EANS-General Meeting: STRABAG SE / Resolutions of the General Meeting

28.06.2019, 6817 Zeichen

General meeting information transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

28.06.2019

STRABAG SE Villach Dividend announcement ISIN: AT000000STR1

The 15th Annual General Meeting of STRABAG SE held on 28 June 2019, in line with the proposal made by the Management Board, voted to pay out a dividend of EUR 1.30 per share for the 2018 financial year.

The shares of STRABAG SE will be traded ex-dividend 2018 from Friday, 5 July 2019. The record date for the dividend is Monday, 8 July 2019. On the trading day after the record date, i.e. on 9 July 2019, an uncertificated security assigned ISIN AT0000A28FM0 will be registered for each bearer share with the custodian bank of the respective shareholder as a "value right" (Wertrecht) certifying the claim to receive the dividend for the 2018 financial year. This Wertrecht confers the right to receive the dividend beginning with 9 July 2019 against reciprocal and simultaneous transfer of the value right to Raiffeisen Centrobank AG, company registration number FN 117507f, Tegetthoffstraße 1, 1010 Vienna, as designated paying agent in accordance with the following provisions:

1. Dividend payment

Each value right documents entitlement to the dividend of EUR 1.30 per share for the 2018 financial year as determined by STRABAG SE, company registration number FN 88983h, Triglavstrasse 9, 9500 Villach ("STRABAG"). Dividends are paid out interest-free.

The designated paying agent is Raiffeisen Centrobank AG, company registration number FN 117507f, Tegetthoffstrasse 1, 1010 Vienna ("paying agent"). The paying agent acts exclusively as the agent of STRABAG and accepts no obligations whatsoever towards the holders of the value rights. No contractual or fiduciary relationship is established between the paying agent and the holders of the value rights.

The paying agent will pay the dividend against reciprocal and simultaneous transfer of the value right to the custodian bank of the holder of the value right. Payment is also conditional upon presentation of proof pursuant to item 2 below (for Rasperia Trading Limited) or confirmation pursuant to item 3 below (for all other shareholders).

Payment of the dividend will be made less 27.5 % capital gains tax to the extent that no tax exemption from the obligation to withhold capital gains tax applies and is invoked.

The dividend will be paid out by the paying agent on the condition that STRABAG has approved the confirmations issued by the custodian banks of the holders of the value rights and has provided the paying agent with the necessary amounts for the payment of the dividend (including reimbursement of expenses pursuant to item 5 below) in good time and in full.

2. Proof to be provided by Rasperia Trading Limited

The dividend shall not be paid out to persons designated by the Office of Foreign Assets Control (OFAC) as Specially Designated Nationals (SDNs), in particular Oleg Deripaska, or to companies that are at least 50 percent owned and/or controlled by one or more SDNs.

Reciprocal and simultaneous payment to Rasperia Trading Limited, company registration number HE 187571, Cyprus, or to the stated company with the name and legal form MEZHDUNARODNAYA KOMPANIYA AKTSIONERNOE OBSHCHESTVO "RASPERIA TRADING LIMITED" [international joint stock company "Rasperia Trading Limited"], company registration number OGRN 1193926007153, Russian Federation, ("Rasperia") can therefore only be made on the condition that Rasperia (or its legal successor(s)) is/are not at least 50 percent owned and/or controlled by one or more SDNs. The paying agent will pay the dividend to Rasperia (or its legal successor(s)) as soon as documentary proof of this fact has been provided and has been expressly confirmed by STRABAG in writing.

3. Confirmation from the custodian bank for shareholders other than Rasperia

Upon submission of value rights, the custodian bank of each holder of value rights other than Rasperia must issue a confirmation indicating that the value rights were not held by Rasperia either on 9 July 2019 or on the date of redemption. The confirmation form is available for download on the STRABAG website (www.strabag.com).

The fully completed and signed confirmation must be transmitted by the custodian bank to the paying agent by fax.

The confirmation may not be dated more than three bank working days prior to receipt by the paying agent.

4. Submission period

The value rights and proof pursuant to item 2 above or confirmation pursuant to item 3 above can be submitted to the paying agent from 9 July 2019, 9:00 a.m. Vienna time, to 11 July 2022, 5:00 p.m. Vienna time. Dividends not claimed within the aforementioned time will lapse to the company's favour.

5. Reimbursement of expenses

The costs of processing the dividend payment by means of value rights will be reimbursed by STRABAG to each custodian bank in the amount of EUR 8 per custody account. This reimbursement amount can be claimed by each custodian bank of a holder of value rights when presenting proof pursuant to item 2 or confirmation pursuant to item 3.

6. Applicable law, place of jurisdiction

The rights and duties of the value right holders and of STRABAG are subject to Austrian law, with the exclusion of the referring statutes of Austrian international private law. The place of performance is Vienna, Austria.

For all legal disputes in connection with these processing conditions, exclusive jurisdiction shall rest with the competent court in commercial matters in Vienna, to the extent permitted by mandatory law and/or unless any other mandatory place of jurisdiction applies (cf. in particular Section 83a of the Austrian Jurisdiction Act [JN]).

For legal action brought by a consumer against STRABAG, exclusive jurisdiction shall rest, according to the consumer's choice, with either the local court competent for the matter at the consumer's place of residence or the court at the place where the registered office of STRABAG is situated or any other court which has competence under statutory provisions, to the extent permitted by mandatory law and/or unless any other mandatory place of jurisdiction applies (cf. in particular Section 83a of the Austrian Jurisdiction Act [JN]).

Villach, June 2019 The Management Board

end of announcement euro adhoc

Attachments with Announcement: ---------------------------------------------- http://resources.euroadhoc.com/documents/2246/12/10325681/1/D...

issuer: STRABAG SE Donau-City-Straße 9 A-1220 Wien phone: +43 1 22422 -0 FAX: +43 1 22422 - 1177 mail: investor.relations@strabag.com WWW: www.strabag.com ISIN: AT000000STR1, AT0000A05HY9 indexes: SATX, WBI, ATX stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/4106/aom

Number One Awards 2025 an AT&S, Do&Co, Erste Group, Morgan Stanley, Palfinger, EAM (Kategorien 1-6 von 12)

Strabag

Uhrzeit: 19:03:24

Veränderung zu letztem SK: 0.44%

Letzter SK: 79.70 ( 0.13%)

Bildnachweis

Aktien auf dem Radar:VIG, Kapsch TrafficCom, UBM, EuroTeleSites AG, Flughafen Wien, Palfinger, ATX, ATX Prime, ATX TR, ATX NTR, Bawag, Andritz, Mayr-Melnhof, Telekom Austria, RBI, voestalpine, SBO, Frequentis, Pierer Mobility, BKS Bank Stamm, Oberbank AG Stamm, Warimpex, Amag, EVN, CPI Europe AG, Lenzing, Österreichische Post, RHI Magnesita, Deutsche Telekom, Allianz, Fresenius.

Random Partner

RWT AG

Die Firma RWT Hornegger & Thor GmbH wurde 1999 von den beiden Geschäftsführern Hannes Hornegger und Reinhard Thor gegründet. Seitdem ist das Unternehmen kontinuierlich, auf einen derzeitigen Stand von ca. 30 Mitarbeitern, gewachsen. Das Unternehmen ist in den Bereichen Werkzeugbau, Formenbau, Prototypenbau und Baugruppenfertigung tätig und stellt des Weiteren moderne Motorkomponenten und Präzisionsteile her.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Mayr-Melnhof und Andritz vs. Wienerberger und RHI...

- VIG und Generali Assicuraz. vs. AXA und Zurich In...

- O2 und Drillisch vs. Tele Columbus und Swisscom –...

- ArcelorMittal und ThyssenKrupp vs. voestalpine un...

- Nike und bet-at-home.com vs. World Wrestling Ente...

- Silver Standard Resources und Rio Tinto vs. Gazpr...

Featured Partner Video

Wiener Börse Party #1053: ATX erneut etwas fester, Zeppelin Hotel Tech startet, Opening Bell Ritschy feat. FACC und Pierer Mobility

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse. Inh...

Books josefchladek.com

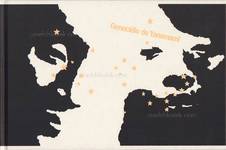

Genocídio do Yanomami

2025

Void

Zur neuen Wohnform

1930

Bauwelt-Verlag

Tagada

2025

Fotohof

Il senso della presenza

2025

Self published

Krass Clement

Krass Clement Paul Graham

Paul Graham Nikola Mihov

Nikola Mihov Adriano Zanni

Adriano Zanni Oliver Gerhartz

Oliver Gerhartz Allied Forces

Allied Forces