21st Austria weekly - Wienerberger, Kapsch TrafficCom (23/02/2022)

27.02.2022, 1610 Zeichen

Wienerberger: The Wienerberger Group looks back on 2021 as the most successful year in the company’s history. Wienerberger’s focus on innovative, digital and sustainable system solutions has enabled it to deliver excellent performance and strong organic growth across all business units, despite challenging market conditions. In 2021, external revenues increased by 18% to almost Euro 4.0 bn (2020: Euro 3.4 bn). Proactive margin management and strict cost discipline drove an EBITDA increase of 24% to Euro 694 mn (2020: Euro 558 mn) over the same period. "We will consistently pursue our growth strategy and thus ensure further growth in North America and Europe", CEO Heimo Scheuch says.

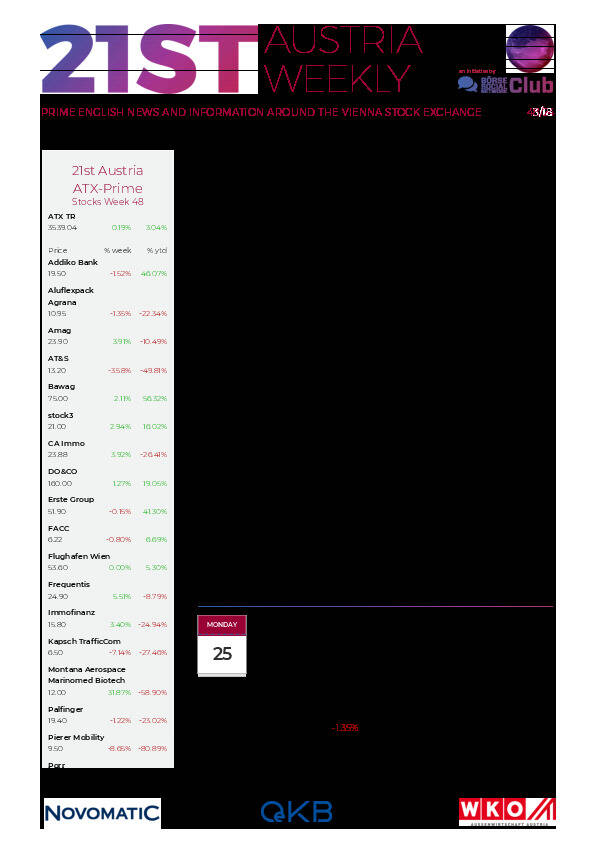

Wienerberger: weekly performance:

Kapsch TrafficCom: After three quarters in a persistently difficult market environment, Kapsch TrafficCom succeeded in achieving a positive operating result (EBIT) of Euro 6 mn (previous year: Euro -89 mn). Revenues of Euro 379 mn were 1 % below the previous year's level. Earnings attributable to shareholders amounted to Euro -2 min (previous year: Euro -78 mn), corresponding to earnings per share of Euro -0.19 (previous year: Euro -6.03). The lower sales for the period were mainly due to the 20% decline in the implementation business. The operations business, on the other hand, increased by 12%, mainly due to projects in South Africa and Bulgaria. The components business continued to suffer from supply chain bottlenecks and declined by 2%.

Kapsch TrafficCom: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (23/02/2022)

Börsenradio Live-Blick, Di. 3.12.24: Um 9:31 Uhr perfekter 20.000er-Schlussakkord für den Live-Blick, 2025 in neuem Setup wieder da

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, Amag, S Immo, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Erste Group, Strabag, Wienerberger, Kapsch TrafficCom, Cleen Energy, Gurktaler AG Stamm, Linz Textil Holding, Wolford, Warimpex, Oberbank AG Stamm, BKS Bank Stamm, Addiko Bank, Agrana, EVN, Flughafen Wien, OMV, Palfinger, Österreichische Post, Telekom Austria, Uniqa, VIG, Deutsche Telekom, Mercedes-Benz Group.

Random Partner

Montana Aerospace

Montana Aerospace zählt dank ihrer globalen Präsenz in Entwicklung und Fertigung sowie ihrer Multimaterial-Kompetenz zu den weltweit führenden Herstellern von komplexen Leichtbaukomponenten und Strukturen für die Luftfahrtindustrie. Als hochgradig integrierter Komplettanbieter mit State-of-the-Art-Fertigungsstätten in Europa, Amerika und Asien unterstützen wir die Local-to-Local-Strategie unserer Kunden.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten