21st Austria weekly - Uniqa, Immofinanz, S Immo (24/05/2024)

26.05.2024, 1753 Zeichen

Uniqa: The premiums written of UNIQA Insurance Group AG including savings portions from unit-linked and index-linked life insurance rose by 10.9 per cent to €2,184.3 million in the first three months of 2024 compared with the same period of the previous year (1 – 3/2023: €1,969.4 million). Above all, property and casualty insurance and health insurance contributed to this very pleasing growth. The UNIQA Group’s earnings before taxes improved significantly by 16.8 per cent to €145.1 million (1 – 3/2023: €124.3 million). Consolidated profit/(loss) – the proportion of net profit/(loss) for the period attributable to the shareholders of UNIQA Insurance Group AG – increased by 5.9 per cent to €106.9 million (1 – 3/2023: €101.0 million). The solvency capital requirement ratio in accordance with Solvency II, which is considered to be a measure of capitalisation, was at a high level at UNIQA at around 264 per cent as at the reporting date of 31 March 2024.

Uniqa: weekly performance:

Immofinanz/S Immo: Immofinanz starts preparations for a squeeze-out of S Immo AG. In the course of the squeeze-out, shares in S Immo held by minority shareholders shall be transferred to Immofinanz as main shareholder in exchange for appropriate cash compensation. Together with its parent company CPI Property Group S.A. Immofinanz holds a stake of approximately 88.37% in the share capital of S Immo, taking into account the treasury shares of S Immo of approximately 92.54%.. The squeeze-out currently relates to 5,246,664 S Immo shares, which corresponds to approximately 7.13% of the share capital.

Immofinanz: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (24/05/2024)

Börsepeople im Podcast S16/05: Maximilian Lahrmann

Bildnachweis

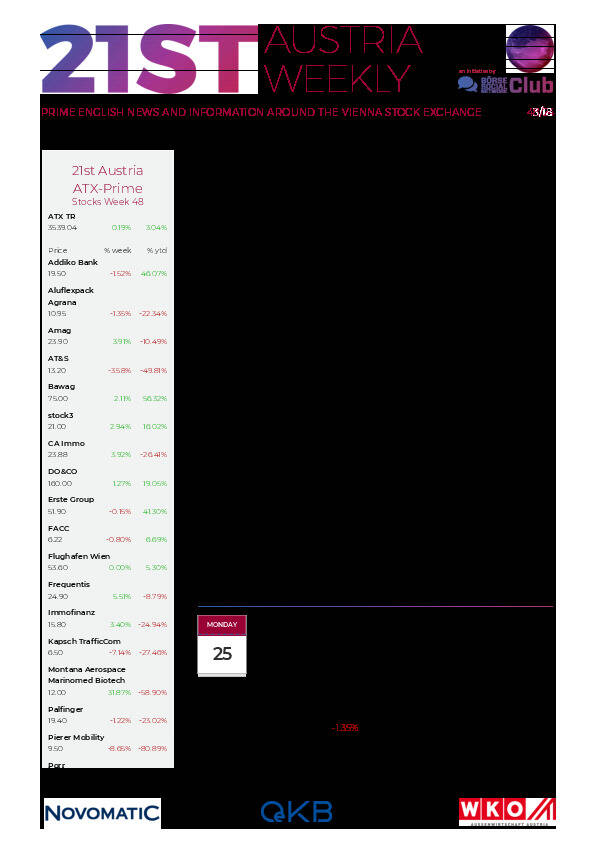

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Warimpex, Wienerberger, Kapsch TrafficCom, AT&S, Frauenthal, Gurktaler AG Stamm, Polytec Group, Wolftank-Adisa, Porr, Oberbank AG Stamm, UBM, Palfinger, Zumtobel, Addiko Bank, Agrana, Erste Group, EVN, Flughafen Wien, OMV, Österreichische Post, S Immo, Telekom Austria, Uniqa.

Random Partner

Fabasoft

Fabasoft ist ein europäischer Softwarehersteller und Cloud-Anbieter. Das Unternehmen digitalisiert und beschleunigt Geschäftsprozesse, sowohl im Wege informeller Zusammenarbeit als auch durch strukturierte Workflows und über Organisations- und Ländergrenzen hinweg. Der Konzern ist mit Gesellschaften in Deutschland, Österreich, der Schweiz, Großbritannien und den USA vertreten.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten