21st Austria weekly - Kapsch TrafficCom, EuroTelesSites, A1 Telekom Austria (11/02/2025)

16.02.2025, 2896 Zeichen

Kapsch TrafficCom: Kapsch TrafficCom, a provider of transportation solutions for sustainable mobility, has been awarded a framework tolling contract by Vegfinans AS, which is the largest toll charger in Norway in terms of loan financing of road projects. The company has secured the four-year framework contract estimated at EUR 7.5 million, with the potential to grow to an amount in the low double-digit millions. The contract will see the deployment of the Autopass MLFF (Multi-Lane Free Flow) tolling system across both brownfield and greenfield sites, meaning that Kapsch TrafficCom will either upgrade existing tolling infrastructure or build new roadside systems along previously untolled roads.

Kapsch TrafficCom: weekly performance:

EuroTeleSites: Revenues of EuroTeleSites AG in its first full year after amounted to mEUR 270.2 (including positive one-time effects of mEUR 4), and so equals a growth of 9.8% vs 2023 proforma figures. EBITDA reached mEUR 227.3 with EBITDA margin at 84.1%. "EuroTeleSites achieved high revenues, driven by 172 new sites (net adds) and additional 224 third-party tenants. Furthermore, we successfully managed our costs effectively. Exceeding revenue guidance of 5% in 2024, resulting in total revenues of mEUR 270.2, we are proud to present solid financial results for the first full year”, says Ivo Ivanovski, CEO of EuroTeleSites. Lars Mosdorf, CFO of EuroTeleSites, adds: “Our 2024 results demonstrate that we are firmly on track. Our ambitious business plan translates into reliable numbers. In 2024, we have proven the strength and resilience of our business model, generating positive Free Cash Flow from day one. Notably, we surpassed our deleveraging targets, reducing our net debt ratio to 6.2x, an improvement of almost 1.1x from 7.3x in 2023 (Proforma)."

EuroTeleSites AG: weekly performance:

A1Telekom Austria: The A1 Group expects to achieve revenue growth of 2-3 % in the 2025 financial year. As in previous years, A1 Group anticipate that the majority of this growth will come from higher service revenues, both from Austria and international markets. Key growth drivers include upselling in the mobile consumer business, high demand for connectivity and ICT solutions in the business seg- ment, and growth in the fixed-line business in international markets. In the financial year 2024, EBITDA increased by 5% and, excluding the mentioned one-off effects, it grew by 6.3%. In the full year, the largest contributions to EBITDA growth came from Bulgaria, Croatia, and Serbia. Excluding one-off effects, all countries except Slovenia registered an EBITDA increase. The net result fell slightly in the financial year 2024 to EUR 627 mn (2023: EUR 646 mn). Revenues in 2024 increased by3.1 % to 5,413 mn.

Telekom Austria: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (11/02/2025)

Wiener Börse Party #1106: ATX zu Mittag 4 Prozent im Minus, ein fehlendes Listing bzw, warum mir diese Marktphase in die Hände spielt

Bildnachweis

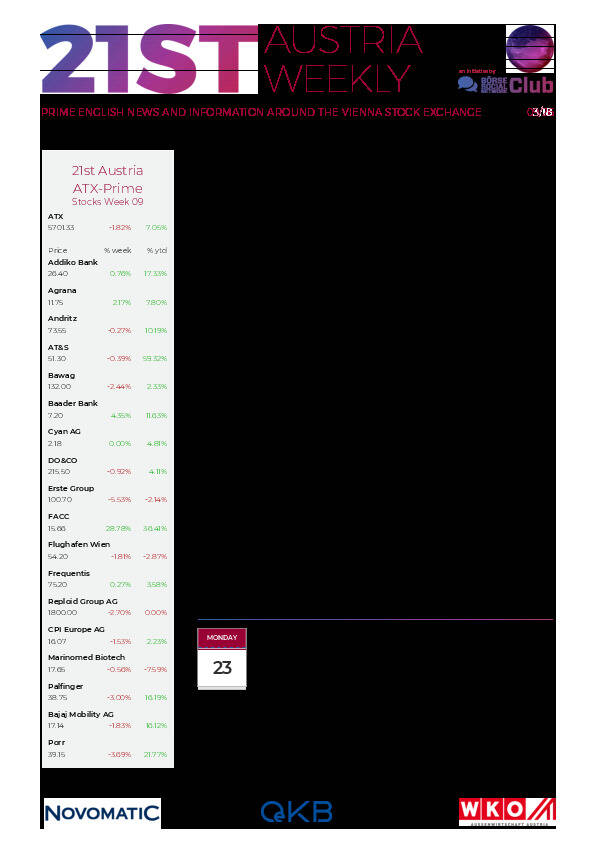

Aktien auf dem Radar:Bawag, FACC, RHI Magnesita, Addiko Bank, Kapsch TrafficCom, Austriacard Holdings AG, AT&S, ATX, ATX TR, voestalpine, Porr, ATX NTR, Erste Group, RBI, Uniqa, Lenzing, VIG, DO&CO, Andritz, Amag, EuroTeleSites AG, Marinomed Biotech, Bajaj Mobility AG, ATX Prime, EVN, Flughafen Wien, Mayr-Melnhof, Palfinger, Polytec Group, Rath AG, RWT AG.

Random Partner

Novomatic

Der Novomatic AG-Konzern ist als Produzent und Betreiber einer der größten Gaming-Technologiekonzerne der Welt und beschäftigt mehr als 21.000 Mitarbeiter. Der Konzern verfügt über Standorte in mehr als 45 Ländern und exportiert innovatives Glücksspielequipment, Systemlösungen, Lotteriesystemlösungen und Dienstleistungen in mehr als 90 Staaten.

>> Besuchen Sie 53 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten