ANDRITZ GROUP: Results for the first quarter of 2016

ANDRITZ GROUP: Results for the first quarter of 2016

04.05.2016, 5694 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

quarterly report

Graz, May 4, 2016. International technology Group ANDRITZ saw a solid development of profitability in the first quarter of 2016 despite slight declines in sales and order intake.

The key financial figures developed as follows:

Sales amounted to 1,285.6 million euros (MEUR) and were thus lower than the reference figure for the previous year (-8.5% versus Q1 2015: 1,404.3 MEUR). All business areas recorded a decline in sales.\nOrder intake, at 1,247.4 MEUR, reached a satisfactory level, however, it was 12.8% below the reference figure of the previous year (Q1 2015: 1,430.6 MEUR). While the PULP & PAPER business area in particular and also SEPARATION were able to increase order intake compared to Q1 2015, HYDRO and METALS saw a significant decline in order intake.\nOrder backlog as of March 31, 2016 amounted to 7,147.6 MEUR, thus decreasing slightly compared to the end of last year (December 31, 2015: 7,324.2 MEUR).\nDespite the decline in sales, EBITA increased to 83.9 MEUR (Q1 2015: 73.4 MEUR). This is due to the very positive development in the PULP & PAPER and HYDRO business areas. Thus, profitability of the Group (EBITA margin) increased to 6.5% (Q1 2015: 5.2%).\nNet income without non-controlling interests increased to 52.5 MEUR (Q1 2015: 44.0 MEUR).\nThe situation on the markets served by ANDRITZ basically has not changed compared to 2015. While unchanged good project and investment activity prevails in the PULP & PAPER business area, several projects in HYDRO and METALS have been stopped temporarily or delayed due to uncertain demand. Based on the business results achieved in the first quarter of 2016, ANDRITZ expects Group sales for 2016 to decrease slightly compared to 2015. At the same time, however, profitability is expected to remain at a solid level.

- End -

Key financial figures at a glance

Unit Q1 2016 Q1 2015 +/- 2015 Sales MEUR 1,285.6 1,404.3 -8.5% 6,377.2 HYDRO MEUR 367.9 407.9 -9.8% 1,834.8 PULP & PAPER MEUR 457.6 480.5 -4.8% 2,196.3 METALS MEUR 333.0 377.1 -11.7% 1,718.1 SEPARATION MEUR 127.1 138.8 -8.4% 628.0

Order intake MEUR 1,247.4 1,430.6 -12.8% 6,017.7 HYDRO MEUR 252.0 447.0 -43.6% 1,718.7 PULP & PAPER MEUR 545.6 462.4 +18.0% 2,263.9 METALS MEUR 299.3 384.9 -22.2% 1,438.6 SEPARATION MEUR 150.5 136.3 +10.4% 596.5

Order backlog (as of end of period) MEUR 7,147.6 7,785.6 -8.2% 7,324.2

EBITDA MEUR 106.7 96.1 +11.0% 534.7 EBITDA margin % 8.3 6.8 - 8.4 EBITA MEUR 83.9 73.4 +14.3% 429.0 EBITA margin % 6.5 5.2 - 6.7

Earnings Before Interest and Taxes (EBIT) MEUR 74.2 61.5 +20.7% 369.1

Financial result MEUR 0.7 1.1 -36.4% 7.3

Earnings Before Taxes (EBT) MEUR 74.9 62.6 +19.6% 376.4

Net income (without non-controlling interests) MEUR 52.5 44.0 +19.3% 267.7

Cash flow from operating activities MEUR 167.5 37.2 +350.3% 179.4

Capital expenditure MEUR 16.5 20.8 -20.7% 101.4

Employees (as of end of period;

without apprentices) - 24,195 24,855 -2.7% 24,508

All figures according to IFRS. Due to the utilization of automatic calculation programs, differences can arise in the addition of rounded totals and percentages. MEUR = million euros. EUR = euros.

Press release for download The press release is available for download at the ANDRITZ web site: www.andritz.com/news.

The ANDRITZ GROUP ANDRITZ is a globally leading supplier of plants, equipment, and services for hydropower stations, the pulp and paper industry, the metalworking and steel industries, and for solid/liquid separation in the municipal and industrial sectors. The publicly listed technology Group is headquartered in Graz, Austria, and has a staff of approximately 24,200 employees. ANDRITZ operates over 250 sites worldwide.

Annual and financial reports The annual reports and financial reports of the ANDRITZ GROUP are available as PDF for download at www.andritz.com. Printed copies can be requested by e-mail to investors@andritz.com.

Disclaimer Certain statements contained in this press release constitute "forward-looking statements". These statements, which contain the words "believe", "intend", "expect", and words of a similar meaning, reflect the Executive Board's beliefs and expectations and are subject to risks and uncertainties that may cause actual results to differ materially. As a result, readers are cautioned not to place undue reliance on such forward-looking statements. The company disclaims any obligation to publicly announce the result of any revisions to the forward- looking statements made herein, except where it would be required to do so under applicable law.

end of announcement euro adhoc

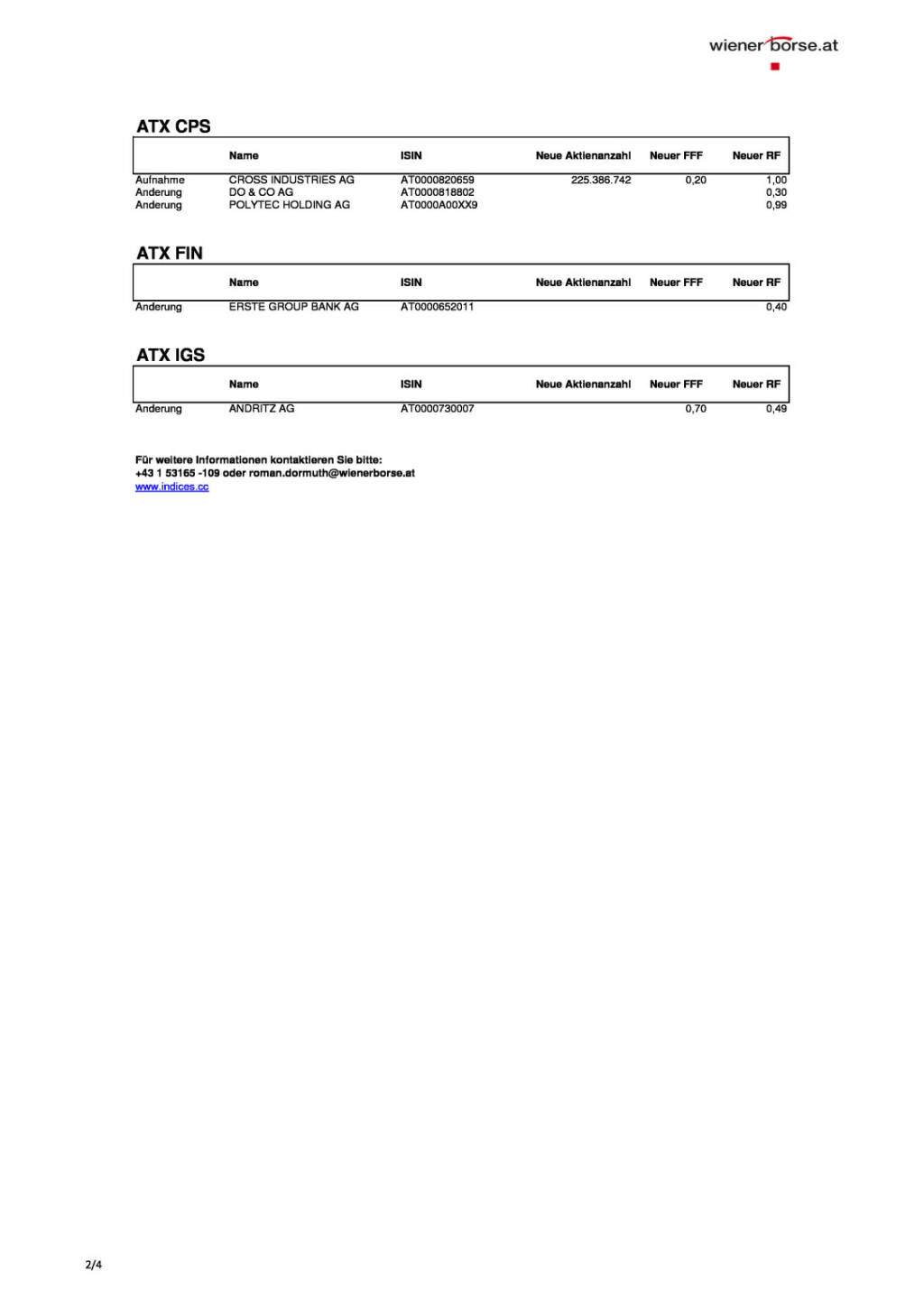

company: Andritz AG Stattegger Straße 18 A-8045 Graz phone: +43 (0)316 6902-0 FAX: +43 (0)316 6902-415 mail: welcome@andritz.com WWW: www.andritz.com sector: Machine Manufacturing ISIN: AT0000730007

indexes: WBI, ATX Prime, ATX, ATX five

stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2900/aom

BSN PodcastsChristian Drastil: Wiener Börse Plausch

Wiener Börse Party #771: ATX runter, CD delisted, krank und ein bissl traurig; Big News zu Erste Group und Warimpex, AT&S gefällt

AndritzAkt. Indikation: 56.10 / 56.30

Uhrzeit: 23:00:33

Veränderung zu letztem SK: 1.54%

Letzter SK: 55.35 ( -9.41%)

Bildnachweis

Aktien auf dem Radar:Agrana, Pierer Mobility, Warimpex, Immofinanz, CA Immo, Flughafen Wien, voestalpine, Verbund, AT&S, EVN, Lenzing, ATX, ATX Prime, ATX TR, Wienerberger, Wolford, Frequentis, Andritz, DO&CO, Strabag, Erste Group, Marinomed Biotech, RBI, Telekom Austria, Oberbank AG Stamm, Zumtobel, Palfinger, Amag, Österreichische Post, S Immo, Uniqa.

Random Partner

UBM

Die UBM fokussiert sich auf Immobilienentwicklung und deckt die gesamte Wertschöpfungskette von Umwidmung und Baugenehmigung über Planung, Marketing und Bauabwicklung bis zum Verkauf ab. Der Fokus liegt dabei auf den Märkten Österreich, Deutschland und Polen sowie auf den Asset-Klassen Wohnen, Hotel und Büro.>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab. Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnierenRunplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2UVV6 | |

| AT0000A2REB0 | |

| AT0000A3DTK7 |

- Wiener Börse: ATX geht schwächer aus der Donnerst...

- Wiener Börse Nebenwerte-Blick: Agrana, Warimpex a...

- Wie Pierer Mobility, Agrana, Marinomed Biotech, R...

- Wie Andritz, RBI, Erste Group, Telekom Austria, Ö...

- Österreich-Depots: Schwache Ultimo-Bilanz, Nebenw...

- Börsegeschichte 31.10: RHI Magnesita (Börse Gesch...

Featured Partner Video

143. Laufheld Online Workout für Läufer

0:00 - Start des Workouts / start of workout -------------------------------------------------------------------------------------------------------------- Mehr Infos und Einblicke findet ihr auf...

Books josefchladek.com

Misplacements

2023

Self published

Fotoform

1988

Nishen

Ústí nad Labem

1965

Severočeské krajské nakladatelství

Essick Peter

Essick Peter Mimi Plumb

Mimi Plumb Eron Rauch

Eron Rauch Eron Rauch

Eron Rauch