21st Austria weekly - Andritz, CA Immo, Addiko (14/03/2022)

20.03.2022, 2127 Zeichen

Andritz: International technology group Andritz has successfully completed the start-up of a high-capacity, pressurized refining system at Guangxi Guoxu Dongteng Wood-Based Panel Co. Ltd., Guangxi province, China. The pressurized refining system, featuring a capacity of 45 bdmt/h and a 64” disc refiner, is designed to achieve superior fiber properties at low consumption of electrical and thermal energy. The system uses a mixture of eucalyptus and pine wood chips as raw material to produce high-quality furniture boards.

Andritz: weekly performance:

Addiko: On 10 March 2022, the Constitutional Court of the Republic of Slovenia unanimously decided to suspend the “Law on limiting and distributing currency risk among creditors and borrowers of loans in Swiss francs” in its entirety following the appeal submitted by Addiko Bank and eight other banks. “While we welcome the unanimous decision of the Constitutional Court to grant our injunction and suspend the law until its final assessment as a step in the right direction, we will continue to pursue all legal efforts and challenge this unconstitutional CHF Law.”, commented the Group CEO Herbert Juranek.

Addiko Bank: weekly performance:

CA Immo: The Management Board of CA Immo has decided to propose to the Annual General Meeting to be held on May 5, 2022, to deviate from the original dividend policy and to carry forward the entire net profit for the business year 2021. The background to this decision is the fact that dividends totaling Euro 3.50 per share ("basic dividend" and "additional basic dividend") have already been paid out of the net profit reported as of December 31, 2020 in fiscal year 2021 and that a further dividend of Euro 2.50 per share ("super dividend") will be paid out to shareholders in the current fiscal year on March 15, 2022. Especially, in light of the current geopolitical environment and increased market uncertainty and volatility, an additional dividend payment is not planned for financial year 2021.

CA Immo: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (14/03/2022)

Wiener Börse Party #793: Pierer Mobility kräftig im Plus, Sparplan-Festival bei der EAM, mein wikifolio Case eines CFA Awards

Bildnachweis

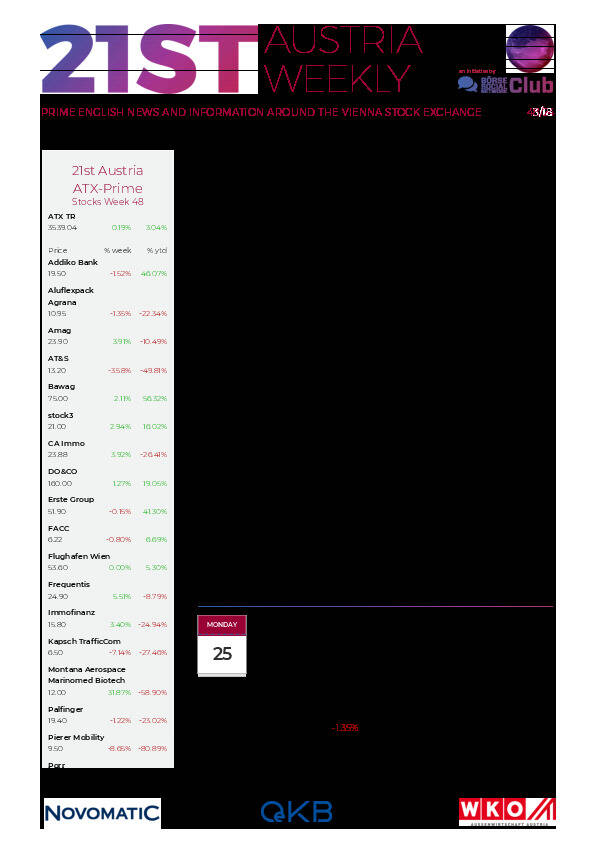

Aktien auf dem Radar:Pierer Mobility, Amag, S Immo, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Erste Group, Strabag, Wienerberger, Kapsch TrafficCom, Cleen Energy, Gurktaler AG Stamm, Linz Textil Holding, Wolford, Warimpex, Oberbank AG Stamm, BKS Bank Stamm, Addiko Bank, Agrana, EVN, Flughafen Wien, OMV, Palfinger, Österreichische Post, Telekom Austria, Uniqa, VIG.

Random Partner

UBM

Die UBM fokussiert sich auf Immobilienentwicklung und deckt die gesamte Wertschöpfungskette von Umwidmung und Baugenehmigung über Planung, Marketing und Bauabwicklung bis zum Verkauf ab. Der Fokus liegt dabei auf den Märkten Österreich, Deutschland und Polen sowie auf den Asset-Klassen Wohnen, Hotel und Büro.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten