21st Austria weekly - ams, Atrium Real Estate (23/07/2019)

28.07.2019, 4010 Zeichen

ams: ams, a leading worldwide supplier of high performance sensor solutions, reports second quarter results with revenues in the upper half of the guidance range and operating profitability above expectations. Second quarter group revenues were USD 415.2 mn, up 8% sequentially compared to the first quarter and up 72% from USD 241.6 mn in the same quarter 2018. Group revenues for the first half of 2019 were USD 801.2 mn, up 22% compared to USD 655.2 mn recorded in the first half of 2018. The adjusted result from operations (EBIT) for the second quarter was USD 50.0 mn or 12% of revenues (excluding acquisition-related and share-based compensation costs), strongly increasing from a loss of USD 46.4 mn in the same period 2018 (USD 21.9 mn or 5% of revenues including acquisition-related and share-based compensation costs, up from a loss of USD 72.8 mn in the same period 2018). For the first half of 2019, the adjusted EBIT was USD 73.2 mn, up from USD 24.2 mn in the same period 2018. Adjusted net income for the second quarter was USD 25.2 mn, compared to a loss of USD 99.0 mn for the same period 2018. Operating cash flow for the second quarter was USD 50.7 mn compared to USD -69.1 mn in the same quarter last year, while operating cash flow for the first half was USD 145.7 mn compared to USD -17.6 mn in the first half year 2018. Total backlog on 30 June 2019 (excluding consignment stock agreements) was USD 304.2 mn compared to USD 285.2 mn at the end of the first quarter and USD 525.6 million on 30 June 2018. ams recently confirmed that it has been engaged in discussions with OSRAM Licht AG regarding a potential transaction. ams requires M&A opportunities to be strategically compelling and demonstrably value enhancing, and for larger transactions, financially accretive, achievable with a sustainable capital structure and fitting ams’ financial model. Against this background and under the circumstances at the time, ams did last week not see a sufficient basis for continuing the discussions with Osram Licht AG. However, as part of its technology-led M&A strategy ams continues to evaluate all opportunities with the objective to create value for its shareholders while satisfying the criteria above, and has today decided to re-evaluate a potential transaction with Osram Licht AG. In addition, ams was recently approached by potential financial partners and has exchanged views which confirm its belief that ams can arrange prudent and committed financing for this potential transaction. For the third quarter 2019, ams expects strong sequential and year-on-year growth driven by high volume ramps for smartphone sensing solutions while its other end markets continue their contribution to ams’ overall results.

AMS: weekly performance:

Atrium Real Estate: Atrium European Real Estate, owner, operator and redeveloper of shopping centres and retail realestate in Central Europe, announces that the Independent Committee of the Board of Directors of Atrium has reached an agreement with Nb (2019) B.V. (“Bidco”), which is an indirect wholly-owned subsidiary of Gazit-Globe Ltd (“Gazit”), on the terms and conditions of a recommended all cash acquisition of the entire issued, and to be issued ordinary share capital of Atrium that is not already owned directly or indirectly by Gazit. As at the date of the announcement, Gazit and its certain affiliates together own approximately 60.1 per cent of Atrium ́s issued share capital. Under the terms of the Acquisition, each shareholder will be entitled to receive for each share Euro 3.75 in cash. The Independent Committee of the Board of Directors of Atrium confirms its intention to recommend unanimously that the Atrium shareholders vote in favour of the Scheme at the court meeting and the resolutions to be proposed at the general meeting. The acquisition is expected to become effective on 2 January 2020.

Atrium: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (23/07/2019)

Börsepeople im Podcast S16/05: Maximilian Lahrmann

Bildnachweis

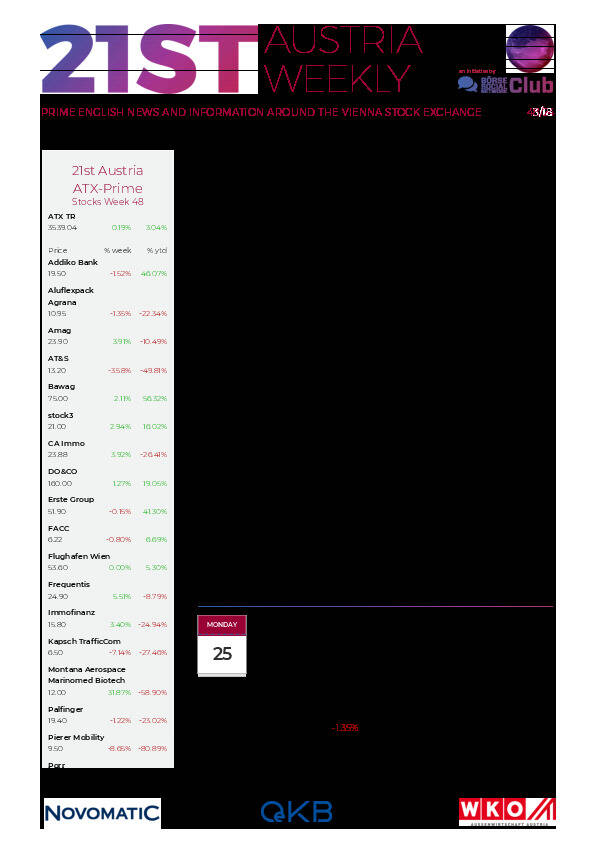

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Warimpex, Wienerberger, Kapsch TrafficCom, AT&S, Frauenthal, Gurktaler AG Stamm, Polytec Group, Wolftank-Adisa, Porr, Oberbank AG Stamm, UBM, Palfinger, Zumtobel, Addiko Bank, Agrana, Erste Group, EVN, Flughafen Wien, OMV, Österreichische Post, S Immo, Telekom Austria, Uniqa.

Random Partner

wikifolio

wikifolio ging 2012 online und ist heute Europas führende Online-Plattform mit Handelsstrategien für alle Anleger, die Wert auf smarte Geldanlage legen. wikifolio Trader, darunter auch Vollzeitinvestoren, erfolgreiche Unternehmer, Experten bestimmter Branchen, Vermögensverwalter oder Finanzredaktionen, teilen ihre Handelsideen in Musterportfolios, den wikifolios. Diesen kannst du einfach und direkt folgen – mit einer Investition in das zugehörige, besicherte wikifolio-Zertifikat.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten