21st Austria weekly - Do&Co, Lenzing (17/06/2021)

20.06.2021, 2569 Zeichen

Lenzing: Lenzing AG, a leading provider of sustainably produced specialty fibers for the global textile and non-woven industries, has two renowned national awards to celebrate. Austria's Leading Companies (ALC), which was held on Wednesday, June 16, 2021, again recognized the country's most successful companies. In a competition organized by PwC Austria, Die Presse newspaper and KSV1870, a credit protection firm and business platform, Lenzing won first prize in the "Climate protection" category. "After what was an extremely challenging year, we are especially pleased to have received this award. It's a fantastic acknowledgement of our achievements and commitment to a sustainable way of doing business, even in difficult times. Of course, our thanks go to our 7,500 members of staff, who made this success possible", said Robert van de Kerkhof, Member of the Managing Board at Lenzing Group.

Lenzing: weekly performance:

Do&Co: Catering-Company Do&Co recorded revenue in the amount of Euro 253.46 mn, representing a decrease of 72.9% on the previous year. The EBITDA of the Do&Co was Euro 45.04 mn (PY: Euro 70.11m) in the business year 2020/2021. Consolidated earnings before interest and tax (EBIT) of the Do&Co Group amounted to Euro -27.31 mn for the business year 2020/2021, Euro 25.38 mn lower than in the same period of the previous year. Despite very tough market conditions, new lockdowns and uncertainties due to the COVID-19 pandemic, it was even possible to achieve a positive net result again in the third and fourth quarters of the business year 2020/2021 thanks to rigorous cost management. The acquisition of new major customers such as Delta Air Lines in Detroit or Jet Blue in Los Angeles, San Diego and Palm Springs or the strenghtening of business relations with Qatar Airways and Etihad show that Do&Co still offers a highly competitive product portfolio that is particularly well received by quality-focused customers even during the crisis. Also, in the remaining two divisions, Do&Co prepared itself very well during the pandemic; not only with the existing restaurants, café and the event business, but also with new projects, such as the two new restaurants and boutique hotel in Munich or the gourmet retail activities in Vienna, soon to be in Munich and London also. This is why Do&Co expects a significant increase in revenue as well as improvement of the result for the upcoming business year 2021/2022.

DO&CO: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (17/06/2021)

Börsepeople im Podcast S23/01: Michael Mayer

Bildnachweis

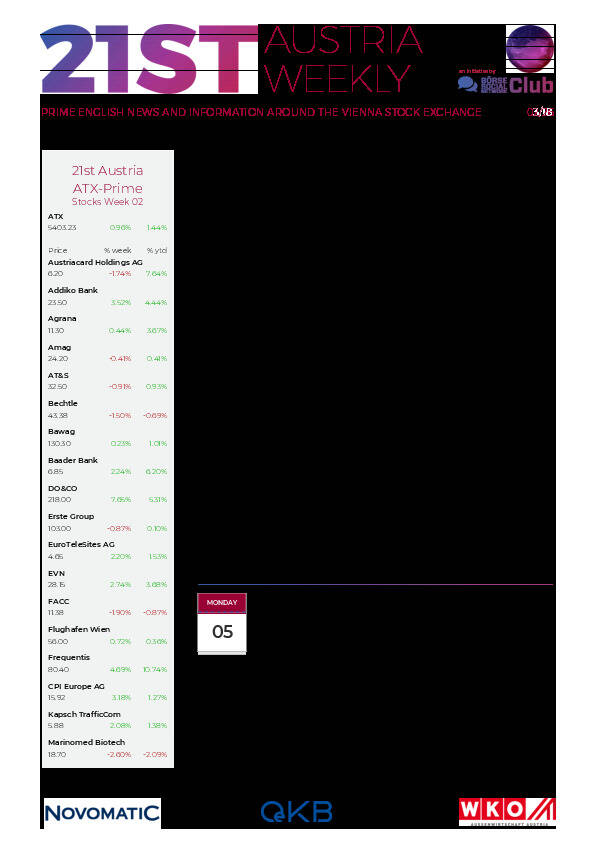

Aktien auf dem Radar:voestalpine, AT&S, Andritz, RHI Magnesita, Austriacard Holdings AG, Pierer Mobility, Rosgix, Addiko Bank, CA Immo, Rosenbauer, FACC, Lenzing, OMV, EVN, Mayr-Melnhof, Wolford, Zumtobel, Gurktaler AG Stamm, Gurktaler AG VZ, Polytec Group, RBI, VIG, Wienerberger, Amag, UBM, Palfinger, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Josef Manner & Comp. AG, SW Umwelttechnik.

Random Partner

Bajaj Mobility AG (vormals Pierer Mobility AG)

Die Bajaj Mobility AG (vormals PIERER Mobility AG) ist die Holdinggesellschaft der KTM-Gruppe, einem der führenden Motorradhersteller Europas. Mit ihren Marken KTM, Husqvarna und GASGAS zählt die KTM AG zu den europäischen Premium-Motorradherstellern. Das Produktportfolio umfasst neben Motorrädern mit Verbrennungsmotor auch High-End-Komponenten (WP) sowie Fahrzeuge mit innovativen Elektroantrieben.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten