21st Austria weekly - A1 Group, Mayr-Melnhof (26/04/2023)

30.04.2023, 1420 Zeichen

A1 Group: The first quarter of the 2023 financial year was another solid one for A1 Group. The company continued to grow its revenues and profits. Total revenues increased by 8% year-on-year to EUR 1,258 mn, with both service and equipment revenues growing in all segments. In total, service revenues increased by 5% and equipment revenues by 26%. On the cost side, workforce costs increased by 3%, while restructuring costs remained stable. Electricity costs increased significantly both year-over-year and sequentially. The increaseis mainly due to the segment Austria, which had to pay higher prices in Q1 2023. EBITDA increased by 1% year-on-year to EUR 436 mn and EBIT by 0.3% to 195 mn.

Telekom Austria: weekly performance:

Mayr-Melnhof: The Mayr-Melnhof Group (MM) has approved a comprehensive investment project to increase the long-term competitiveness of its largest board and paper mill, MM Kwidzyn in Poland. Energy and CO2 cost reduction, pulp integration and entry into the market for sack kraft papers are to set the mill up for sustainable future success. The investment project of around EUR 660 million. The implementation of the investment project is planned for the years 2023- 2026 with disbursements until 2027. Financing is planned from internally generated resources.

Mayr-Melnhof: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (26/04/2023)

Börsenradio Live-Blick, Di. 3.12.24: Um 9:31 Uhr perfekter 20.000er-Schlussakkord für den Live-Blick, 2025 in neuem Setup wieder da

Bildnachweis

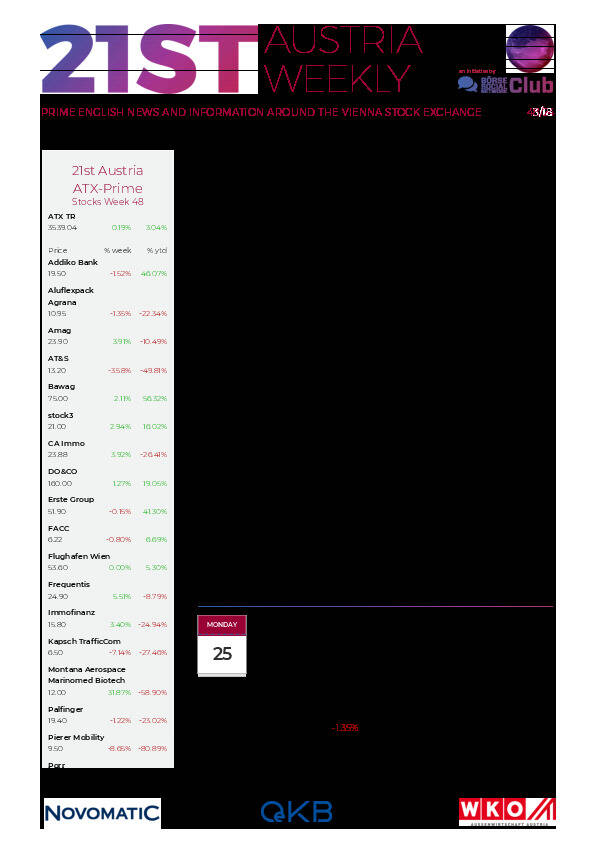

Aktien auf dem Radar:Pierer Mobility, Amag, S Immo, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Erste Group, Strabag, Wienerberger, Kapsch TrafficCom, Cleen Energy, Gurktaler AG Stamm, Linz Textil Holding, Wolford, Warimpex, Oberbank AG Stamm, BKS Bank Stamm, Addiko Bank, Agrana, EVN, Flughafen Wien, OMV, Palfinger, Österreichische Post, Telekom Austria, Uniqa, VIG, Deutsche Telekom, Mercedes-Benz Group.

Random Partner

UBM

Die UBM fokussiert sich auf Immobilienentwicklung und deckt die gesamte Wertschöpfungskette von Umwidmung und Baugenehmigung über Planung, Marketing und Bauabwicklung bis zum Verkauf ab. Der Fokus liegt dabei auf den Märkten Österreich, Deutschland und Polen sowie auf den Asset-Klassen Wohnen, Hotel und Büro.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten