21st Austria weekly - Wolftank-Adisa, OMV, ams, UBM/CA Immo (29/07/2020)

02.08.2020, 3895 Zeichen

Wolftank: With reference to the company's ad hoc announcement on 3rd of June 2020, Wolftank-Adisa Holding AG is pleased to announce the majority takeover of Rovereta Srl, a 100% subsidiary of Petroltecnica Spa, on the basis of the signed contracts. "With its expertise in water and soil treatment, as well as in the very economical recycling of the processed materials, Rovereta Srl will massively increase our value chain" says Peter Werth, CEO of Wolftank Group. "Above all, we expect a significant reduction in costs for the disposal and treatment of contaminated soil and water which will have a positive effect on our margins in this business segment," Werth continued. As a result of the acquisition and the joint business volume in the soil & water remediation sector, Wolftank Group expects significant synergies, especially in purchasing, research & development and the operation of a joint technology- and sales-platform. At the same time, it expects faster growth through the expansion of its international offering capabilities.

OMV: Austrian oil and gas company reported consolidated sales revenues for the first six month of Euro 7,898 mn, a decrease of 31% to the period of the year before. The clean CCS Operating Result declined considerably from 1,806 mn in 6m/19 to Euro 844 mn. The contribution from Upstream amounted to Euro (15) mn (6m/19: 1,043 mn). In Downstream, the clean CCS Operating Result stood at Euro 810 mn (6m/19: Euro 801 mn).

OMV: weekly performance:

ams: ams, a leading worldwide supplier of high performance sensor solutions, reports record revenues for the second quarter, up 13% year-on-year and at the mid-point of the expectation range, with strong adjusted operating profitability at the top end of the expectation range. Second quarter group revenues were USD 460.3 mn, down 8% sequentially from the first quarter and up 13% from USD 407.3 mn in the same quarter 2019. Group revenues for the first half of 2020 were USD 960.9 mn, up 22%. The adjusted result from operations (EBIT) for the second quarter was USD 90.1 mn or 20% of revenues (excluding acquisition-related and share-based compensation costs), increasing from USD 49.0 mn in the same period 2019 (USD 39.2 mn or 9% of revenues including acquisition-related and share-based compensation costs, up from USD 21.5 mn in the same period 2019). For the first half of 2020, the adjusted EBIT was USD 191.0 mn or 20% of revenues (excluding acquisition-related and share-based compensation costs), significantly up from USD 71.8 million in the same period 2019 (USD 99.0 mn or 10% of revenues including acquisition-related and share-based compensation costs, up from USD 17.1 mn in the first half year 2019). For the third quarter 2020, ams expects very good growth for the ams business despite the ongoing Covid-19 pandemic impacting economies and its end markets, on a sequential basis. This growth will be driven by volume ramps for smartphone sensing solutions while ams’ non-consumer business in Automotive and Industrial continues to show limited demand and provide a muted contribution to the results. Based on available information and the above mentioned definition, ams expects third quarter revenues for the ams business of USD 530-570 million, up 20% sequentially at the midpoint.

AMS: weekly performance:

UBM/CA Immo: Austrian real estate company CA Immo and developer UBM Development have started construction of the Kaufmannshof residential and office building in the Zollhafen Mainz district. The building will have total gross floor space of around 8,600 m², of which approx. 55% will be for residential and 45% for office use. Completion of the building is scheduled for mid-2022. The investment amounts to a total of around Euro 37 mn.

UBM: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (29/07/2020)

Wiener Börse Party #791: Mundart-Folge mit Wolfgang Fellner, Rudi Fußi, Wien+Bund vs. alle, KÖSt- & KTM-Idee, ausverkauftes Wien-IPO

Bildnachweis

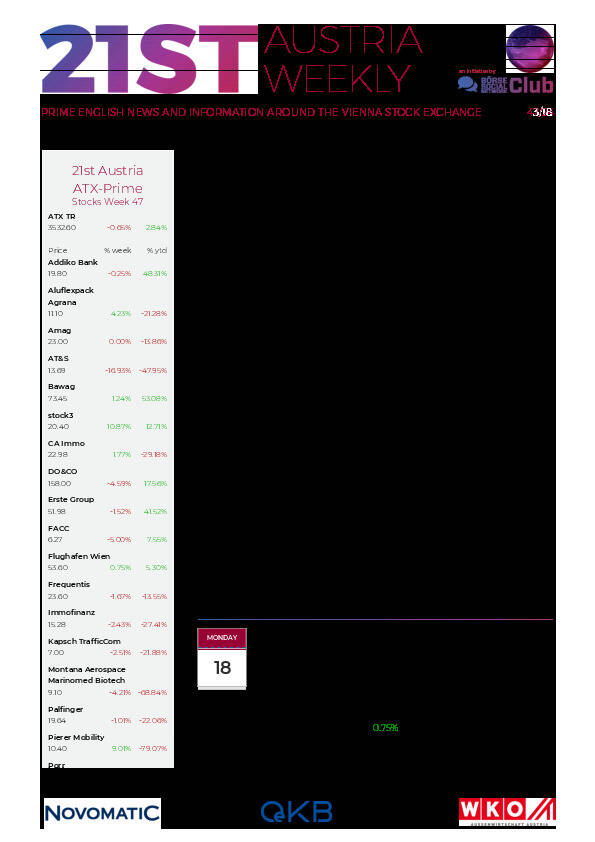

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Flughafen Wien, Immofinanz, CA Immo, Andritz, Frequentis, Marinomed Biotech, Polytec Group, AT&S, FACC, Uniqa, Warimpex, Wienerberger, Rosenbauer, Cleen Energy, SW Umwelttechnik, Porr, Oberbank AG Stamm, Kapsch TrafficCom, DO&CO, Addiko Bank, Agrana, Erste Group, EVN, OMV, Palfinger, Österreichische Post, S Immo, Telekom Austria.

Random Partner

Mayr-Melnhof Gruppe

Die Mayr-Melnhof Gruppe ist Europas größter Karton- und Faltschachtelproduzent. Das Unternehmen konzentriert sich konsequent auf seine Kernkompetenz, die Produktion und Verarbeitung von Karton zu Verpackungen für Konsumgüter des täglichen Bedarfes. Damit wird ein langfristig attraktives und ausgewogenes Geschäft mit überschaubarer Zyklizität verfolgt.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten