Kapsch TrafficCom AG / Results for the first quarter 2020/21.

12.08.2020, 7527 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.Financial Figures/Balance SheetVienna -Headlines.Termination of several major projects, an ongoing personnel shortage in North America and additional expenses for the implementation of new software lead to a decline in revenues and earnings.\nNo dividend for 2019/20.\nProgram launched to reduce costs and increase efficiency.\nStill too many uncertainties for quantitative outlook on full year 2020/21.\n"We are currently in a period of weakness. However, I am convinced that we aretaking the right steps to quickly put the company back on the road to success,"says Georg Kapsch, CEO of Kapsch TrafficCom.Unlessotherwisestated, all Q1 2019/20 Q1 2020/21 +/-values inEUR millionRevenues 186.2 138.5 -25.6%EBIT 4.6 -11.3 > -100%EBIT margin 2.4% -8.2% -10.6%Profit forthe periodattributable 2.4 -10.0 > -100%to equityholdersEarnings per 0.19 -0.77 > -100%share (EUR)Vienna, August 12, 2020 - The final earnings for the first quarter of financialyear 2020/21 published today by Kapsch TrafficCom hardly differ from theanticipated revenues and operating profit (EBIT) announced on July 24, 2020.Revenues decreased by approximately 26% to EUR 138 million in Q1. This declineis mainly due to developments in the EMEA region (Europe, Middle East, Africa).Last year, revenues still included projects that have been completed in themeantime: two projects for the German infrastructure charge, the operation ofthe nation-wide toll system in the Czech Republic and the implementation of thenation-wide toll system in Bulgaria. This alone explains a drop in revenues ofaround EUR 38 million. In South Africa, the COVID-19 situation in particular ledto a drop in revenues of EUR 6 million.By contrast, revenues continued to rise in the Americas region (North, Central,and South America). The critical factor here was the strong implementationbusiness. In the APAC region (Asia-Pacific), revenues fell by 7%.The EBIT was at EUR -11 million (previous year: EUR 5 million). It has not yetbeen possible to compensate for the loss of profitable major projects. At thesame time, the company has not yet been able to adapt its cost base to the newcircumstances. The implementation of new software in individual customer systemscontinued to result in additional costs. The difficult situation with staff inNorth America has also hurt profitability.In Q1 2020/21, Kapsch TrafficCom achieved earnings for the period attributableto equity holders of EUR -10 million (previous year: EUR 2 million). Thiscorresponds to earnings per share of EUR -0.77 (previous year: EUR 0.19). Freecash flow was very negative at -EUR 27 million. More than EUR 20 million of thisamount resulted from changes in working capital. In particular, trade payableswere reduced, which caused the balance sheet to decline. Total assets fell toEUR 677 million as of June 30, 2020 (March 31, 2020: EUR 727 million) and thenet debt rose to EUR 205 million (March 31, 2020: EUR 176 million). The equityratio increased slightly to 26% (March 31, 2020: 25%).In anticipation of a difficult financial year, Kapsch TrafficCom has launched aprogram to both define short-term cost reduction measures and to create thebasis for sustainable growth. The goals include sustainable cost reductions inthe double-digit million range and the cushioning of negative factorsinfluencing earnings in the current financial year. The first measures arealready being implemented and more will follow. As a sign of how seriouslymanagement takes this program, the members of the Executive Board and the 15executives on the Global Leadership Team are waiving 10% of their fixed salaryfor at least six months.It is not yet possible to quantify the effects of COVID-19 on the business. Inindividual cases, there are delays within projects and in tenders. Moreover,visibility for the second half of the financial year remains low. For thisreason, and due to the weak Q1 results, the Executive Board is stepping awayfrom the original dividend proposal (EUR 0.25 per share) and will not beproposing a distribution at the Annual General Meeting on September 9, 2020.From today's point of view, management expects profitability for financial year2020/21 to be significantly better than in the previous year. Based on theperformance in Q1, achieving a positive EBIT is expected to be much morechallenging than originally anticipated, given the low visibility anduncertainties surrounding COVID-19.Segment Results.In Q1 2020/21, 77% of the revenues were attributed to the ETC segment and 23% tothe IMS segment. 48% of revenues were generated in the Europe, Middle East, andAfrica (EMEA) region, 47% in the Americas region (North, Central, and SouthAmerica), and 5% in the Asia-Pacific (APAC) region.ETC(ElectronicTollCollection).Unless Q1 2019/20 Q1 2020/21 +/-otherwisestated, allvalues in EURmillionRevenues 147.0 106.0 -27.9%EBIT 7.6 -8.9 > -100%EBIT margin 5.2% -8.4% -13.6%In Q1 2020/21, ETC revenues fell to EUR 106 million (-28%). ETC EBIT was EUR -9 million (previous year: EUR 8 million). The EBIT margin reached -8% (previousyear: 5%).IMS(IntelligentMobilitySolutions).Unless Q1 2019/20 Q1 2020/21 +/-otherwisestated, allvalues inEUR millionRevenues 39.1 32.5 -17.0%EBIT -3.1 -2.5 20.1%EBIT margin -7.9% -7.6% 0.3%In Q1 2020/21, segment revenues totaled EUR 32 million (-17%). IMS EBIT was atEUR -2 million and thus better than the figure of the previous year (EUR -3 million).The highlights report of the first quarter 2020/21 will be available at http://kapsch.net/ktc/ir http://kapsch.net/ktc/ir from today at 7:35 am (CEST).---Kapsch TrafficCom is a globally renowned provider of transportation solutionsfor sustainable mobility. Our innovative solutions in the application fields ofTolling, Traffic Management, Demand Management and Mobility Services contributeto a healthy world without traffic congestion.We have brought projects to fruition in more than 50 countries around the globe.With our one-stop solutions, we cover the entire value chain of our customers,from components to design and implementation to operation of systems.As part of the Kapsch Group and headquartered in Vienna, Kapsch TrafficCom hassubsidiaries and branches in more than 30 countries. It has been listed in thePrime Market segment of the Vienna Stock Exchange since 2007 (ticker symbol:KTCG). Kapsch TrafficCom's about 5,100 employees generated revenues of EUR 731million in financial year 2019/20.end of announcement euro adhocAttachments with Announcement:----------------------------------------------http://resources.euroadhoc.com/documents/2235/5/10537154/1/KT...issuer: Kapsch TrafficCom AG Am Europlatz 2 A-1120 Wienphone: +43 50811 1122FAX: +43 50811 99 1122mail: ir.kapschtraffic@kapsch.netWWW: www.kapschtraffic.comISIN: AT000KAPSCH9indexes:stockmarkets: Wienlanguage: EnglishDigital press kit: http://www.ots.at/pressemappe/411/aom

Wiener Börse Party #1079: Kleine ATX-Korrektur am Ende einer weiteren Rekordwoche, Erste 2x über 100, Porr und AT&S vor den Vorhang

Kapsch TrafficCom

Uhrzeit: 19:03:28

Veränderung zu letztem SK: -1.69%

Letzter SK: 5.92 ( -1.99%)

Bildnachweis

Aktien auf dem Radar:EuroTeleSites AG, RHI Magnesita, Flughafen Wien, Austriacard Holdings AG, Addiko Bank, Zumtobel, FACC, Pierer Mobility, Andritz, CA Immo, Lenzing, Mayr-Melnhof, OMV, UBM, SBO, Wiener Privatbank, Frequentis, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, Amag, EVN, CPI Europe AG, Österreichische Post, Telekom Austria, Verbund, adidas, Fresenius Medical Care, Volkswagen Vz., Siemens Energy, Hannover Rück.

Random Partner

Uniqa

Die Uniqa Group ist eine führende Versicherungsgruppe, die in Österreich und Zentral- und Osteuropa tätig ist. Die Gruppe ist mit ihren mehr als 20.000 Mitarbeitern und rund 40 Gesellschaften in 18 Ländern vor Ort und hat mehr als 10 Millionen Kunden.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- 21st Austria weekly - Kapsch TrafficCom (23/01/2026)

- 21st Austria weekly - Austrian Post, AT&S (22/01/...

- 21st Austria weekly - wienerberger, Kapsch Traffi...

- 21st Austria weekly - Vienna Airport, Kapsch Traf...

- 21st Austria weekly - Verbund, Porr (19/01/2026)

- 21st Austria weekly - ATX with first close over 5...

Featured Partner Video

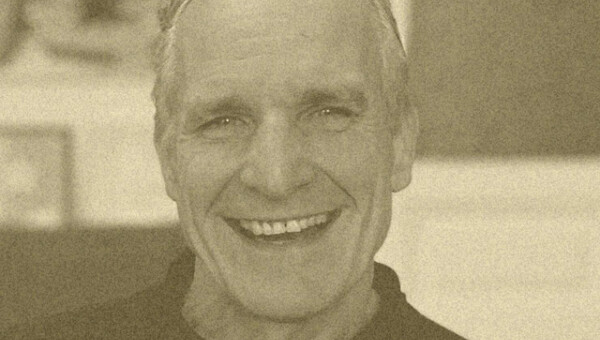

Börsepeople im Podcast S22/20: Johannes Linhart

Johannes Linhart ist Leiter Wirtschaft und Politik beim Senat der Wirtschaft. Diese Folge ist für mich eine ganz besondere und wurde bewusst für das Jahresende ausgewählt, denn es wimmelt nur so an...

Books josefchladek.com

Not Shameless

2025

Self published

zooreal

2003

Kontrast Verlag

As Long as the Sun Lasts

2025

Void

Jeff Mermelstein

Jeff Mermelstein Anna Fabricius

Anna Fabricius Jacques Fivel

Jacques Fivel Claudia Andujar

Claudia Andujar Krass Clement

Krass Clement Jan Holkup

Jan Holkup