Climate-Tech Start-Up EcoNetix secures 7-digit Seed Investment Round

Climate-Tech Start-Up EcoNetix secures 7-digit Seed Investment Round

28.03.2024, 4074 Zeichen

Wien (OTS) - In March 2024, the Vienna based climate-tech start-up EcoNetix secured a 7-digit seed investment round comprising lead investor Voltares Ventures, Persistent and asc impact.

EcoNetix develops a data-driven tech solution for monitoring and tracking CO2 savings (dMRV) and is building a global carbon credit portfolio. With local partners, EcoNetix develops and certifies large-scale reforestation, coastal restoration, and renewable energy projects in Africa. According to consulting powerhouse McKinsey & Company the CDR market is expected to grow substantially in the next years and could be worth up to $ 1.2 trillion by 2050.

“Our mission is to save 100 million tons of CO2eq by 2030 and bring back trust into the carbon market” say managing directors Jakob Zenz (Founder and CEO) and Paul Nimmerfall (Co-Founder and COO), adding “the carbon market was rightly criticized in the past for lacking transparency, we have started EcoNetix to change that”. David Salzgeber (Co-Founder and CTO) specifies that “being able to gather live data from very remote places is a real game changer. Through our tech solution we collect huge amounts of data via satellites, on-ground sensors, cameras, and weather stations. This ensures high-quality carbon credits”.

EcoNetix currently is active in 6 countries on 3 continents (Tanzania, DRC, Kenya, Angola, UAE, and EU) and employs over 150 people with its project partners worldwide. Following this seed round the management plans to grow the core team from 5 to 15 employees and open 9 country desks within the remaining 9 months of 2024.

The Seed Round has been lead by Voltares Ventures, co-lead by Persistent and financially supported by asc impact.

Zwtl.: About the investors:

Voltares is a group of companies dedicated to clean energy, based in Vienna. Voltares responds to the climate crisis by developing renewable energy projects in the Global South, and by investing into climate tech companies.

“We are excited to partner with EcoNetix to join the ongoing transformation of the CO2 savings market towards a more transparent, efficient and impactful monitoring. As investors and developers with ongoing projects in Georgia, India and Sri Lanka we eagerly anticipate utilizing the EcoNetix platform from the first moment on.”

– Cornelius Patt, Founder & CEO

Persistent, founded in 2012, is Africa’s Climate Venture Builder. Persistent is a leader and pioneer investor in the off-grid energy and e-mobility sectors in Sub-Saharan Africa, with over 25 early-stage investments in pay-as-you-go (PAYG) solar distributors, commercial and industrial solar (C&I), mini-grid developers, technology enablers and e-mobility companies. Persistent has contributed to improving 5 million lives, powering 600,000 households, avoiding over one million tons of CO2e, and creating 15,000 jobs.

“EcoNetix represents the newest generation of innovative carbon project development companies, complementing our existing portfolio and unlocking new revenue streams for the broader climate sector in Africa. We believe companies like Econetix will make carbon markets reliable and trustworthy again and enable carbon finance to accelerate the vital transition required for climate change mitigation. We are also excited to get exposure to the African nature-based solutions space through their work.”

– Tobias Ruckstuhl, Managing Partner

asc impact is an impact fund with investments into sustainable forestry and agriculture in Sub-Saharan Africa.

“We see EcoNetix’ mission as crucial for the success of the broader carbon market. In a short time Jakob, Paul and their team have shown great initiative and ethics on the ground. They combine creative solutions to problems of the carbon markets and are putting in the hard work wherever it is needed. We were able to compare their work to many other firms: It is our conviction that EcoNetix can deliver high-value and transparent carbon certificates. We are happy to support the Seed Round with a substantial financial commitment in order to strengthen our partnership.”

– Karl Kirchmayer, Managing Partner

SportWoche Podcast #140: Flag Football und Österreichs Top-Position dabei, erklärt von Ines-Jeanne Paupie

Aktien auf dem Radar:Pierer Mobility, UBM, Palfinger, Immofinanz, Addiko Bank, CA Immo, SBO, Porr, Rosenbauer, EuroTeleSites AG, Frequentis, Kostad, Linz Textil Holding, Marinomed Biotech, Wiener Privatbank, Warimpex, Agrana, Amag, EVN, Flughafen Wien, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG, E.ON , BASF, Zalando, Mercedes-Benz Group, Allianz, Hannover Rück.

Random Partner

Wiener Börse

Die Wiener Börse wurde im Jahr 1771 als eine der ersten Börsen weltweit gegründet. Zu den Hauptgeschäftsbereichen zählen der Handel am Kassamarkt und der Handel mit strukturierten Produkten. Zusätzliche Leistungen umfassen Datenverkauf, Indexentwicklung und -management sowie Seminare und Lehrgänge.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A36XA1 | |

| AT0000A2REB0 | |

| AT0000A3C5R2 |

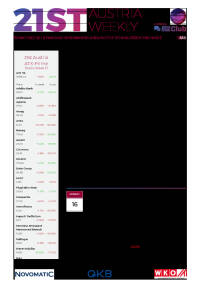

- 21st Austria weekly - CA Immo (20/12/2024)

- 21st Austria weekly - Marinomed, Valneva (19/12/2...

- 21st Austria weekly - Pierer Mobility, Kontron, A...

- 21st Austria weekly - Marinomed, Frequentis (17/1...

- 21st Austria weekly - Kapsch TrafficCom, Verbund,...

- 21st Austria weekly - ATX in week 51 down (21/12/...

Featured Partner Video

Nordischer Sonntag

Das Sporttagebuch mit Michael Knöppel - 1. Dezember 2024 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch Twitter: @Sporttagebuch_

Das Sporttagebuch mit Michael Knöppel - 1...

Books josefchladek.com

Zessho, Yokosuka Story (石内 絶唱、横須賀ストーリ)

1979

Shashin Tsushin Sha

Brilliant Scenes: Shoji Ueda Photo Album

1981

Nippon Camera

Ambiente urbano 1970-1980

2024

Electa

Fotoform

1988

Nishen

De Muur

2002

Fotokabinetten Gemeentemuseum Den Haag

Walker Evans

Walker Evans Charlie Simokaitis

Charlie Simokaitis Adolf Čejchan

Adolf Čejchan Hans Hollein

Hans Hollein Yasuhiro Ishimoto

Yasuhiro Ishimoto