21st Austria weekly - FACC, CA Immo, ams, Do&Co, Uniqa (21/12/2020)

27.12.2020, 3291 Zeichen

FACC: The corona crisis and the expected related negative effects on the financial and earnings development of the Group required an adjustment of the contractual conditions of the existing syndicated loan (total volume Euro 285 mn distributed over seven banks, maturity on August 29th, 2023). The focus was on the semi-annually tested financial covenant Net Financial Debt / EBITDA less or equal to 4.0. In the negotiations, which were always on mutual partnership level, a waiver of the covenant (Covenant Holiday) and an adjustment of the covenant (Covenant Reset) were agreed for the next test dates. On December 31st, 2022 FACC will return to the originally agreed covenant of Net Financial Debt / EBITDA less or equal to 4.0.

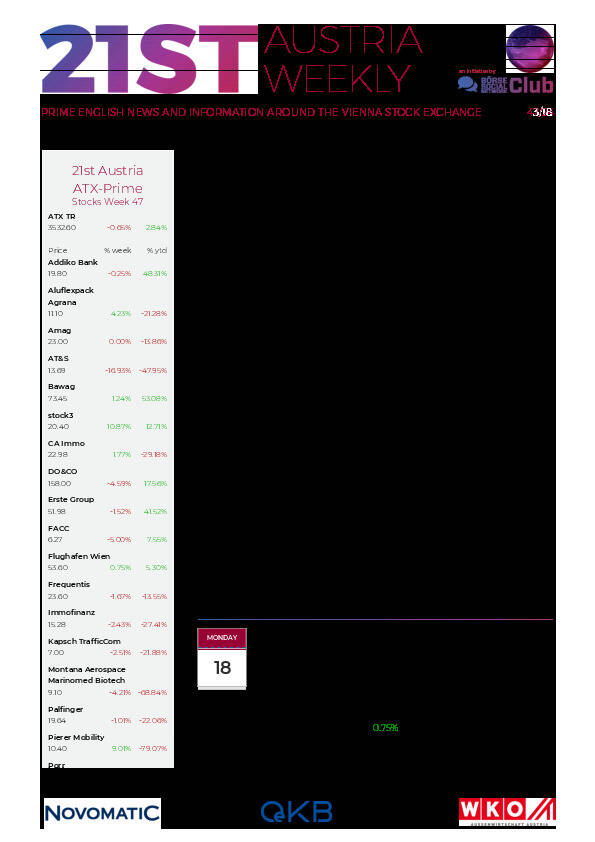

FACC: weekly performance:

CA Immo: In a joint sale together with the owner of the adjacent site, Austrian real estate company CA Immo have sold a 17,614 sqm land plot in Dusseldorf, with gross sale proceeds of Euro 61.9 mn, corresponding to a premium of 146% above the Q3 book value of Euro 25.2 mn. Closing is scheduled for the end of the first quarter of 2021. Further, CA Immo has concluded a long-term rental agreement with the Bundesanstalt für Immobilienaufgaben (BImA) for approximately 3,500 sqm of rental space in NEO, a high-rise office and hotel building in Munich. Following the conclusion of this lease, NEO is now 64% let. CA Immo’s investment volume amounts to Euro 68.1 mn.

CA Immo: weekly performance:

ams: ams, a leading worldwide supplier of high performance sensor solutions, and Precision Biomonitoring, a Canadian-based leader in virus detection tools, announce a global partnership to share technologies to develop an innovative testing device for the Covid-19 (SARS-CoV-2) virus. The partner-ship will see ams’ innovative spectral sensor technology paired with Precision Biomonitoring’s lateral flow and digital capabilities. The combination is expected to re-imagine mass testing devices for Covid-19 (SARS-CoV-2). Initial results, on inactivated virus particles, indicate a very good sensitivity in the order of cycle time (CT) 31, which could lead to the identification of asymptomatic persons.

AMS: weekly performance:

Do&Co: Catering company Do & Co announced its first cooperation with Delta Air Lines. As of March 16th, 2021 Do & Co will be the airline's sole Hub Caterer in Detroit (DTW) for the next 10 consecutive years. Do & Co will be in charge of the entire board service across all short and long haul flights. With more than 400 daily departures in 2019, Detroit is one of Delta Air Lines' biggest and most important Hubs in the US. The contractual partnership therefore signals a decisive milestone in the realization of Do & Co's US expansion plans.

DO&CO: weekly performance:

Uniqa: The international rating agency Standard & Poor's (S&P) again confirmed its “A-” rating of Uniqa Insurance Group with a stable outlook. Positive factors in S&P's decision particularly included the company's strong market position in Austria, CEE and Russia, its leading role in health insurance in Austria and its “excellent” capital adequacy according to the S&P Global Ratings capital model.

Uniqa: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (21/12/2020)

Wiener Börse Party #789: ATX verliert trotz sehr starker VIG, der Erste Bank George fehlt mir heute sehr, dazu ein S Immo Zufall

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, voestalpine, Warimpex, Addiko Bank, Immofinanz, CA Immo, Andritz, AT&S, Zumtobel, OMV, Amag, Linz Textil Holding, Wolford, Oberbank AG Stamm, DO&CO, Agrana, Erste Group, EVN, Flughafen Wien, Palfinger, Österreichische Post, S Immo, Telekom Austria, Uniqa, VIG.

Random Partner

Semperit

Die börsennotierte Semperit AG Holding ist eine international ausgerichtete Unternehmensgruppe, die mit ihren beiden Divisionen Semperit Industrial Applications und Semperit Engineered Applications Produkte aus Kautschuk entwickelt, produziert und in über 100 Ländern weltweit vertreibt.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten