21st Austria weekly - Frequentis, Raiffeisen Bank International (11/08/2020)

16.08.2020, 2518 Zeichen

Frequentis: Frequentis,an international supplier of communication and information systems for control centres with safety-critical tasks, acquired a shareholding in Spanish software company Nemergent Solutions, a young Spanish company headquartered in Bilbao, which is active in the field of “Mission Critical Services” (3GPP), such as MCPTT (Mission Critical Push-To-Talk) via LTE. Current cooperation projects are in the field of Public Transport and Public Safety, where Nemergent Solutions is contributing with software for application services and end devices, i.e. mobile terminals for emergency services. “We have already enjoyed an excellent working relationship with Nemergent Solutions. We are pleased that we can now strategically expand and deepen this cooperation in the form of an investment,” says Frequentis CEO Norbert Haslacher. “The LTE mobile communications standard brings new opportunities in safety-critical broadband communication; with our bundled software and technology competence we will further expand our market position”.

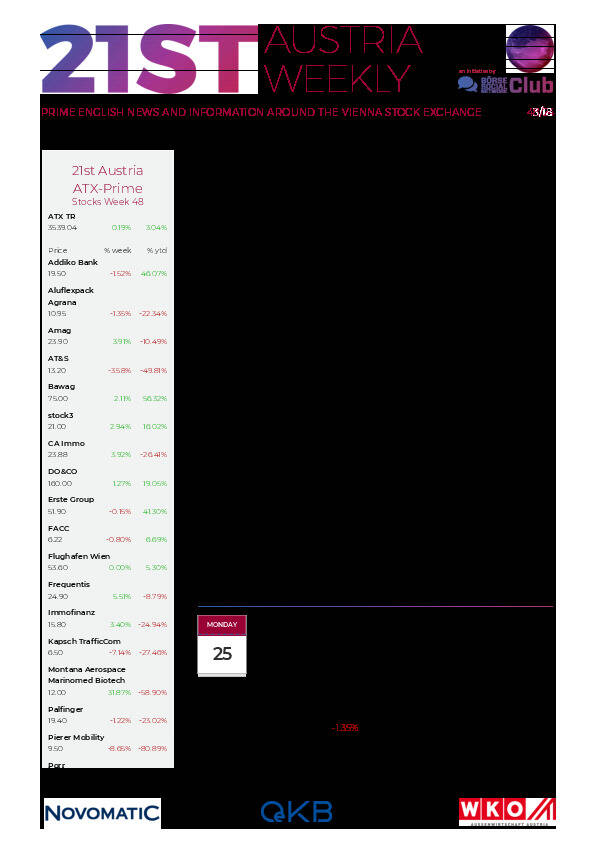

Frequentis: weekly performance:

Raiffeisen Bank International: In the first half of 2020, Raiffeisen Bank International (RBI) generated a consolidated profit of Euro 368 mn. Consolidated profit declined Euro 203 mn year-on-year. The result was negatively impacted by direct and indirect effects of the COVID-19 crisis. These are reflected in credit risk costs as well as in impacts relating to payment moratoriums and impairments on investments and goodwill. “RBI is in solid shape. We have a good capital base and a strong liquidity position. We leave our outlook unchanged. We expect RBI to generate a consolidated return on equity in the mid-single digit range this year,” said CEO Johann Strobl. The recession caused by the COVID-19 pandemic was most noticeably reflected by impairment losses on financial assets, which reached Euro 312 mn compared to a very modest level of Euro 12 mn in the previous year. At 1.9 per cent, the NPE ratio was down 0.2 percentage points from the year-end level, mainly due to the increased lending volume. The NPE coverage ratio improved 2.4 percentage points to 63.3 per cent. Total capital ratio (fully loaded) at 17.5 per cent On a fully loaded basis (each) and including the half-year result, the CET1 ratio stood at 13.2 per cent, the tier 1 ratio at 14.6 per cent and the total capital ratio at 17.5 per cent.

RBI: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (11/08/2020)

SportWoche Podcast #137: Tennis-Highlights, Rankings & Rookies 2024 aus österreichischer Sicht feat. Thomas Schweda, ÖTV

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Warimpex, Wienerberger, Kapsch TrafficCom, AT&S, Frauenthal, Gurktaler AG Stamm, Polytec Group, Wolftank-Adisa, Porr, Oberbank AG Stamm, UBM, Palfinger, Zumtobel, Addiko Bank, Agrana, Erste Group, EVN, Flughafen Wien, OMV, Österreichische Post, S Immo, Telekom Austria, Uniqa.

Random Partner

VIG

Die Vienna Insurance Group (VIG) ist mit rund 50 Konzerngesellschaften und mehr als 25.000 Mitarbeitern in 30 Ländern aktiv. Bereits seit 1994 notiert die VIG an der Wiener Börse und zählt heute zu den Top-Unternehmen im Segment “prime market“ und weist eine attraktive Dividendenpolitik auf.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten