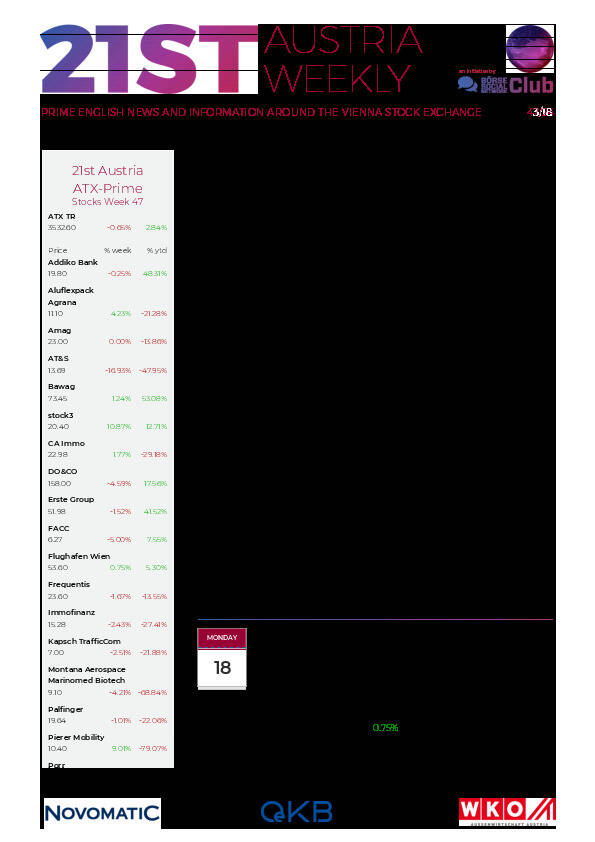

21st Austria weekly - Palfinger, Bawag, Kapsch TrafficCom (28/10/2024)

03.11.2024, 3645 Zeichen

Palfinger: PALFINGER AG recorded a revenue of EUR 1,745.0 million, an operating result (EBIT) of EUR 158.7 million and a consolidated net result of EUR 90.8 million in the first three quarters of 2024. Despite a slight decline in revenue, PALFINGER achieved a good result. The European core markets, especially Germany, are stagnating, while the upcoming US election is slowing down the demand in North America (NAM). PALFINGER recorded strong growth in the Asia-Pacific region (APAC) driven by high demand especially in India, while China remained flat. In the Latin America region (LATAM), Brazil and Argentina are on course for growth. The marine sector benefited from offshore crane orders as well as from growing service business, which boosted revenue and profitability. Reduced inventories of finished goods in the third quarter are reflected in working capital. "Our geographical and product diversification has been a decisive resilience factor in the first three quarters. Given the volatile economic situation, we are actively tackling the challenges, increasing the attractiveness of our portfolio, intensifying customer proximity in growth regions and implementing cost-cutting measures," said Andreas Klauser, CEO of PALFINGER AG.

Palfinger: weekly performance:

Bawag: BAWAG Group released its results for the third quarter 2024, reporting a net profit of € 178 million, earnings per share of € 2.25, and a RoTCE of 24.0%. The operating performance of our business was strong with pre-provision profits of € 265 million and a cost-income ratio of 32.3%. This resulted in a net profit of € 520 million, € 6.58 earnings per share and a RoTCE of 23.9% for the first nine months 2024. Anas Abuzaakouk, CEO, commented: “We delivered net profit of € 178 million, EPS of € 2.25, and a return on tangible common equity of 24.0% during the third quarter 2024. The operating performance of our business was very strong with pre-provision profits of € 265 million and a cost-income ratio of 32.3%. In addition to our strong operating performance, the first three quarters of the year have been defined by M&A and Integration planning ensuring constant dialogue with the businesses, our regulators, and laying out detailed integration plans. There has been a great deal of work taking place behind the scenes. I’m happy to announce that we received formal ECB approval for the acquisition of Knab in the Netherlands last Friday. We are excited about welcoming the team, rolling out the integration plans, and pursuing the many opportunities ahead of us as one team.We plan to provide more details on both acquisitions, our integration plans, Group targets, and capital plans during our investor day scheduled on March 4, 2025.”

Bawag: weekly performance:

Kapsch TrafficCom: After seven years of project delivery success and continuous operational accomplishments, Kapsch TrafficCom has been awarded a 10-year contract extension to enhance travel and toll services in one of the nations most traveled regions. Riverside County Transportation Commission (RCTC) has awarded Kapsch TrafficCom a 10-year toll services contract extension. This continues the project scope now through 2041. The award covers all toll services Kapsch TrafficCom provides for RCTC – including roadside toll operations and maintenance on SR-91 and I-15 Express Lanes and the customer support and operations of the Riverside Express toll program. The overall project encompasses 25 miles, and processes over 45 million trips annually.

Kapsch TrafficCom: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (28/10/2024)

Börsepeople im Podcast S16/02: Yvonne de Bark

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, Warimpex, Semperit, Austriacard Holdings AG, Addiko Bank, Immofinanz, Verbund, VIG, CA Immo, Flughafen Wien, Uniqa, AT&S, Cleen Energy, Kostad, Porr, Wolford, Oberbank AG Stamm, UBM, DO&CO, Agrana, Amag, Erste Group, EVN, OMV, Palfinger, Österreichische Post, S Immo, Telekom Austria, Wienerberger, Zalando, SAP.

Random Partner

Cleen Energy AG

Die Cleen Energy AG ist im Bereich nachhaltige Stromerzeugung durch Photovoltaik-Anlagen und energieeffiziente LED-Lichtlösungen für Gemeinden, Gewerbe und Industrie, einem wichtigen internationalen Zukunfts- und Wachstumsmarkt, tätig.

Ein Fokusbereich ist das Umrüsten auf nachhaltige Gesamtlösungen. Zusätzlich baut CLEEN Energy den Bereich Leasing und Contracting von Licht- und Photovoltaikanlagen aus, der einen wachsenden Anteil am Umsatz ausmacht.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten