21st Austria weekly - Wienerberger, Warimpex (27/04/2022)

01.05.2022, 1415 Zeichen

Wienerberger: Despite the Russian gas supply freeze in Bulgaria and Poland, production at Wienerberger is currently continuing unabated at all European plants. Wienerberger is well prepared for this situation thanks to a forward-looking energy procurement policy, has already purchased around 90% of the gas required this year, has contingency plans in place in the respective countries and is in contact with governments and local planning authorities.

Wienerberger: weekly performance:

Warimpex: Real estate developer Warimpex Group achieved a positive operational performance in 2021. The hotel segment saw a particularly solid recovery compared with the weak year caused by the pandemic in 2020 and in the office segment, properties with long-term leases that are contractually assured generated ongoing cash flows. Along with obtaining important building permits for development projects in Poland, the company started the construction of Mogilska 35 Office in Krakow. New leases were concluded in Budapest and Krakow, so B52 Office and Mogilska 43 Office are both fully occupied now. The overall occupancy rate for the office properties is 96 per cent. The Warimpex Group’s result for the period improved significantly, going from a loss of Euro 31.1 mn to a gain of Euro 12.0 mn.

Warimpex: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (27/04/2022)

Wiener Börse Party #790: ATX schwächer, FMA kommuniziert Rekordstrafe, EVN heute 35 Jahre an der Börse, Socgen Day in Wien

Bildnachweis

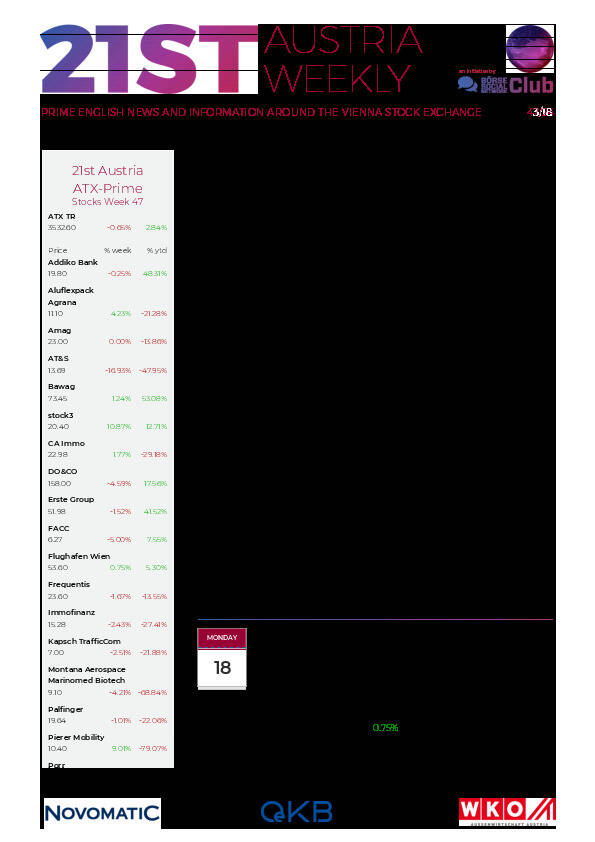

Aktien auf dem Radar:Pierer Mobility, voestalpine, Warimpex, Immofinanz, CA Immo, Addiko Bank, Andritz, Frequentis, AT&S, Zumtobel, OMV, FACC, Uniqa, Strabag, Austriacard Holdings AG, Amag, Cleen Energy, DO&CO, Marinomed Biotech, UBM, Wolford, Oberbank AG Stamm, Kapsch TrafficCom, Agrana, Erste Group, EVN, Flughafen Wien, Palfinger, Österreichische Post, S Immo, Telekom Austria.

Random Partner

Agrana

Die Agrana Beteiligungs-AG ist ein Nahrungsmittel-Konzern mit Sitz in Wien. Agrana erzeugt Zucker, Stärke, sogenannte Fruchtzubereitungen und Fruchtsaftkonzentrate sowie Bioethanol. Das Unternehmen veredelt landwirtschaftliche Rohstoffe zu vielseitigen industriellen Produkten und beliefert sowohl lokale Produzenten als auch internationale Konzerne, speziell die Nahrungsmittelindustrie.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten