stockholdings to ensure product availability led inventories to increase in the past financial year. This is reflected in an increase in inventories of finished goods and work in progress, which rose to EUR 4.40 million (previous year: EUR 1.53 million). Furthermore, the modernization of the product portfolio and new go-to-market model led to a changed assessment of the usability of finished goods, a factor that further increased the value of inventories. Personnel expenses decreased by EUR 1.62 million to EUR 73.86 million (previous year: EUR 75.48 million), while the average number of employees (full-time equivalents) fell by three to 1,571.

Given the expansion in the proprietary online business and higher rental payments in the proprietary retail business, also as a result of exchange rate movements, other operating expenses rose from EUR 54.97 million to EUR 56.94 million. Thanks to its positive revenue performance, Wolford nevertheless managed to increase its EBITDA slightly from EUR 10.94 million to EUR 11.01 million. EBIT came to EUR 1.55 million, as against EUR 2.17 million in 2014/15, and thus almost matched the previous year's figure - irrespective of substantially lower other operating income (EUR 2.30 million, as against EUR 12.76 million in 2014/15). In the previous year, EBIT benefited not only from the accounting gain on the sale of the property not required for operations in Bregenz, but also from the sale of two lease options (other operating income of EUR 6.36 million) and exchange rate gains of EUR 1.64 million. In the past 2015/16 financial year, Wolford only received EUR 1.12 million from the sale of non-core rental apartments.

Earnings before tax came to EUR 0.62 million, as against EUR 1.21 million in the previous year. Income tax amounted to EUR -6.81 million (previous year: EUR -0.18 million). Due to a more conservative interpretation of IAS 12, deferred tax assets of EUR 6.53 million were reversed in the 2015/16 financial year. As a result of this one-off item, earnings before tax totaled EUR -6.19 million (previous year: EUR 1.03 million) and thus fell significantly short of the previous year's figure, as did the earnings per share of EUR -1.26 (previous year: EUR 0.21).

"Our bottom-line earnings figures were marked by a one-off item due to the reversal of deferred tax assets. Our operating earnings offer a far more meaningful indication of the company's performance. Excluding one-off items in the previous financial year, we boosted our operating earnings by almost EUR 5 million," comments Axel Dreher, CFO and COO of Wolford. "We are on the right track with our operations."

As in the previous year, the Management Board will be proposing a dividend of EUR 0.20 per share for the past financial year for approval by the Annual General Meeting.

Balance sheet structure remains solid

The Wolford Group's consolidated equity amounted to EUR 68.15 million at the balance sheet date on April 30, 2016 and thus fell EUR 6.68 million short of the equivalent figure in the financial statements for the previous year. This development was due to negative earnings after tax. The equity ratio amounted to a solid 49% at the balance sheet date (previous year: 51%). Net debt rose year- on-year by EUR 3.74 million to EUR 20.86 million.

Roadmap developed to enhance profitability

Wolford has set itself the targets of generating sustainably profitable growth and achieving an EBIT margin of 10 % by the 2019/20 financial year. To meet these objectives, the company is consistently pressing ahead with implementing the measures already introduced in 2014 to boost revenues (revitalize brand, modernize product portfolio, refocus market communications, and boost multichannel distribution). Wolford reached some key milestones in this respect in the past financial year. One example is the development of a new store concept that is now due to be made gradually available for customers to experience on location. It will be unveiled for the first time from September 2016 at the key locations in Berlin, Los Angeles (Beverly Hills), and Shanghai. Since 2015, Wolford has also been implementing a new go-to-market model, one that is exclusively aligned to end customers' needs and ensures a continuous stream of new merchandise at the point of sale.

Furthermore, in the past financial year the management examined all of the company's organizational structures and defined extensive measures to cut its overall costs. These will be implemented in the next two financial years, and especially in 2016/17. As a result, in the current financial year the company will be pressing consistently ahead with the measures already initiated to optimize its production, logistics, and supply chain, while also systematically enhancing the profitability of its proprietary sales areas. The company is currently also restructuring its sales and marketing organization in Europe and centralizing all indirect support functions in Bregenz and Antwerp. This way, it will be building a regional platform strategy for its global business, with three centers for EMEA, the USA, and Asia. An effective global corporate marketing organization is also being created in Bregenz. This will generate substantial administrative savings over and above the significant efficiency and effectiveness gains in the company's sales and marketing activities expected to result from using a new B2B platform for specialist retailers.

"We made substantial progress in implementing our strategy in the past financial year. And we still have a way to go in order to achieve an EBIT margin of 10% by 2019/20," emphasizes Ashish Sensarma, CEO of Wolford. "And that is why we have developed our roadmap to profitability, which sets out clearly defined milestones."

Outlook

Wolford AG set itself and also met the target of generating positive operating earnings (EBIT) in the 2015/16 financial year. The new 2016/17 financial year began on a subdued note, with revenues throughout the European fashion retail sector performing weakly in the months of May and June.

Wolford nevertheless expects to generate slight revenue growth in the financial year as a whole. Despite foreseeable expenses of around EUR 1.1 million expected for the implementation of new structures, operating earnings are also expected to rise slightly. No further items should result from the reversal of deferred taxes on loss carryovers, as a result of which earnings after tax are also expected to be positive.

The 2015/16 Annual Report and the 2015/16 Annual Financial Report can be viewed and downloaded in the Investor Relations section of the company's website at: company.wolford.com.

http://company.wolford.com/wp-content/uploads/2016/07/Wolford_Annual_Report_2015_16.pdf http://company.wolford.com/wp-content/uploads/2016/07/Wolford_Annual_Financial_Report_2015_16.pdf

Earnings Data ______________________________________________________________ |______________________|____________|2015/16|2014/15|Change (%)| |Revenues______________|in_EUR_mill.|162.40_|157.35_|+3________| |EBIT__________________|in_EUR_mill.|1.55___|2.17___|-29_______| |Earnings_before_tax___|in_EUR_mill.|0.62___|1.21___|-49_______| |Earnings_after_tax____|in_EUR_mill.|-6.19__|1.03___|>100______| |Investments___________|in_EUR_mill.|7.30___|10.97__|-34_______| |Free_cash_flow________|in_EUR_mill.|-2.35__|-0.54__|>100______| |Employees_(on_average)|FTE_________|1,571__|1,574__|-1________|

Balance Sheet Data _________________________________________________________________________ |___________________|____________|April_30,2016|April_30,2015|Change (%)| |Equity_____________|in_EUR_mill.|68.15_________|74.83_________|-9________| |Net_debt___________|in_EUR_mill.|20.86_________|17.12_________|+22_______| |Working_capital____|in_EUR_mill.|43.15_________|38.14_________|+13_______| |Balance_sheet_total|in_EUR_mill.|139.25________|147.44________|-6________| |Equity_ratio_______|in_%________|49____________|51____________|-_________| |Gearing____________|in_%________|31____________|23____________|-_________|

Stock Exchange Data ________________________________________________________________________ |________________________________|____________|2015/16|2014/15|Change (%)| |Earnings_per_share______________|in_EUR______|-1.26__|0.21___|>100______| |Share_price_high________________|in_EUR______|25.48__|24.12__|+6________| |Share_price_low_________________|in_EUR______|21.35__|18.75__|+14_______| |Share_price_at_the_end_of_period|in_EUR______|24.67__|24.00__|+3________| |Shares_outstanding_(weighted)___|In_1,000____|4,912__|4,900__|+1________| |Market_capitalization_(ultimo)__|in_EUR_mill.|123.35_|120.00_|+3________|

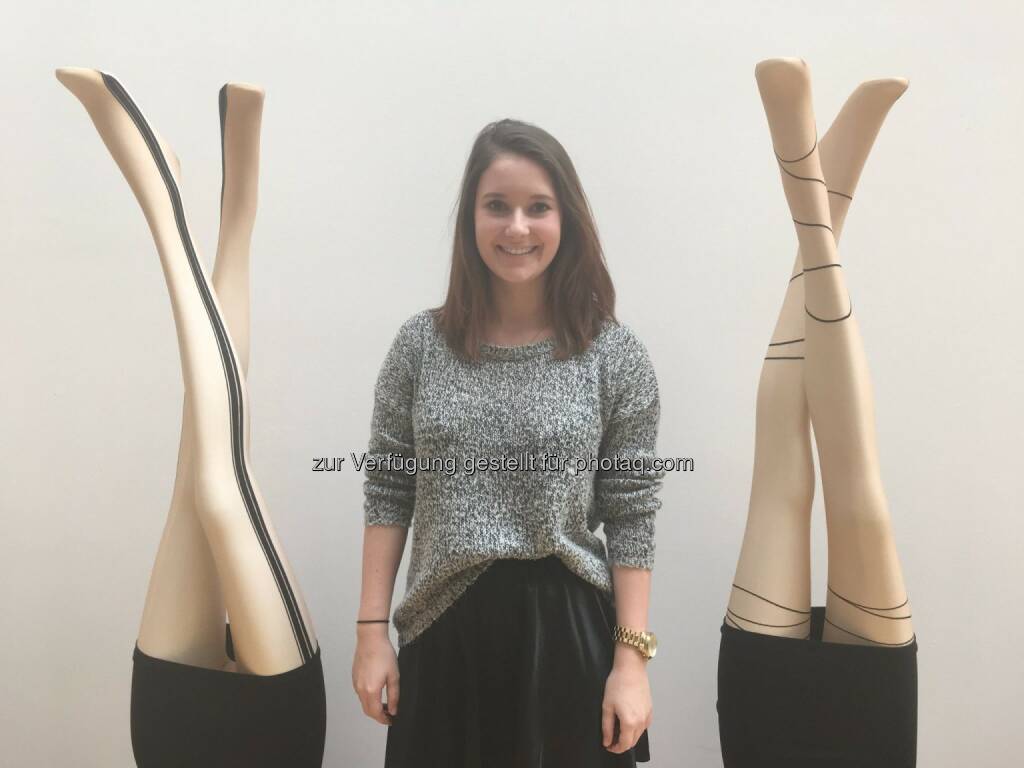

About Wolford AG Wolford AG, which has its headquarters in Bregenz on Lake Constance (Austria), has 16 subsidiaries and markets its products in more than 60 countries via 262 mono-brand points of sales (company-owned and partner-operated), around 3,000 distribution partners, and online. Listed on the Vienna Stock Exchange since 1995, in the 2015/16 financial year (May 1, 2015 - April 30, 2016) the company had around 1,570 employees and generated revenues of EUR 162.4 million. Founded in 1950, Wolford has since grown to become the leading global brand for luxurious legwear, exclusive lingerie, and high-quality bodywear.

end of announcement euro adhoc

company: Wolford Aktiengesellschaft Wolfordstrasse 1 A-6900 Bregenz phone: +43 (0) 5574 690-1268 FAX: +43 (0) 5574 690-1219 mail: investor@wolford.com WWW: company.wolford.com sector: Textiles & Clothing ISIN: AT0000834007

indexes: ATX Prime, ATX Global Players stockmarkets: free trade: Frankfurt, regulated dealing: Wien, ADR: New York language: English

Digital press kit: http://www.ots.at/pressemappe/16324/aom

Wiener Börse Party #1110: ATX mehr als 2 Prozent tiefer, Verbund gesucht, Andritz vielversprechend und Gabler statt Babler

Wolford

Uhrzeit: 22:13:36

Veränderung zu letztem SK: 1.32%

Letzter SK: 3.04 ( 1.33%)

Bildnachweis

Aktien auf dem Radar:FACC, CPI Europe AG, RHI Magnesita, Austriacard Holdings AG, Agrana, Kapsch TrafficCom, OMV, Verbund, DO&CO, Palfinger, RBI, Strabag, Uniqa, VIG, Mayr-Melnhof, Lenzing, Erste Group, ATX, AT&S, ATX NTR, Bawag, Bajaj Mobility AG, Wienerberger, voestalpine, ATX TR, ATX Prime, Amag, Porr, Polytec Group, Rath AG, SBO.

Random Partner

Verbund

Verbund ist Österreichs führendes Stromunternehmen und einer der größten Stromerzeuger aus Wasserkraft in Europa. Mit Tochterunternehmen und Partnern ist Verbund von der Stromerzeugung über den Transport bis zum internationalen Handel und Vertrieb aktiv. Seit 1988 ist Verbund an der Börse.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse: ATX geht 1,76 Prozent tiefer aus de...

- Wiener Börse Nebenwerte-Blick: Rath steigt 4 Prozent

- Wie RHI Magnesita, Bajaj Mobility AG, Polytec Gro...

- Wie voestalpine, DO&CO, Wienerberger, SBO, Verbun...

- Österreich-Depots: Anders als beim ATX ist bei St...

- Börsegeschichte 9.3.: Extremes zu Bawag und Polyt...

Featured Partner Video

Börsepeople im Podcast S23/15: Rainhard Fuchs

Rainhard Fuchs ist Gründer und Geschäftsführer des Climate Tech Unternehmens Glacier. Wir sprechen über Brüssel, Los Angeles, Barcelona, über Pioneers und die Gründung von Glacier, einem ESG-Spezia...

Books josefchladek.com

City Lux

2025

Ludion Publishers

Viewfinders

2025

Studiofaganel

Donde el viento da la vuelta

2023

Self published

Livio Piatti

Livio Piatti Pia Paulina Guilmoth & Jesse Bull Saffire

Pia Paulina Guilmoth & Jesse Bull Saffire Otto Wagner

Otto Wagner Daido Moriyama

Daido Moriyama Tehching Hsieh

Tehching Hsieh Jerker Andersson

Jerker Andersson Henrik Spohler

Henrik Spohler