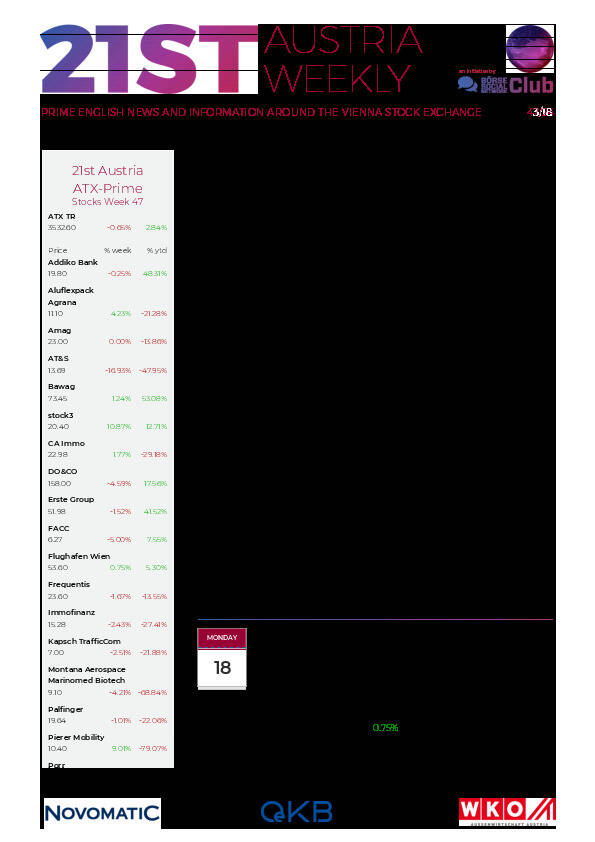

21st Austria weekly - CA Immo, Marinomed, Palfinger (22/11/2021)

28.11.2021, 2416 Zeichen

Marinomed Biotech: Marinomed, an Austrian science-based biotech company with globally marketed therapeutics derived from innovative proprietary technology platforms, today reported the financial results for the first nine months 2021. Revenue increased by 12.9 % to Euro 5.7 mn in the first three quarters of 2021 (9M 2020: Euro 5.1 mn). In addition, governmental funding for the R&D activities and other income generated another Euro 1.4 mn, resulting in a 21.2 % increase of the total income to Euro 7.1 mn (9M 2020: Euro 5.9 mn). Total R&D expenses for both platforms, Carragelose and Marinosolv, amounted to Euro 6.1 mn (9M 2020: Euro 3.9 million), mainly due to additional clinical studies in SARS-CoV-2. Therefore, the loss for the first nine months 2021 was at Euro 6.3 mn and fully in line with expectations (9M 2020: Euro 4.8 mn).

Marinomed Biotech: weekly performance:

CA Immo: Austrian real estate company CA Immo has successfully signed and closed the sale of Wspolna 47-49 in Warsaw. The property totals 7,696 sqm of GLA and 137 parking units. The sale has closed at a premium to the 31 December 2020 book value. The property was acquired by Yareal Polska. Hedwig Höfler, Head of Investment Management: “With the sale of Wspolna 47-49, we have further increased our focus on large, modern Class A office properties in established or emerging office submarkets. This disposal is another step in our capital rotation program, which aims to secure and increase the attractiveness and sustainability of our real estate portfolio.”

CA Immo: weekly performance:

Palfinger: Lifting solutions provider Palfinger signed the contract for the acquisition of TSK Kran und Wechselsysteme GmbH and TSR Lacktechnik GmbH on November 19, 2021. Participation in its long-standing partner in Duisburg strengthens the company's position in northwestern Germany and in the “three country corner”. TSK Kran und Wechselsysteme GmbH has been an important and valuable partner in the northwest of Germany for more than 20 years and holds a significant market share in the Ruhr area. TSK enjoys an excellent reputation, especially in sales and service. At the beginning of 2022, the world's leading manufacturer of innovative crane and lifting solutions will take over the Duisburg-based company.

Palfinger: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (22/11/2021)

Wiener Börse Party #791: Mundart-Folge mit Wolfgang Fellner, Rudi Fußi, Wien+Bund vs. alle, KÖSt- & KTM-Idee, ausverkauftes Wien-IPO

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Flughafen Wien, Immofinanz, CA Immo, Andritz, Frequentis, Marinomed Biotech, Polytec Group, AT&S, FACC, Uniqa, Warimpex, Wienerberger, Rosenbauer, Cleen Energy, SW Umwelttechnik, Porr, Oberbank AG Stamm, Kapsch TrafficCom, DO&CO, Addiko Bank, Agrana, Erste Group, EVN, OMV, Palfinger, Österreichische Post, S Immo, Telekom Austria.

Random Partner

Do&Co

Als Österreichisches, börsennotiertes Unternehmen mit den drei Geschäftsbereichen Airline Catering, internationales Event Catering und Restaurants, Lounges & Hotel bieten wir Gourmet Entertainment auf der ganzen Welt. Wir betreiben 32 Locations in 12 Ländern auf 3 Kontinenten, um die höchsten Standards im Produkt- sowie Service-Bereich umsetzen zu können.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten