Mayr-Melnhof Karton AG / Results for the first three quarters of 2021

16.11.2021, 8541 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Quarterly Report

Vienna -

Strategic acquisitions Kwidzyn and Kotkamills closed in 3rd quarter\nResult impacted by one-off effects from transformation MM Board & Paper\nLag in passing on massive input cost inflation weighs temporarily on margin\nNecessary price increases are implemented\nOngoing high order backlog in both divisions\nIntensified capex program in efficiency and growth on track\nThe MM Group has structurally strengthened its competitiveness and created an attractive platform for further growth in sustainable and innovative fiber-based packaging solutions with the closing of the acquisitions of the cartonboard and paper mills Kwidzyn in Poland and Kotkamills in Finland in the 3rd quarter of 2021. With the acquisitions in the virgin fiber sector, MM has not only consolidated its position as the leading cartonboard and folding carton producer in Europe, but also acquired two new core products, kraft papers and uncoated fine papers. As part of the transformation, the two smaller cartonboard mills, Baiersbronn and Eerbeek, were sold. Furthermore, production at a packaging site in Germany was discontinued at the end of September for restructuring measures. As expected, the income statement for the 3rd quarter therefore includes various one-off effects.

In the current business of the first three quarters of 2021, sustained strong demand for cartonboard packaging and papers and thus high capacity utilization in both divisions was offset by an increase in raw material and energy costs, unprecedented in its sharpness. The price increases implemented in the first nine months have not yet been able to compensate the continuing rise in costs. Therefore, where possible, a new cartonboard price increase was fixed for the 4th quarter and a further price step for all cartonboard grades was announced as of the beginning of 2022.

The increase of 4.7 % in the Group's operating profit for the first three quarters of 2021 mainly results from one-off effects in MM Board & Paper, while MM Packaging recorded a rather robust ongoing development.

The objective for the coming months is to compensate for the continuing rise in raw material and energy costs by further price adjustments and structural cost reductions in order to catch up again in margins.

Group Key indicators (IFRS)

consolidated, in millions of EUR 1-3Q/2021 1-3Q/2020 +/- Sales 2,107.1 1,903.5 +10.7 % EBITDA 283.0 307.1 -7.8 % Operating Profit 177.2 169.3 +4.7 % Operating margin (in %) 8.4 % 8.9 % -48 bp Profit before tax 162.4 160.6 +1.1 % Profit for the period 128.4 116.3 +10.4 % Earnings per share (in EUR) 6.37 5.78

INCOME STATEMENT

The Group's consolidated sales increased basically acquisition-related by 10.7 % or EUR 203.6 million to EUR 2,107.1 million (1-3Q 2020: EUR 1,903.5 million).

At EUR 177.2 million, the operating profit was 4.7 % above the previous year's value (1-3Q 2020: EUR 169.3 million). The first three quarters include one-off expenses in the amount of EUR 58.0 million: From the initial consolidation of the mills Kwidzyn and Kotkamills EUR 31.9 million, which are mainly attributable to ancillary acquisition costs including transaction taxes as well as capitalization of order backlogs and the inventory valuation; and in the division MM Packaging EUR 26.1 million restructuring costs. This is offset by preliminary one-off income from the sale of the Eerbeek and Baiersbronn mills in the amount of EUR 50.1 million. The Group's operating margin was therefore at 8.4 % (1-3Q 2020: 8.9 %).

Financial income totaled EUR 1.9 million (1-3Q 2020: EUR 1.0 million). The increase in financial expenses from EUR -5.4 million to EUR -16.8 million resulted primarily from the issuance of Schuldschein loans and Namensschuldverschreibungen to finance the acquisitions and organic growth projects. "Other financial result - net" changed from EUR -4.2 million to EUR 0.1 million, in particular owing to currency translation.

At EUR 162.4 million, profit before tax was slightly above the previous year (1- 3Q 2020: EUR 160.6 million). Income tax expense totaled EUR 34.0 million (1-3Q 2020: EUR 44.3 million), resulting in an effective Group tax rate of 20.9 % (1- 3Q 2020: 27.6 %). The reduction compared to the previous year is primarily due to tax-free income from company disposals.

Accordingly, profit for the period increased from EUR 116.3 million to EUR 128.4 million.

It should be noted that the purchase price allocation from the acquisitions had not yet been completed as of the publication date of this report and that the figures are therefore preliminary. Further consolidation details are planned for subsequent reporting at year-end.

DEVELOPMENT IN THE 3RD QUARTER

In addition to the structural changes at MM Board & Paper, the development in the 3rd quarter of 2021 was characterized by strongly increasing input costs, which could only be partially compensated by higher sales prices. At EUR 817.5 million, consolidated sales were acquisition-related above the figure of the previous quarter (EUR 648.3 million) and the previous year's level (3Q 2020: EUR 637.0 million).

The Group's operating profit reached EUR 85.1 million after EUR 30.9 million in the 2nd quarter of 2021 and EUR 46.8 million in the 3rd quarter of the previous year. The preliminary income from the sale of the Eerbeek and Baiersbronn mills in the amount of EUR 50.1 million was offset by one-off expenses from the acquisition of the mills Kwidzyn and Kotkamills in the amount of EUR 31.9 million. The Group's operating margin was thus 10.4 % (2Q 2021: 4.8 %; 3Q 2020: 7.3 %). Profit for the period totaled EUR 66.2 million (2Q 2021: EUR 18.3 million; 3Q 2020: EUR 31.4 million).

Capacity utilization of the division MM Board & Paper at 95 % in the 3rd quarter was lower than in the previous quarter (2Q 2021: 99 %; 3Q 2020: 95 %), mainly owing to the planned annual maintenance shutdowns at Kwidzyn and Kotkamills. Due to one-off income, the division's operating margin increased to 9.5 % (2Q 2021: 4.6 %; 3Q 2020: 3.5 %).

MM Packaging's operating margin of 10.4 % was in line with the figure for the 1st quarter of 2021 and thus also above the figure for the 2nd quarter of 2021 of 4.5 %, which was impacted by restructuring expenses, as well as the previous year's level (3Q 2020: 9.3 %).

OUTLOOK

Demand and order situation continue to be in good shape for both divisions. Nevertheless, in view of existing capacity limitations, sales volume can currently only increase slightly. However, the expansions recently initiated in several plants of MM Packaging will stepwise enable more business from the beginning of next year. At MM Board & Paper, where the focus of investments is on efficiency improvements and optimization of the product portfolio, the expansive effects will only gradually take effect from 2023 onwards.

In view of the continuing cost inflation for raw materials and energy, the focus remains on compensating this weight by increasing sales prices as soon as possible and by structural cost reductions in order to catch up again in terms of margins. After MM Board & Paper has fixed a new cartonboard price increase for the 4th quarter, where possible, a further price increase for cartonboard and paper has been announced for the beginning of 2022. In contrast, rising cartonboard and paper prices mean new cost challenges for MM Packaging, which can only be passed on with a time lag.

The operating performance of the newly acquired mills Kwidzyn and Kotkamills is in line with expectations. Similar to the MM Board & Paper division as a whole, profitability in the 4th quarter is primarily impacted by the extraordinary energy price increases and delayed passing on through sales prices.

----

Please find the detailed Press Release and the Report for the first three quarters of 2021 as well as the CEO Audio-Q&A-Webcast on our website: https:// www.mm.group.

Forthcoming results: March 15, 2022 Financial Results for 2021

end of announcement euro adhoc

issuer: Mayr-Melnhof Karton AG Brahmsplatz 6 A-1040 Wien phone: +43 1 50 136 FAX: mail: investor.relations@mm.group WWW: www.mm.group ISIN: AT0000938204 indexes: ATX PRIME, ATX stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/33715/aom

Börsenradio Live-Blick, Di. 20.8.24: DAX technisch überkauft zunächst schon 11. Tag im Plus; Fokus Bayer, Telekom, Hannover Re

Mayr-Melnhof

Uhrzeit: 11:15:23

Veränderung zu letztem SK: -0.38%

Letzter SK: 104.00 ( 0.58%)

Bildnachweis

1.

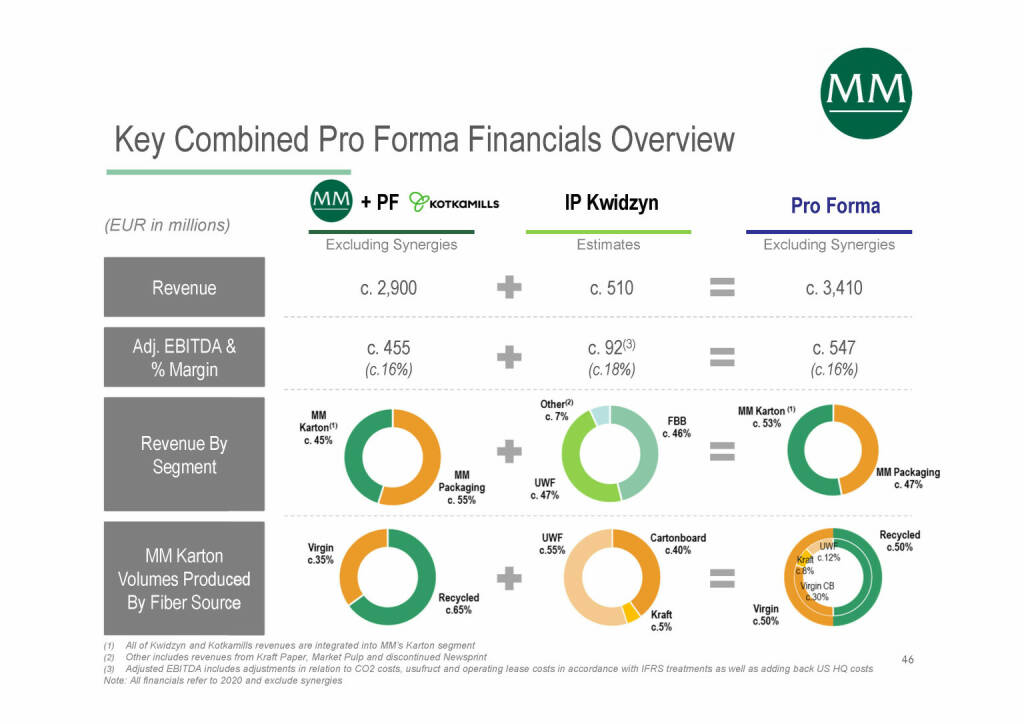

Mayr-Melnhof - Key Combined Pro Forma Financials Overview

>> Öffnen auf photaq.com

Aktien auf dem Radar:Rosenbauer, FACC, CA Immo, Addiko Bank, Lenzing, Strabag, Wienerberger, ams-Osram, Immofinanz, OMV, RBI, EuroTeleSites AG, Cleen Energy, Marinomed Biotech, Pierer Mobility, Semperit, Oberbank AG Stamm, Flughafen Wien, BKS Bank Stamm, Polytec Group, Zumtobel, Agrana, Amag, Erste Group, EVN, Österreichische Post, RHI Magnesita, S Immo, Telekom Austria, Uniqa, VIG.

Random Partner

Österreichische Post

Die Österreichische Post ist der landesweit führende Logistik- und Postdienstleister. Zu den Hauptgeschäftsbereichen zählen die Beförderung von Briefen, Werbesendungen, Printmedien und Paketen. Das Unternehmen hat Tochtergesellschaften in zwölf europäischen Ländern.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A382G1 | |

| AT0000A2SKM2 | |

| AT0000A3C5E0 |

- HYPO OÖ: Geringes Risiko im Kreditgeschäft als "w...

- Börsenradio Live-Blick 20/8: DAX technisch bereit...

- wikifolio Champion per ..: Christian Scheid mit S...

- ATX-Trends: Semperit, Flughafen Wien, RBI, Erste ...

- Immofinanz verkauft Büro-Projekt in Bukarest für ...

- Kapsch TrafficCom mit 50 Jahre-Deal in den USA

Featured Partner Video

138. Laufheld Online Workout für Läufer

0:00 - Start des Workouts / start of workout -------------------------------------------------------------------------------------------------------------- Mehr Infos und Einblicke findet ihr auf...

Books josefchladek.com

A Way of Seeing

1965

The Viking Press

操上 和美

2002

Switch Publishing Co Ltd

Inside

2024

Muga / Ediciones Posibles

Körpersplitter

1980

Veralg Droschl

Gruvarbetare i Wales

1977

Trydells

Martin Parr

Martin Parr Jerker Andersson

Jerker Andersson Emil Schulthess & Hans Ulrich Meier

Emil Schulthess & Hans Ulrich Meier Walker Evans

Walker Evans Martin Frey & Philipp Graf

Martin Frey & Philipp Graf