21st Austria weekly - Kapsch TrafficCom, Uniqa (20/11/2024)

24.11.2024, 1474 Zeichen

Kapsch TrafficCom: The Kapsch TrafficCom Group, provider of transportation solutions for sustainable mobility, achieved a slight increase in revenues in the first half of financial year 2024/25. Revenues in the first half of the current financial year amounted to EUR 275 million, thus 3% higher than the previous year's figure of EUR 266 million. The operating result (EBIT) amounted to EUR -1 million in the reporting period after EUR 74 million in the first half of the previous year. There were no one-off operating effects in the reporting period. The negative EBIT mainly resulted from the deconsolidation of subsidiaries - in particular from the sale of the South African company TMT - with a total effect of EUR -7 million. Without these effects, EBIT would have been operationally positive and improved compared to the previous year.

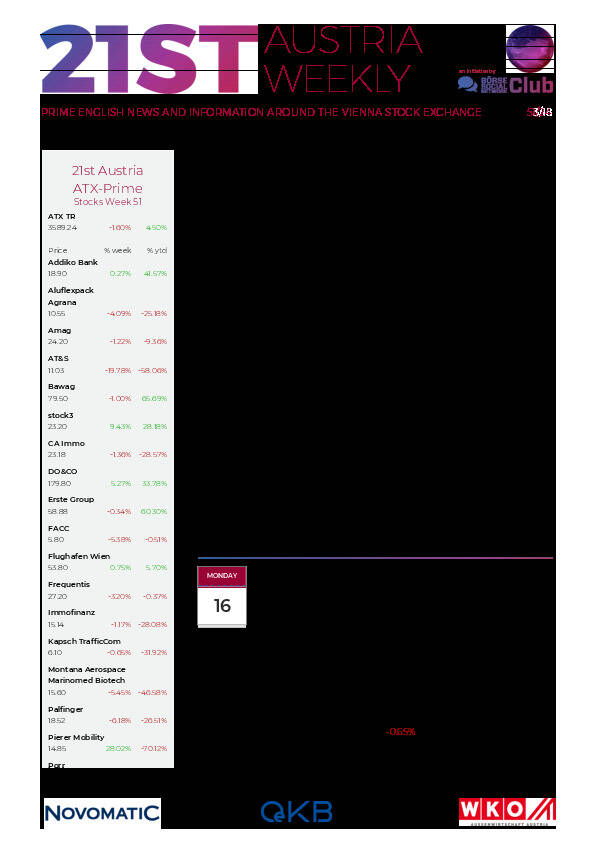

Kapsch TrafficCom: weekly performance:

Uniqa: The managing board and the supervisory board of UNIQA Insurance Group AG have decided to sell all of UNIQA's shareholding in SIGAL UNIQA Group Austria (90 per cent. shareholding) to Mr. Avni Ponari, the founder and minority shareholder of SIGAL Group Austria. The share purchase agreement is expected to be signed in the coming days. The purchase price is subject to confidentiality. SIGAL UNIQA Group Austria is active in Albania, Kosovo and North Macedonia.

Uniqa: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (20/11/2024)

Börsepeople im Podcast S16/15: Elvira Karahasanovic

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, UBM, Palfinger, Addiko Bank, Immofinanz, CA Immo, Mayr-Melnhof, Polytec Group, Verbund, RBI, Athos Immobilien, Cleen Energy, EuroTeleSites AG, Kostad, Lenzing, Josef Manner & Comp. AG, VAS AG, Wolford, Agrana, Amag, EVN, Flughafen Wien, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG, BASF, Zalando, Mercedes-Benz Group, Allianz.

Random Partner

iMaps Capital

iMaps Capital ist ein Wertpapier- und Investmentunternehmen mit Schwerpunkt auf aktiv verwaltete Exchange Traded Instruments (ETI). iMaps, mit Sitz auf Malta und Cayman Islands, positioniert sich als Private Label Anbieter und fungiert als Service Provider für Asset Manager und Privatbanken, welche ETIs zur raschen und kosteneffizienten Emission eines börsegehandelten Investment Produktes nutzen wollen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten