Mayr-Melnhof Karton AG / Results for the 1st Half-Year 2021

Mayr-Melnhof Karton AG / Results for the 1st Half-Year 2021

19.08.2021, 7405 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Mid Year Results

Vienna -

Transformational acquisitions of Kwidzyn and Kotkamills beginning of August executed\nPrice increases lagging input cost inflation leave margins temporarily squeezed\nHigh orderbook in Cartonboard and Packaging\nOngoing structural cost-adjustments\nThe MM Group continued to record high capacity utilization in both divisions in the 2nd quarter of 2021 with good demand for cartonboard and cartonboard packaging. 1st half-year sales of the MM Group were thus slightly above the previous year's level. However, as expected, this was offset by a significant weight on results owing to the ongoing massive cost inflation for raw materials, energy and logistics. The time lag between the rapid cost increase and the implemented price increases led to a major squeeze in operating profit in the cartonboard business. By contrast, current business development in the packaging division was more robust. However, as already announced, necessary restructuring measures at a packaging site in Germany resulted in one-off expenses of approximately EUR 26 million.

Our goal is to compensate the significant cost increase the best possible by a further cartonboard price increase as of October. For the current 3rd quarter, however, ongoing pressure on margins is to be expected due to the lag in passing on of costs. In addition, the one-off effects from the initial consolidation of the acquisitions and deconsolidation of the disposals will impact the 3rd quarter results.

STRATEGIC UPDATE

Through the transformational acquisitions of the Kwidzyn mill in Poland, and Kotkamills, Finland, we have structurally strengthened the Group's competitiveness. Both mills offer us a growth platform for the next decade through innovations, especially in the area of sustainability, a favorable cost position and the strengthening of our leading position in European cartonboard. In addition, we acquired two new core businesses "Kraft Papers" and "Uncoated Fine Papers". In line with the expanded product portfolio, the division MM Karton has been renamed MM Board & Paper. Part of the transformation was the disposal of the smaller cartonboard mills Eerbeek, Netherlands, and Baiersbronn, Germany.

Group Key indicators (IFRS, unaudited)

Consolidated, in millions of EUR 1st HY/2021 1st HY/2020 +/- Sales 1,289.6 1,266.5 +1.8 % EBITDA 155.5 211.7 -26.5 % Operating Profit 92.1 122.5 -24.8 % Operating margin (in %) 7.1 % 9.7 % -253 bp Profit before tax 82.9 117.7 -29.5 % Profit for the period 62.2 84.9 -26.7 % Earnings per share (in EUR) 3.07 4.23

INCOME STATEMENT

The Group's consolidated sales increased slightly from EUR 1,266.5 million to EUR 1,289.6 million.

At EUR 92.1 million, operating profit was 24.8 % or EUR 30.4 million lower than in the previous year (1st half of 2020: EUR 122.5 million). This decline is mainly due to the rapid increase in costs in the cartonboard business, which can only be passed on with a time lag. At EUR 26.1 million, one-off expenses from adjustment and restructuring measures were at a similar level as the one-off effects in the 1st half of the previous year (1st half of 2020: EUR 29.5 million). The Group's operating margin was therefore at 7.1 % (1st half of 2020: 9.7 %).

Financial income of EUR 1.0 million (1st half of 2020: EUR 0.9 million) was offset by financial expenses of EUR -10.3 million (1st half of 2020: EUR -3.8 million). The latter increased in particular due to the issuance of Schuldschein loans and Namensschuldverschreibungen in the 1st quarter of 2021 to finance the acquisitions and organic growth projects. "Other financial result - net" amounted to EUR 0.1 million (1st half of 2020: EUR -1.9 million) mainly due to changes in the foreign exchange result.

Profit before tax totaled EUR 82.9 million, compared to EUR 117.7 million in the previous year. Income tax expense was at EUR 20.7 million (1st half of 2020: EUR 32.8 million), resulting in an effective Group tax rate of 25.0 % (1st half of 2020: 27.9 %).

Accordingly, profit for the period decreased from EUR 84.9 million to EUR 62.2 million.

DEVELOPMENT IN THE 2ND QUARTER

At EUR 648.3 million, consolidated sales were in line with the 1st quarter (EUR 641.3 million) and slightly above the previous year's level (2Q 2020: EUR 619.9 million).

Mainly due to the one-off expenses for restructuring measures in the packaging division as well as the strong increase in input costs in the cartonboard sector the Group's operating profit decreased to EUR 30.9 million after EUR 61.2 million in the 1st quarter of 2021 and EUR 57.9 million in the 2nd quarter of the previous year. The operating margin was thus at 4.8 % (1Q 2021: 9.6%; 2Q 2020: 9.3 %). Profit for the period totaled EUR 18.3 million (1Q 2021: EUR 43.9 million; 2Q 2020: EUR 39.8 million).

Cartonboard capacities were again almost fully utilized in the 2nd quarter at 99 % (1Q 2021: 99 %; 2Q 2020: 99 %). The division's operating margin amounted to 4.6 % (1Q 2021: 7.3 %; 2Q 2020: 9.6 %).

The operating margin of the packaging division decreased to 4.5 % (1Q 2021: 10.4 %; 2Q 2020: 8.4 %) due to the one-off expenses.

OUTLOOK

Along with ongoing good demand on our sales markets, the strong cost inflation on the procurement markets has been persisting also in the 3rd quarter. Thus, the margins of MM remain under pressure despite improved selling prices. Although recovered paper prices stayed stable at a peak level at the beginning of the summer, it is unclear whether this will result in a cap. In contrast, the strong price increase for many other input factors continues unabated. A further cartonboard price increase from October onwards is intended to compensate for the cost increase in the cartonboard sector the best possible. On the other hand, higher cartonboard prices mean new cost weight for MM Packaging, which can only be passed on with a time lag.

For the acquisitions of Kwidzyn and Kotkamills, the positive contribution from the current result will be offset by one-off expenses this year due to the capitalization of high order backlogs and inventory valuation in the course of initial consolidation. As a result, the new mills' earnings will only be fully reflected from 2022 onwards. On the other hand, the disposal of the Eerbeek and Baiersbronn mills is expected to generate a deconsolidation gain of between EUR 45 - 55 million in the 3rd quarter, which will be partly offset by acquisition costs including transaction taxes.

----

Please find the detailed Press Release and the Half-Year Financial Report 2021 as well as the CEO video statement and the details for today's CEO Conference Call on our website: https://www.mm.group https://www.mm.group.

Forthcoming results: November 16, 2021 Results for the first three quarters of 2021

end of announcement euro adhoc

issuer: Mayr-Melnhof Karton AG Brahmsplatz 6 A-1040 Wien phone: +43 1 50 136 FAX: mail: investor.relations@mm-karton.at WWW: www.mayr-melnhof.com ISIN: AT0000938204 indexes: ATX, ATX PRIME stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/33715/aom

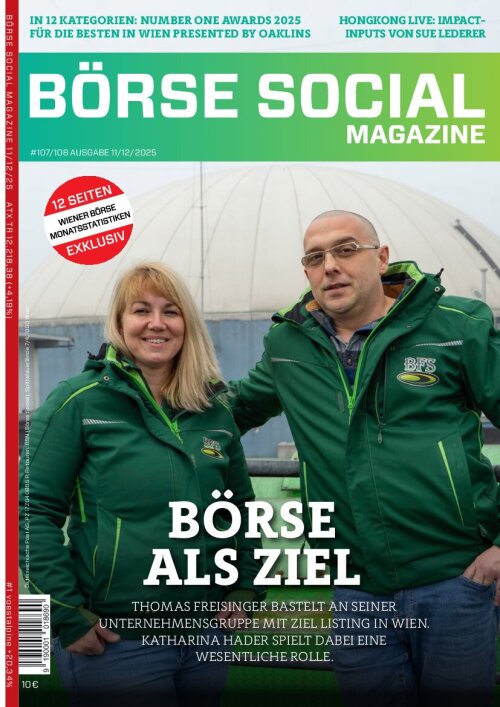

BörseGeschichte Podcast: Max Otte vor 10 Jahren zum ATX-25er

Mayr-Melnhof

Uhrzeit: 12:48:31

Veränderung zu letztem SK: 1.25%

Letzter SK: 91.80 ( -1.71%)

Bildnachweis

Aktien auf dem Radar:voestalpine, AT&S, Andritz, RHI Magnesita, Austriacard Holdings AG, Pierer Mobility, Rosgix, Addiko Bank, CA Immo, Rosenbauer, FACC, Lenzing, OMV, EVN, Mayr-Melnhof, Wolford, Zumtobel, Gurktaler AG Stamm, Gurktaler AG VZ, Polytec Group, RBI, VIG, Wienerberger, Amag, UBM, Palfinger, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Josef Manner & Comp. AG, SW Umwelttechnik.

Random Partner

AT&S

Austria Technologie & Systemtechnik AG (AT&S) ist europäischer Marktführer und weltweit einer der führenden Hersteller von Leiterplatten und IC-Substraten. Mit 9.526 Mitarbeitern entwickelt und produziert AT&S an sechs Produktionsstandorten in Österreich, Indien, China und Korea und ist mit einem Vertriebsnetzwerk in Europa, Asien und Nordamerika präsent. (Stand 06/17)

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Österreichische Post setzt sich bei Ausschreibung...

- Neuer Erste AM-Laufzeitfonds fokussiert auf Inves...

- Polytec übernimmt Composites-Geschäft von Profol

- Fear of missing out bei wikifolio 14.01.26: TKMS

- ATX TR-Frühmover: Bawag, voestalpine, CA Immo, RB...

- Bilfinger, BB Biotech am besten (Peer Group Watch...

Featured Partner Video

Börsepeople im Podcast S22/21: Roland Sinkovits

Roland Sinkovits, Niederlassungsleiter und Head of Sales Österreich bei Flossbach von Storch, ist mein 1. Gast 2026. Wir sprechen über eine spannende Karriere bei der UniCredit, Capital Invest / Pi...

Books josefchladek.com

Das Neue Haus

1941

Verlag Dr. H. Girsberger & Cie

Posedy / Hunting Stands

2025

PositiF

New York 1969

2014

Ishi Inc.

Photographie n'est pas L'Art

1937

GLM

Donde el viento da la vuelta

2023

Self published

Krass Clement

Krass Clement Sasha & Cami Stone

Sasha & Cami Stone Livio Piatti

Livio Piatti