21st Austria weekly - Vienna Stock Exchange, Kapsch TrafficCom (02/10/2020)

04.10.2020, 3205 Zeichen

Vienna Stock Exchange: By the end of September 2020, the equity turnover increased by 10.46% in comparison to last year. At the end of Q3, equity turnover totalled Euro 52 bn. The average monthly turnover is Euro 5.77 bn. The most actively traded Austrian stocks were Erste Group Bank AG with Euro 9.10 bn, ahead of OMV AG with Euro 7.10 bn and Raiffeisen Bank International AG with Euro 4.29 bn. In fourth and fifth place were voestalpine AG (Euro 4.14 bn) and Verbund AG (Euro 3.34 bn). In the second-largest segment, the global market, which was established in 2017, Euro 2.63 bn in turnover was reported in the course of the year. This is an increase of 73.53% compared to the previous year. The global market currently offers a selection of 718 securities from 26 countries. The national index ATX including dividends is down 33.09% due to the heavy weighting of the financial, oil and steel sectors. The cyclical composition of the ATX is currently causing a steeper downturn, whereas in an economic upswing it also rises disproportionately. "Corona teaches patience to investors. In the long term, despite several crises, stocks represent one of the most lucrative investment forms and offer many opportunities. Only those who sow steadily will be able to reap later," says Christoph Boschan, CEO of the Vienna Stock Exchange. He argues in favour of a one-year retention period from the capital gains tax as an incentive for investors. "Investing must be made easier in order to activate private capital and make it available to society and the economy. Long-term investors should be able to use their already taxed labour income tax-free". According to Boschan, this could be decisive for the future of Austria, because government packages worth billions will not be enough to overcome the crisis. A strong private economy, innovation and a functioning capital market can make all the difference.

Kapsch TrafficCom: Kapsch TrafficCom, provider of intelligent transportation systems, evised ist outlook. Based on initial indications for the second quarter the company expects no improvement of the revenue and earnings situation compared to the first quarter of financial year 2020/21. Consequently, the operating result (EBIT) of the financial year will likely be clearly negative. A negative two-digit million value is expected. An important reason for this is Covid-19: Revenues in the profitable components business strongly suffer from decreased traffic volumes. In addition – in spite of some pleasing project wins – there are more delays in tender processes and the award of contracts. Catch-up effects in a relevant scale are expected not before the next financial year. Possible impairments of non-current assets cannot be ruled out for financial year 2020/21. For the annual revenues, precise forecasts are also still difficult. Currently the company assumes a decline of 15 to 20%. As a result of the expected clearly negative results, the current dividend policy is being suspended until further notice. No dividend shall be expected for financial year 2020/21.

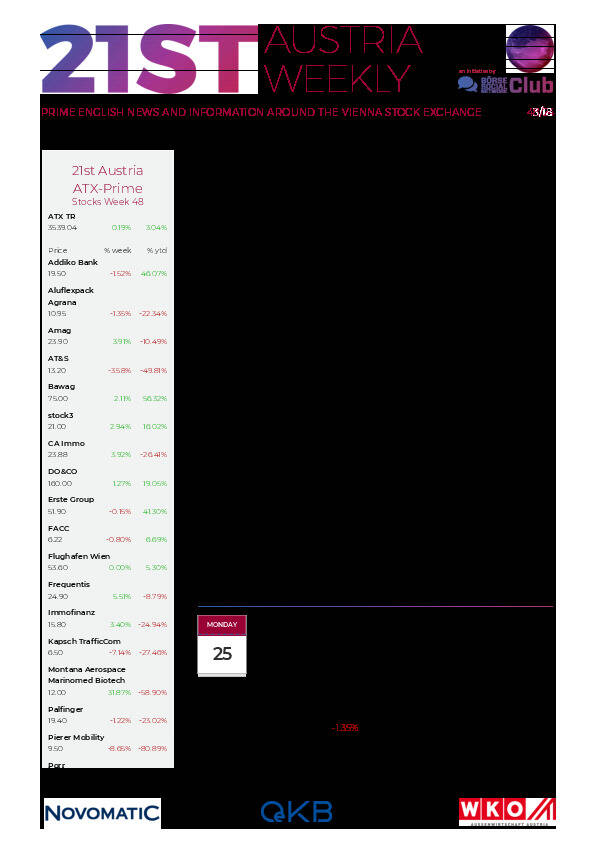

Kapsch TrafficCom: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (02/10/2020)

Börsepeople im Podcast S16/06: Georg Bursik

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, S Immo, Porr, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Erste Group, VIG, Andritz, EVN, Mayr-Melnhof, Cleen Energy, FACC, Hutter & Schrantz Stahlbau, Kapsch TrafficCom, Marinomed Biotech, Polytec Group, SW Umwelttechnik, UBM, Warimpex, Semperit, Oberbank AG Stamm, Agrana, Amag, Flughafen Wien, OMV, Palfinger, Österreichische Post, Telekom Austria, Uniqa.

Random Partner

Erste Group

Gegründet 1819 als die „Erste österreichische Spar-Casse“, ging die Erste Group 1997 mit der Strategie, ihr Retailgeschäft in die Wachstumsmärkte Zentral- und Osteuropas (CEE) auszuweiten, an die Wiener Börse. Durch zahlreiche Übernahmen und organisches Wachstum hat sich die Erste Group zu einem der größten Finanzdienstleister im östlichen Teil der EU entwickelt.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten