21st Austria weekly - AMAG, OMV, Andritz, CA Immo (29/10/2020)

01.11.2020, 3555 Zeichen

AMAG: Revenue of Austrian based aluminium group AMAG in the first three quarters of 2020 stood at Euro 673.2 mn, compared with Euro 821.5 mn in the previous year (-18.1 %). While primary aluminium shipments increased compared with the previous year, a tangible decrease in demand occurred for recycled cast alloys and aluminium rolled products. Total shipments in Q1-Q3/2020 stood at 303,900 tonnes (336,500 tonnes in Q1-Q3/2019). Lower aluminium prices are also exerting a negative effect on revenue. In the first three quarters of 2020, the average price amounted to 1,663 USD/t, down 9 % year-on-year. EBIT amounted to Euro 17.7 mn, compared with Euro 47.9 mn in the previous year. Net income after taxes decreased from Euro 30.0 mn to Euro 11.1 mn. Demand for aluminium products continues to be affected by the global COVID-19 pandemic. According to the CRU, however, medium- and long-term demand trend forecasts for primary aluminium and aluminium rolled products reflect an unchanged positive outlook. From today's perspective, it is assumed that pre-coronavirus levels in the sectors that AMAG supplies - with the exception of packaging and aircraft - will not be reached again until 2022 at the earliest. Packaging sector demand trends are expected to remain stable. It is anticipated that it will take the aircraft industry around another five years to reattain its 2019 shipments level. The development of the aluminium price as well as the US import tariffs for Canadian primary metal are characterised by low visibility. Based on the current situation, however, the Metal Division will continue to benefit from lower raw material costs in Q4/2020. Overall, from today's perspective, the Management Board anticipates full-year EBITDA for the AMAG Group in a range between Euro 90 mn and Euro 100 mn.

Amag: weekly performance:

OMV: Consolidated sales revenues of Austrian oil and gas company OMV in the third quarter decreased by 38% to Euro 3,696 mn due to the overall lower global commodity price environment and fallen liquid hydrocarbon sales volumes. The clean CCS Operating Result declined by 67% from Euro 949 mn to Euro 317 mn, primarily due to lower prices and reduced demand. The contribution of Upstream was EUR (24) mn (Q3/19: Euro 449 mn). In Downstream, the clean CCS Operating Result amounted to Euro 335 mn (Q3/19: Euro 490 mn). The clean CCS net income weakened to Euro 160 mn (Q3/19: Euro 593 mn). The clean CCS net income attributable to stockholders was Euro 80 mn (Q3/19: EUR 457 mn). Clean CCS Earnings Per Share came in at Euro 0.24 (Q3/19: Euro 1.40).

OMV: weekly performance:

Andritz: International technology group Andritz has received an order to supply a new cut-to-length line and two heavy-duty levelers to Hunan Valin Lianyuan Iron & Steel Co. Ltd., China. The order includes the mechanical and electrical equipment as well as start-up, which is scheduled for the third quarter of 2021.

Andritz: weekly performance:

CA Immo: A new tenant for the CA Immo office project completion ViE on Erdberger Lände has been confirmed: From February 2021, an institutional investment grade tenant will lease a total of approx. 1,250 sqm of office space on a long-term basis. Including this lease, the building is now around 90% let. Other tenants in the building include the market research institute GfK, JTI Austria Gmbh/Austria Tabak GmbH, Eli Lilly GmbH, Delta Holding GbmH and Robert Bosch.

CA Immo: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (29/10/2020)

Wiener Börse Party #789: ATX verliert trotz sehr starker VIG, der Erste Bank George fehlt mir heute sehr, dazu ein S Immo Zufall

Bildnachweis

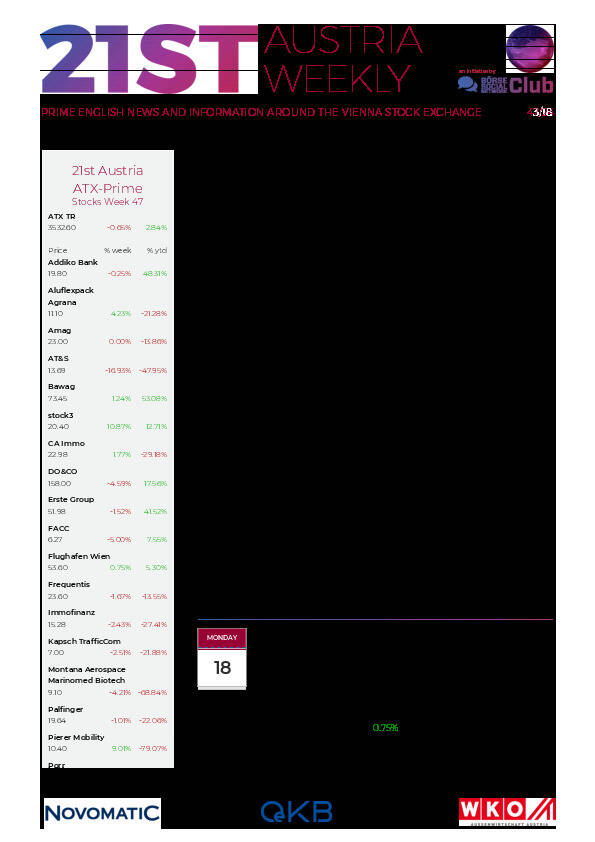

Aktien auf dem Radar:Pierer Mobility, voestalpine, Warimpex, Addiko Bank, Immofinanz, CA Immo, Andritz, AT&S, Zumtobel, OMV, Amag, Linz Textil Holding, Wolford, Oberbank AG Stamm, DO&CO, Agrana, Erste Group, EVN, Flughafen Wien, Palfinger, Österreichische Post, S Immo, Telekom Austria, Uniqa, VIG.

Random Partner

Kostad Steuerungsbau

Kostad ist ein österreichisches Familienunternehmen, das sich auf maßgeschneiderte Elektromobilitätslösungen spezialisiert hat. Das Unternehmen bietet Produkte und Dienstleistungen rund um die Elektromobilität in den Bereichen Schaltschrankbau, Automatisierungstechnik, Kabelkonfektionierung, Elektroprojektierung und Software an. Kostad hat in mehreren Ländern der Welt Schnell-Ladestationen für Elektrofahrzeuge errichtet.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten