EANS-Other capital market information: Atrium European Real Estate Limited / Notification of share buyback transactions (Article 5 of Reg. (EU) market abuse)

02.06.2020, 4262 Zeichen

Other capital market information transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Publication pursuant to Art 5 para 1 lit b) and 3 of Regulation (EU) No 596/2014 and Art 2 para 2 and 3 of the Commission Delegated Regulation (EU) No 2016/1052

Jersey, 2 June 2020 - Atrium European Real Estate Limited (VSE/ Euronext: ATRS) ("Atrium" or the "Company"), a leading owner, operator and redeveloper of shopping centres and retail real estate in Central Europe, announces that in the period from 25 May 2020 to 29 May 2020, it has acquired a total of 6,456 shares under the share buyback programme announced on 17 March 2020 in accordance with Art 2 para 2 of the Commission Delegated Regulation (EU) 2016/1052.

The total number of shares repurchased, the weighted average price and the aggregated volume for the period per day amounted to:

_____________________________________________________________________________ | | Total number of | Weighted average |Aggregated volume | | Date |repurchased shares | price (EUR) | (EUR) | |___________________|_____(number)______|__________________|__________________| | Trading Venue | | | | |XWBO (Vienna Stock | | | | |_____Exchange)_____|___________________|__________________|__________________| |____25.05.2020_____|_______3,964_______|_______2.60_______|______10,296______| | Trading Venue | | | | | XAMS (Euronext | | | | |____Amsterdam)_____|___________________|__________________|__________________| |____25.05.2020_____|_______1,251_______|_______2.60_______|______3,253_______| |____26.05.2020_____|_______1,241_______|_______2.65_______|______3,289_______|

The total number of shares repurchased since 17 March 2020 amounts to 630,221 shares. Detailed information on the individual transactions of the share buyback programme are published in accordance with Art 2 para 3 of the Commission Delegated Regulation (EU) 2016/1052 on Atriums website https://www.aere.com/ sharebuy.aspx. The shares were purchased by a credit institution commissioned by Atrium and exclusively via the Vienna Stock Exchange and Euronext Amsterdam.

For further information: FTI Consulting Inc.: +44 (0)20 3727 1000 Richard Sunderland/Claire Turvey/Ellie Sweeney: atrium@fticonsulting.com

About Atrium European Real Estate Atrium is a leading owner, operator and redeveloper of shopping centres and retail real estate in Central Europe. Atrium specializes in locally dominant food, fashion and entertainment shopping centres in the best urban locations. Atrium owns 26 properties with a total gross leasable area of over 809,000 sqm and with a total market value of approximately EUR2.6 billion. These properties are located in Poland, the Czech Republic, Slovakia and Russia, and with the exception of one, are all managed by Atrium's internal team of retail real estate professionals.

The Company is established as a closed-end investment company incorporated and domiciled in Jersey and regulated by the Jersey Financial Services Commission as a certified Jersey listed fund, and is listed on both the Vienna Stock Exchange and the Euronext Amsterdam Stock Exchange. Appropriate professional advice should be sought in the case of any uncertainty as to the scope of the regulatory requirements that apply by reason of the above regulation and listings. All investments are subject to risk. Past performance is no guarantee of future returns. The value of investments may fluctuate. Results achieved in the past are no guarantee of future results.

end of announcement euro adhoc

issuer: Atrium European Real Estate Limited Seaton Place 11-15 UK-JE4 0QH St Helier Jersey / Channel Islands phone: +44 (0)20 7831 3113 FAX: mail: richard.sunderland@fticonsulting.com WWW: http://www.aere.com ISIN: JE00B3DCF752 indexes: stockmarkets: Wien, Luxembourg Stock Exchange language: English

Digital press kit: http://www.ots.at/pressemappe/2915/aom

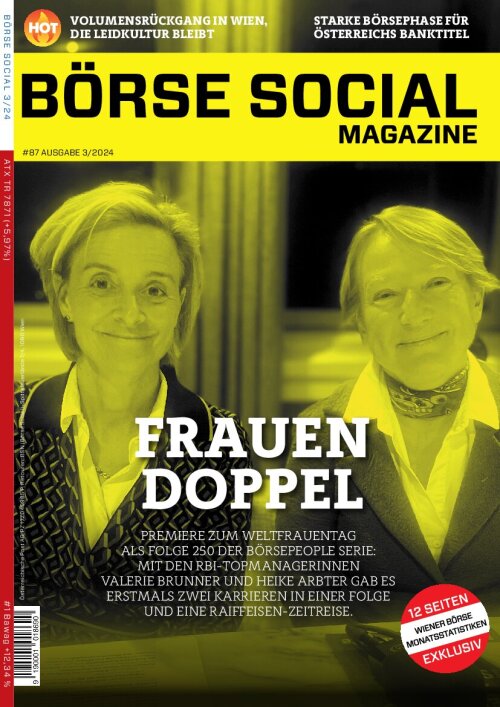

Börsepeople im Podcast S12/11: Patrick Kesselhut

Atrium

Uhrzeit: 08:09:14

Veränderung zu letztem SK: 4.75%

Letzter SK: 2.90 ( 0.00%)

Bildnachweis

Aktien auf dem Radar:Addiko Bank, Immofinanz, Wienerberger, Flughafen Wien, Warimpex, Porr, AT&S, Palfinger, Strabag, Uniqa, Verbund, Pierer Mobility, Andritz, Frequentis, S Immo, Oberbank AG Stamm, Amag, Agrana, CA Immo, Erste Group, EVN, Kapsch TrafficCom, OMV, Österreichische Post, Telekom Austria, VIG, Deutsche Bank, IBM, Caterpillar, Beiersdorf, Symrise.

Random Partner

Marinomed

Erforscht und entwickelt völlig neuartige Technologieplattformen, die innovative Therapien gegen Atemwegs- und Augenerkrankungen ermöglichen. Aus wissenschaftlichen Ideen werden so neue Patente, Marken und Produkte geschaffen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A347X9 | |

| AT0000A2U2W8 | |

| AT0000A39UT1 |

- Neues Kursziel für AMAG-Aktie

- wikifolio whispers a.m. Tesla, Münchener Rück, Al...

- DAX-Frühmover: BASF, Airbus Group, Münchener Rück...

- ATX TR-Frühmover: Österreichische Post, Lenzing, ...

- Stratec Biomedical, Aixtron am besten (Peer Group...

- ATX-Trends: Strabag, S Immo, Erste Group, RBI ...

Featured Partner Video

Tamos Tag als Training

Das Sporttagebuch mit Michael Knöppel - 7. April 2024 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch Twitter: @Sporttagebuch_

Das Sporttagebuch mit Michael Knöppel - 7. A...

Books josefchladek.com

NA4JOPM8

2021

ist publishing

Terra Vermelha

2023

Void

Ta-ra

2023

ediciones anómalas

Ros Boisier

Ros Boisier Futures

Futures Stefania Rössl & Massimo Sordi (eds.)

Stefania Rössl & Massimo Sordi (eds.) Christian Reister

Christian Reister Sergio Castañeira

Sergio Castañeira Sebastián Bruno

Sebastián Bruno