21st Austria weekly - Verbund, OMV (28/07/2022)

31.07.2022, 1746 Zeichen

Verbund: Austrian utility company Verbund saw a significant improvement in the results posted for the first half year. EBITDA climbed by 110.5% to Euro 1,378.9 mn. The Group result surged by 151.8% to Euro 817.1 mn compared with the same period of the previous year. The hydro coefficient for the run-of-river power plants dropped to 0.90, or 6 percentage points below the prior-year figure and 10 percentage points below the long-term average. Generation from the annual storage power plants rose by 18.7% in quarters the period compared with the prior-year reporting period. The sharp increase in wholesale electricity prices on the futures and spot markets gave a significant boost to earnings. The average sales prices obtained for Verbund’s own generation from hydropower rose by Euro 65.9/MWh to Euro 112.5/MWh. The consolidation of Gas Connect AustriaGmbH and the significantly higher contribution from flexibility products also had a positive effect. The Group result for the first half of the year was influenced by non-recurring effects of Euro 82.6 mn, compared to Euro 9.3 mn in the first half of 2021. Adjusted for these non-recurring effects, the Group result rose by 133.0% to Euro 734.5 mn.

Verbund: weekly performance:

OMV: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (28/07/2022)

Wiener Börse Party #791: Mundart-Folge mit Wolfgang Fellner, Rudi Fußi, Wien+Bund vs. alle, KÖSt- & KTM-Idee, ausverkauftes Wien-IPO

Bildnachweis

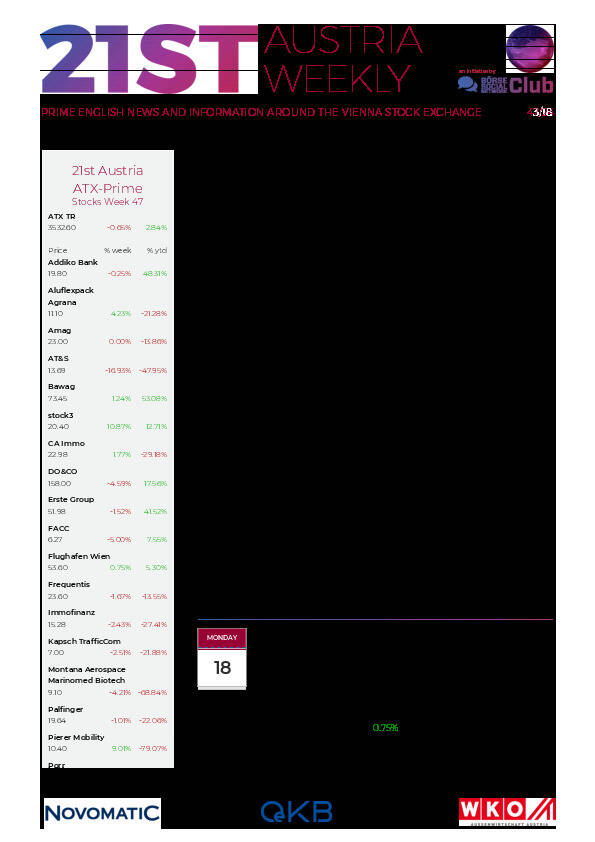

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Flughafen Wien, Immofinanz, CA Immo, Andritz, Frequentis, Marinomed Biotech, Polytec Group, AT&S, FACC, Uniqa, Warimpex, Wienerberger, Rosenbauer, Cleen Energy, SW Umwelttechnik, Porr, Oberbank AG Stamm, Kapsch TrafficCom, DO&CO, Addiko Bank, Agrana, Erste Group, EVN, OMV, Palfinger, Österreichische Post, S Immo, Telekom Austria.

Random Partner

OeKB

Seit 1946 stärkt die OeKB Gruppe den Standort Österreich mit zahlreichen Services für kleine, mittlere und große Unternehmen sowie die Republik Österreich und hält dabei eine besondere Stellung als zentrale Finanzdienstleisterin.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten