21st Austria weekly - ams, Rosenbauer (12/11/2019)

17.11.2019, 2104 Zeichen

ams: ams, global leader in the design and manufacture of advanced sensor solutions, welcomes the positive recommendation in support of its all-cash takeover for 100% of the share capital of Osram at a price of Euro 41.00 per share. In particular, ams recognizes the shared views surrounding the strategic logic of the combination and the financial attractiveness of the Offer. Furthermore, ams is pleased that members of the Management Board and Supervisory Board of Osram have stated to tender their shares into the Offer.Osram has concluded a comprehensive business combination agreement with ams and recommends its shareholders accept the current takeover offer. ams encourages all Osram shareholders who have not presently done so, to tender into the Offer and is confident to achieve the minimum acceptance threshold. Osram shareholders are able to tender their shares into the Offer until the acceptance period expires on 5 December 2019 at midnight (CEST). In addition, ams announces that it has entered into a Business Combination Agreement with Osram.

AMS: weekly performance:

Rosenbauer: The Rosenbauer Group, world’s leading manufacturer of systems for firefighting and disaster

protection, expanded its business volume in the first nine months of 2019. Group revenues rose by 11% year-on-year from Euro 552.0 mn to Euro 614.5 mn. In particular, deliveries to North America, Central Europe and Asia were higher, while the Middle East and Northern and Western Europe recorded declines. At Euro 784.1 mn, incoming orders were at the previous year’s level (1-9/2018: Euro 789.9 mn). Expenses for materials and staff were high due to production factors, meaning that EBIT was just Euro 15.1 mn (1-9/2018: € 17.0 mn) despite a stronger operating performance. In view of the very strong capacity utilization at the production facilities, the Rosenbauer Managing Board is raising its revenue target for 2019 to more than Euro 980 mn, the EBIT margin is expected at around 5.1%.

Rosenbauer: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (12/11/2019)

SportWoche Podcast #137: Tennis-Highlights, Rankings & Rookies 2024 aus österreichischer Sicht feat. Thomas Schweda, ÖTV

Bildnachweis

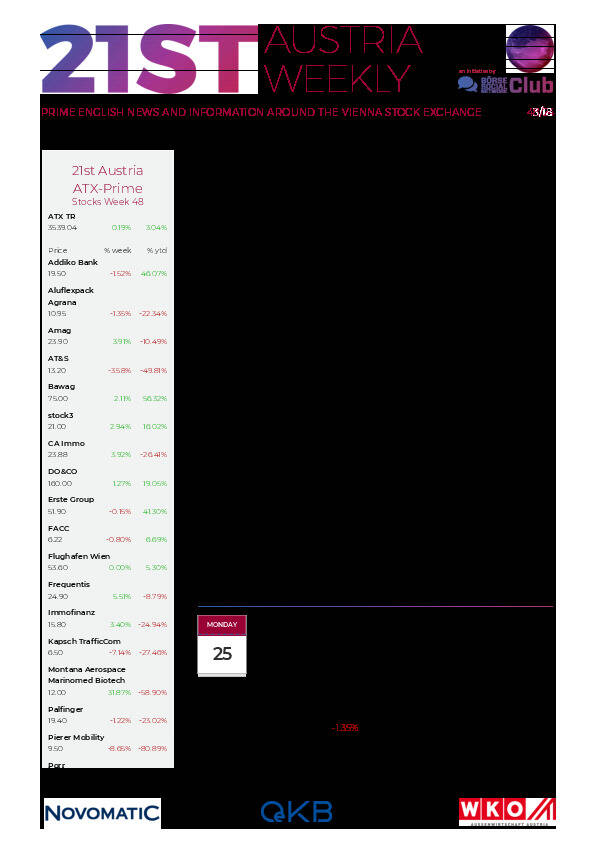

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Warimpex, Wienerberger, Kapsch TrafficCom, AT&S, Frauenthal, Gurktaler AG Stamm, Polytec Group, Wolftank-Adisa, Porr, Oberbank AG Stamm, UBM, Palfinger, Zumtobel, Addiko Bank, Agrana, Erste Group, EVN, Flughafen Wien, OMV, Österreichische Post, S Immo, Telekom Austria, Uniqa.

Random Partner

Addiko Group

Die Addiko Gruppe besteht aus der Addiko Bank AG, der österreichischen Mutterbank mit Sitz in Wien (Österreich), die an der Wiener Börse notiert und sechs Tochterbanken, die in fünf CSEE-Ländern registriert, konzessioniert und tätig sind: Kroatien, Slowenien, Bosnien & Herzegowina (wo die Addiko Gruppe zwei Banken betreibt), Serbien und Montenegro.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten