Wienerberger AG intends to increase payouts to shareholders

Wienerberger AG intends to increase payouts to shareholders

16.09.2019, 4803 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

No Keyword

Vienna - September 16, 2019.

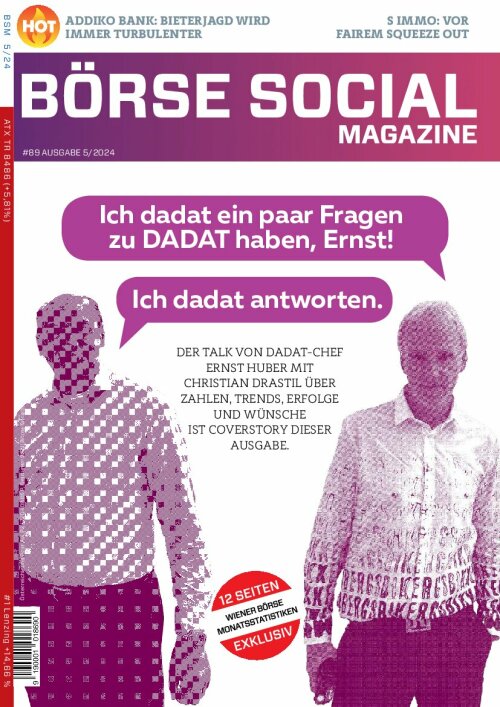

New capital distribution policy provides for distribution of 20-40% of free cash flow to shareholders\nBalance sheet remains strong, providing headroom for enhanced capital returns and strategic growth projects\nImplementation of value-creating growth strategy fully on track\nPlans for further optimization of financing costs\nOutlook for 2019 confirmed\nOn the occasion of its Capital Markets Day, the Wienerberger Group, a leading international supplier of innovative solutions for the building envelope and smart infrastructure, announces a new capital distribution policy. The company intends to distribute 20-40% of the free cash flow to its shareholders in the form of dividends and share buybacks. Moreover, Wienerberger provides an update on the implementation of its value-creating growth strategy and confirms its outlook for EBITDA like-for-like for 2019 within a range of EUR 570-580 million. Wienerberger has made significant progress in implementing its Fast Forward program of performance enhancement measures and is therefore fully on track to achieve its target of a contribution to earnings of EUR 120 million in the period from 2018 to 2020.

To date, Wienerberger's distribution policy has been 10-30% of the free cash flow after deduction of the costs of hybrid capital. In the future, 20-40% of the free cash flow of the respective business year are to be distributed to the shareholders. "We are experiencing profitable growth and have most recently generated the best half-year result in the 200-year history of our company. We want our shareholders to benefit more strongly from this successful performance", says Chairman of the Managing Board Heimo Scheuch.

In implementing its corporate strategy, Wienerberger continues to focus on value-creating growth projects. Currently, the company is looking into attractive M&A projects with a view to broadening its offer of innovative products and services and strengthening its market presence. With its strong balance sheet, the Group has the necessary financial headroom for such strategic growth steps.

In terms of organic growth, Wienerberger is making strong progress in transforming its product and service portfolio. The company's objective is to further increase the percentage of premium products and smart solutions and to play a major role as an innovation leader in the digital transformation of the construction and infrastructure sectors. Wienerberger intends to explore growth opportunities in adjacent and new products to double its revenue share of the total value of the building envelope to 10% over the medium-term.

Moreover, Wienerberger specifies its CAPEX guidance on the occasion of the Capital Markets Day. Recurring maintenance investments are to be within a range of EUR 120 to 140 million on a sustainable basis, with investments of EUR 135 million anticipated for 2019. Discretionary growth investments aimed at strengthening the company's performance and supporting its strategic development will come to approximately EUR 120 million, including investments in capacity expansion, optimization and digitalization projects, as well as research and development.

Wienerberger's growth strategy is being implemented on the basis of strict financial discipline. Wienerberger will capitalize on the refinancing of a corporate bond maturing in 2020 and the call option for the hybrid bond in 2021 to further optimize the Group's financing costs.

Wienerberger Group Wienerberger is the world's largest producer of bricks (Porotherm, Terca) and the market leader in clay roof tiles (Koramic, Tondach) in Europe as well as concrete pavers (Semmelrock) in Central and Eastern Europe. In pipe systems (Steinzeug-Keramo ceramic pipes and Pipelife plastic pipes), the company is one of the leading suppliers in Europe. With its total of 195 production sites, the Wienerberger Group generated revenues of EUR 3.3 billion and EBITDA of EUR 470 million in 2018.

Wienerberger AG is a pure free float company, whereby the majority of shares are held by Austrian and international institutional investors. Additional information on the shareholder structure is provided under https:// wienerberger.com/en/investors/share [https://wienerberger.com/en/investors/ share]

end of announcement euro adhoc

issuer: Wienerberger AG Wienerbergerstraße 11 A-1100 Wien phone: +43 1 60 192-0 FAX: +43 1 60 192-10159 mail: office@wienerberger.at WWW: www.wienerberger.at ISIN: AT0000831706 indexes: ATX stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/594/aom

SportWoche Podcast #117: Floorball, vorgestellt von FBC Dragons Gründer Harry Steinbichler

Wienerberger

Uhrzeit: 13:03:44

Veränderung zu letztem SK: -0.31%

Letzter SK: 32.48 ( 1.18%)

Bildnachweis

Aktien auf dem Radar:Amag, Agrana, RHI Magnesita, Austriacard Holdings AG, Flughafen Wien, Addiko Bank, Rosgix, ATX, ATX Prime, ATX TR, Wienerberger, Bawag, AT&S, Österreichische Post, Palfinger, Semperit, Cleen Energy, Pierer Mobility, UBM, Wiener Privatbank, Oberbank AG Stamm, CA Immo, Erste Group, EVN, Immofinanz, Telekom Austria, Uniqa, VIG, Symrise, Siemens Healthineers, BMW.

Random Partner

Wolftank-Adisa

Die Wolftank-Adisa Holding AG ist die Muttergesellschaft einer internationalen Unternehmensgruppe mit Fokus auf Sanierung und Überwachungen von (Groß–)Tankanlagen und Umweltschutz-Dienstleistungen bei verseuchten Böden und Einrichtungen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2WCB4 | |

| AT0000A37NX2 | |

| AT0000A39UT1 |

- Wienerberger und Palfinger vs. Polytec Group und ...

- Münchener Rück und Swiss Re vs. Generali Assicura...

- Swisscom und Orange vs. Tele Columbus und Telekom...

- ArcelorMittal und Salzgitter vs. ThyssenKrupp und...

- bet-at-home.com und adidas vs. World Wrestling En...

- Silver Standard Resources und Barrick Gold vs. Ga...

Featured Partner Video

Ein Sonntag abseits des Fussballs

Das Sporttagebuch mit Michael Knöppel - 30. Juni 2024 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch Twitter: @Sporttagebuch_

Das Sporttagebuch mit Michael Knöppel - 30. ...

Books josefchladek.com

De Muur

2002

Fotokabinetten Gemeentemuseum Den Haag

On the Verge

2023

Void

Many are Called

1966

Houghton Mifflin

Bonifica

2024

Self published

Liebe in Saint Germain des Pres

1956

Rowohlt

Andreas Gehrke

Andreas Gehrke Kristina Syrchikova

Kristina Syrchikova Mimi Plumb

Mimi Plumb Stefania Rössl & Massimo Sordi (eds.)

Stefania Rössl & Massimo Sordi (eds.) Regina Anzenberger

Regina Anzenberger