24.05.2019, 7876 Zeichen

- The Czech economy is the first to reach current German income per capita in 2046, while Ukraine would be the last to reach today’s German living standards in 2077.

- Insurance markets grow with income by more than 1:1 during transition. Thus, continued convergence in income levels is set to foster convergence in insurance penetration.

Countries with lower income per capita have higher growth prospects and a catch-up with richer countries implies a higher growth rate of insurance premiums. Important determinants of insurance development include income, wealth, the price of insurance, anticipated inflation, real interest rates, the role of the stock market, unemployment, demographic factors, risk aversion, the educational level, religion and culture, financial development, market structure, social security, the legal and regulatory environment and political risk and governance [1]. In more abstract terms, some of these factors are referred to as institutions or ultimate sources of growth. Bad institutions constrain convergence while good institutions enable long-term prosperity. In an ideal world we can abstract from these factors and ask how unconditional income and insurance convergence in transition economies in Central and Eastern Europe (CEE) would look like. In this research note, we estimate this potential for convergence.

In the standard economic growth model, the Cobb-Douglas production function has the form where output (Y) depends on the factors of production capital (K), labor (L) and productivity (A) in period t and is the capital share of income. This implies output per labor where k is capital per labor. Further, we denote growth rates by g for the growth rate of productivity and n for population growth. It can be shown that economic growth evolves by (see image two above)

where is the change in output in period t, is the depreciation rate of capital and denotes the steady-state output. In the model, there are two sources of growth: the rate of technological progress, g, and “convergence”, given by the second term of the right-hand side of the equation. The main assumption in the standard growth model are diminishing returns: Capital (machines, factories) catches up until it reaches a steady-state in which its marginal product (i. e. its return) equals the rate of depreciation. The convergence term says that the farther away output from its steady-state level the higher the speed of the catch-up process. Once an economy has reached its steady-state output level , the second term drops and the economy purely grows by technological progress. It is usually referred to as unconditional convergence as there are no constraints or barriers to convergence. It can also be thought of as a convergence potential of an economy.

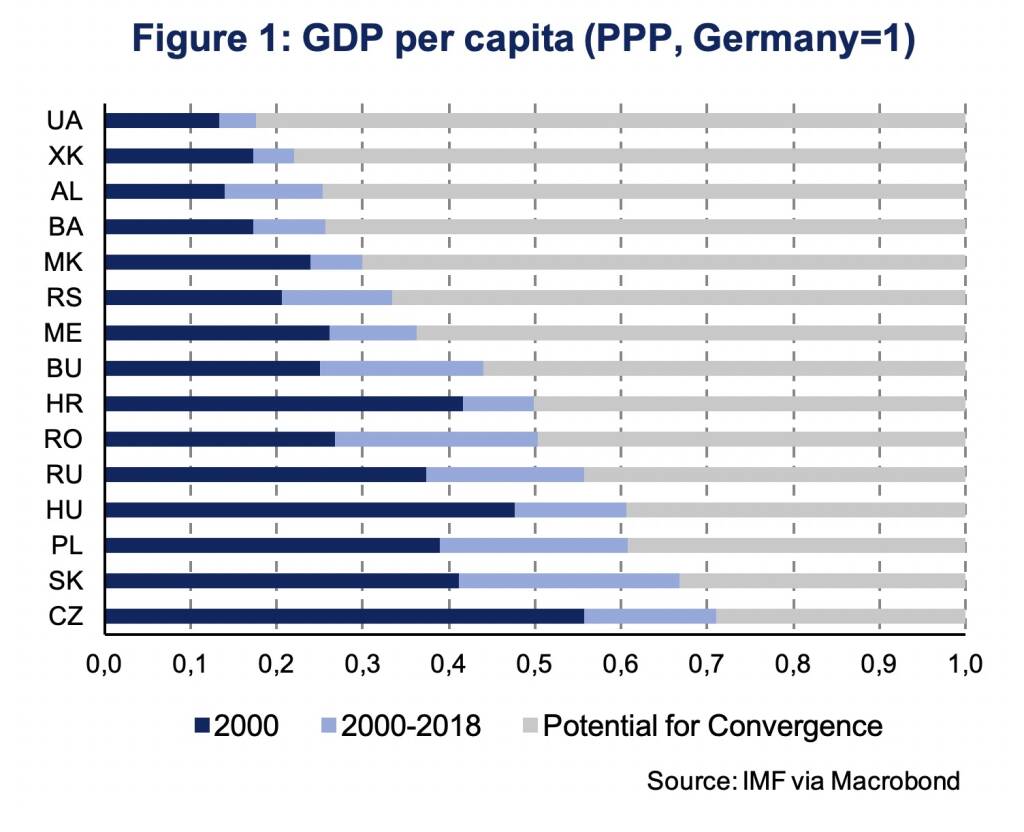

We apply the above model to transition economies in CEE. Figure 1 shows the per capita gross domestic product (GDP) at purchasing power parities (PPP) relative to Germany; the technological frontier.

The GDP per capita level in 2018 relative to Germany gives a proxy for the starting level of for each CEE economy in the model. Technological progress (g) is assumed to grow by 0.5 % per anno (average growth of German total factor productivity between 1990 and 2017 according to the Conference Board) and the German economy is assumed to keep growing at 0.5 % annually. The constant n is proxied by the average %-change in the country-specific working-age population between 2018 and 2050 (United Nations Population Division, demographic projections, medium fertility). All countries exhibit average annual declines in the working-age populations ranging from -0.5 % (Montenegro) to -1.2 % (Bulgaria), which slow down the convergence process. The capital share of income is set at 1/3 and the annual depreciation rate is assumed at 5.0 %. The unconditional convergence process relative to German GDP per capita (PPP) is depicted in Figure 2.

In 2046, the Czech economy is the first to reach today’s income per capita in Germany and Ukraine is the last one to reach Germany’s living standards in 2077. Central Europe (Hungary, Poland, Czech Republic and Slovakia) is the first region to complete the catch-up process until 2053. Countries from the Western Balkan (Albania, North Macedonia, Bosnia & Hercegovina) starting with less than 1/3 of Germany’s living standards are among the catch-up laggards.

Economic convergence has direct effects on insurance markets, as insurance premia rise with income at a rate faster than 1:1 during transition. Table 1 shows the average insurance penetration (insurance premium as a % of GDP) by income group in 2010-2015 (most recent data for a global sample). High income countries had an insurance penetration of 4 %, 2.4 %-age points of which being attributed to life insurance and 1.6 %-age points to non-life insurance. In middle income countries insurance penetration is markedly lower at 1.2 % declining to 0.7 % in low income countries. Moreover, in contrast to high income countries non-life insurance attributes for a larger share of total insurance premium than life insurance. In low income countries (GNI per capita below 1025 USD) life insurance penetration is at 0.2 % of GDP.

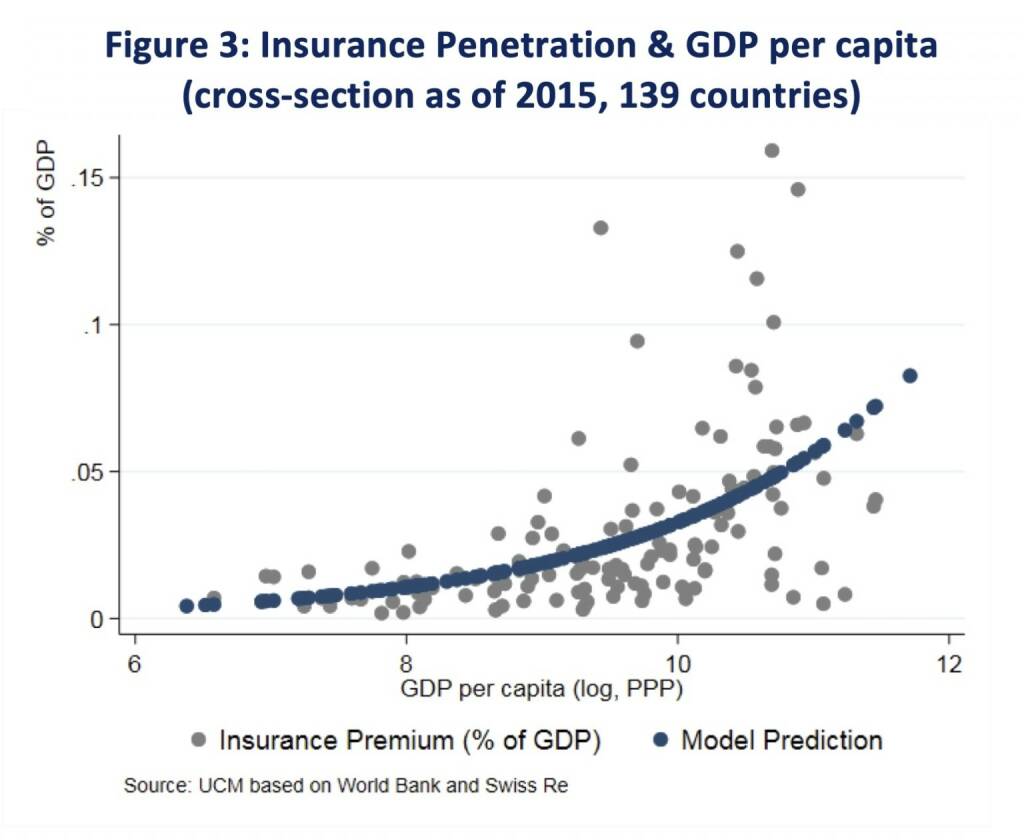

Looking at individual countries, rather than aggregates, shows more diversity, yet a positive correlation between income per capita and insurance penetration is clearly visible (correlation coefficient of 0.5). Figure 3 plots the logarithm of GDP per capita (PPP) in 2015 on the horizontal axis and insurance penetration for a sample of 139 countries (World Bank Global Financial Development Database) on the vertical axis. Insurance penetration is modelled by applying a generalized linear model (GLM) with a binominal model family and a logit link function (logistic regression) using the log of GDP per capita as the sole explanatory variable [2]. As expected, the model predicts a highly statistically significant positive relationship. Country specific deviations from the predicted insurance penetration occur in both directions.

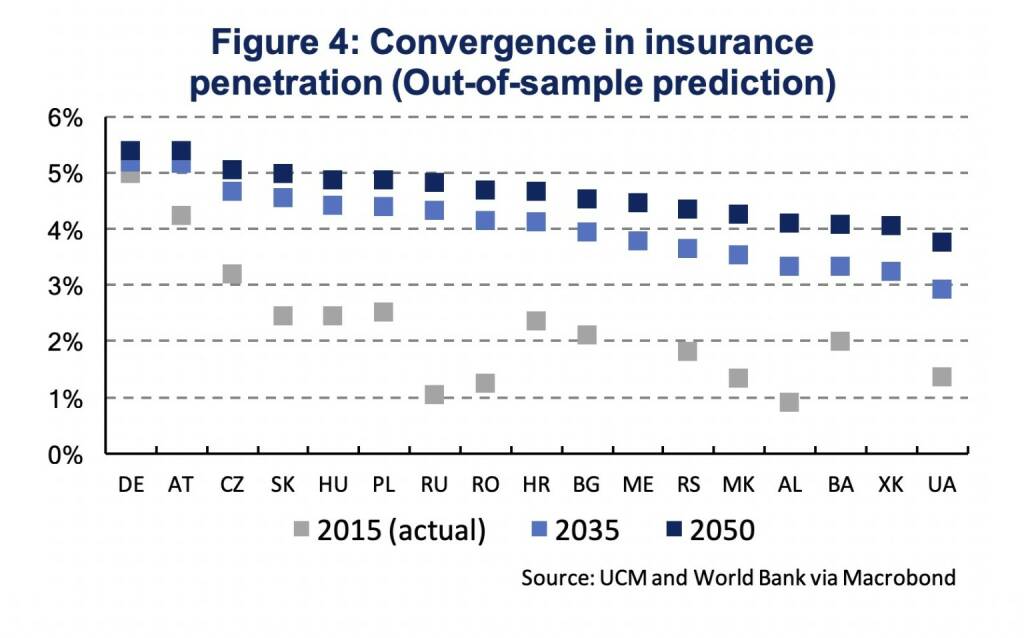

Combining the theoretical model of unconditional convergence with the empirical relationship between GDP per capita and insurance penetration, we can give a rough indication about the implications of convergence for insurance markets in CEE. It should, however, be noted that consistent with unconditional convergence, country specific factors have been left aside such that projected values of insurance penetration reflect a predicted mean at a specific income level rather than a country-specific prediction. Figure 4 shows the actual levels for 2015 alongside the model out-of-sample predictions for the years 2035 and 2050, based on income levels from the unconditional income convergence model. It can be seen that considerable catch-up potential in insurance penetration exists for the CEE region. By 2050 all CEE countries could be close to an insurance penetration rate of Austria today (2018: 4.5 %). Insurance penetration would more than double for the average CEE country by 2050. To what extent convergence in income levels and insurance penetration will follow our unconditional projections will, however, be determined by the right conditions to be put in place to foster catch-up growth.

[1] Ertl (2017): „Insurance Convergence and Post-crisis Dynamics in Central and Eastern Europe“, The Geneva Papers on Risk and Insurance 42 (2): 323-347, https://link.springer.com/article/10.1057/s41288-017-0043-6.

[2] This approach follows the method proposed by Papke and Wooldridge (1996) to fit models with proportional outcome variables: Papke and Wooldridge (1996): “Econometric methods for fractional response variables with an application to 401(k) plan participation rates”, Journal of Applied Econometrics 11: 619–632.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Wiener Börse Party #648: AT&S neue Chancen, but why Friday? 4x High: Addiko Bank, Do&Co, ATX TR, Rosgix

Bildnachweis

1.

GDP per capita

2.

Formula

3.

Unconditional Convergence in CEE

4.

Insurance Penetration by Income Group

5.

Insurance Penetration & GDP per capita

6.

Convergence in insurance penetration

Random Partner

Warimpex

Die Warimpex Finanz- und Beteiligungs AG ist eine Immobilienentwicklungs- und Investmentgesellschaft. Im Fokus der Geschäftsaktivitäten stehen der Betrieb und die Errichtung von Hotels in CEE. Darüber hinaus entwickelt Warimpex auch Bürohäuser und andere Immobilien.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Österreich-Depots: Bergauf (Depot Kommentar)

» Börsegeschichte 13.5.: Walter Rothensteiner, CA Immo (Börse Geschichte) ...

» PIR-News: News zu AT&S, Valneva, Verbund, Research zu RBI ... (Christine...

» Nachlese: Ursula Ressl, Petra Plank und der Live-Blick DAX (Christian Dr...

» Wiener Börse Party #648: AT&S neue Chancen, but why Friday? 4x High: Add...

» Wiener Börse zu Mittag fester: Addiko Bank, FACC und AT&S gesucht, DAX-B...

» Börsenradio Live-Blick 13/5: DAX unchanged, Bayer Charterfolg, Siemens E...

» Börse-Inputs auf Spotify zu u.a. Ursula Ressl, MSCI World, Airbnb, Shopi...

» ATX-Trends: AT&S, DO&CO, Post, Wienerberger ...

» Börse-Inputs auf Spotify zu Petra Plank, Glorreiche Sieben

-

16:49

-

16:01

-

16:01

-

08.05.

-

16:01

-

16:01

-

15:20

-

15:00

-

14:40

-

14:35

-

14:35

-

14:20

-

14:15

-

14:06

-

14:00

-

14:00

-

13:22

-

13:22

-

13:00

-

12:58

-

12:33

-

12:27

-

12:27

-

11:59

-

11:58

-

11:57

-

11:57

-

11:32

-

11:21

-

11:21

-

11:05

-

10:53

-

10:53

-

10:49

-

10:49

-

10:46

-

10:46

-

10:36

-

10:35

-

10:35

-

10:35

-

10:29

-

10:13

-

10:13

-

10:04

-

10:04

-

10:00

-

09:55

-

09:52

-

09:42

-

09:38