21st Austria weekly - S Immo, OMV, Agrana (25/08/2020)

30.08.2020, 2954 Zeichen

S Immo: The listed real estate company S Immo AG has published its figures as of 30 June 2020 and is taking stock of the first half of the year, which was heavily impacted by the Covid-19 pandemic. Despite the negative effects of the Covid-19 crisis, the result from property valuation was positive overall and came to Euro 10.2 mn (HY 2019: Euro 134.1 mn). This was chiefly due to increases in value in Germany, which totalled Euro 32.9 mn and more than compensated for the write-downs in CEE (Euro -20.5 mn) and the slight corrections in Austria (Euro -2.2 mn). Ernst Vejdovszky, CEO of S Immo AG, comments: “2020 is the year of the coronavirus. Its impact can be felt in all areas of life and all sectors, and the property industry is no exception. The second quarter – particularly the months of April and May – brought coronavirus-related losses on a massive scale in some cases. Nonetheless, we still achieved a positive result overall and are continuing to work on minimising the impact of the crisis. We currently expect that the biggest losses are behind us and that we will see a gradual recovery in the second half of the year.” Friedrich Wachernig, member of the S Immo AG’s Management Board, is confident: “We have a strong equity ratio, a highly qualified team and the right properties – ideal conditions for getting through challenging times. The current situation once again shows that our diversified portfolio strategy brings major advantages. While the hotel segment will probably take a while to return to its pre-crisis level, we are hardly seeing any constraints in the office segment. For residential properties – which account for 30% of our portfolio and the majority of our land bank – we even consider rising prices to be a possibility. We are confident for the future. This crisis will also pass.”

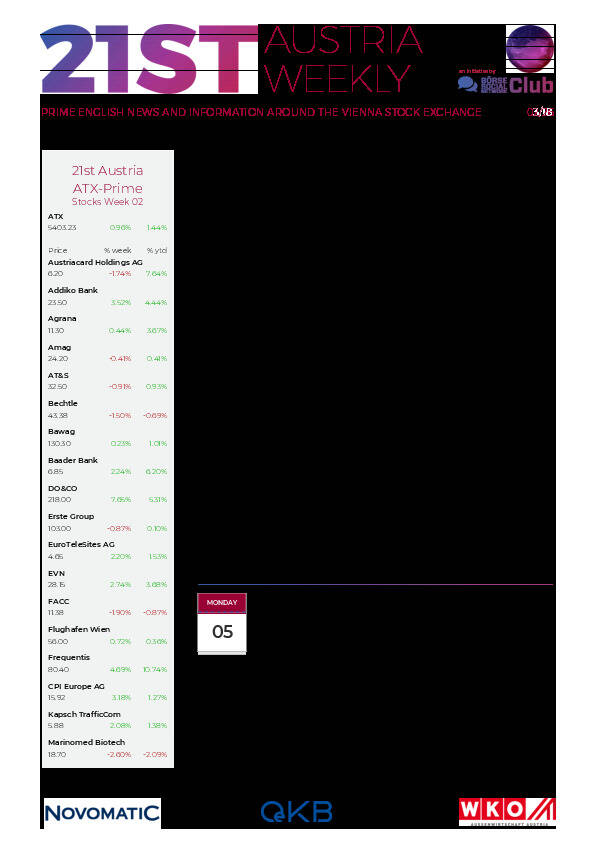

S Immo: weekly performance:

OMV: Austrian based oil and gas company OMV issues new perpetual, subordinated hybrid notes with a total volume of Euro 1.25 bn in two tranches (Tranche 1: 750 mn; Tranche 2: 500 mn). Closing and listing of both tranches of the hybrid notes on the Regulated Market of the Luxembourg Stock Exchange and on the Official Market (Amtlicher Handel) of the Vienna Stock Exchange are intended to take place on or around September 1,2020. Moody's assigns Baa2 rating to OMV's hybrid issuance.

OMV: weekly performance:

Agrana: Supervisory board of sugar, fruit and starch company Agrana Beteiligungs-AG approved the closure of the sugar beet factory at the Leopoldsdorf site in Austria following the completion of the beet processing campaign in December 2020 and concentrate on the site in Tulln. From today's perspective, the restructuring costs associated with the permanent closure would amount to up to Euro 35 mn, of which up to Euro 15 mn would be recognised in cash flows.

Agrana: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (25/08/2020)

Wiener Börse Party #1072: ATX unverändert, Polytec erweitert Investmentstory, Austriacard zieht weiter, Cyber Security für die Ohren

Bildnachweis

Aktien auf dem Radar:voestalpine, AT&S, Andritz, RHI Magnesita, Austriacard Holdings AG, Pierer Mobility, Rosgix, Addiko Bank, CA Immo, Rosenbauer, FACC, Lenzing, OMV, EVN, Mayr-Melnhof, Wolford, Zumtobel, Gurktaler AG Stamm, Gurktaler AG VZ, Polytec Group, RBI, VIG, Wienerberger, Amag, UBM, Palfinger, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Josef Manner & Comp. AG, SW Umwelttechnik.

Random Partner

FACC

Die FACC ist führend in der Entwicklung und Produktion von Komponenten und Systemen aus Composite-Materialien. Die FACC Leichtbaulösungen sorgen in Verkehrs-, Fracht-, Businessflugzeugen und Hubschraubern für Sicherheit und Gewichtsersparnis, aber auch Schallreduktion. Zu den Kunden zählen u.a. wichtige Flugzeug- und Triebwerkshersteller.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten