21st Austria weekly - Mayr-Melnhof, Vienna Stock Exchange, UBM (19/10/2018)

19.10.2018, 3464 Zeichen

Mayr-Melnhof: Austrian packaging group Mayr-Melnhof Packaging announced the acquisition of Tann Group, headquartered in Traun, Austria. Pending the approval of the antitrust authorities the closing is expected by year-end 2018 or the beginning of 2019. The equity purchase price will amount to approximately Euro 275 mn. Tann Group prints on and finishes externally sourced fine paper to produce tipping paper (cigarette filter paper) and is the global market leader in this area. Annual sales of approximately Euro 230 million are generated by 8 production sites in 7 countries and a worldwide workforce of around 1,100 employees, who are taken over. Further more, the company announced that the Supervisory Board of Mayr-Melnhof Karton AG has reappointed Wilhelm Hörmanseder as Chairman of the Management Board.

Mayr-Melnhof: weekly performance:

Vienna Stock Exchange: An amendment to the Austrian Stock Corporation Act (Aktiengesetz) will open the door to the stock exchange for domestic small and medium-sized enterprises as well as growth companies next year. The Vienna Stock Exchange is planning the launch date of 21 January 2019 for the new market segments direct market plus and direct market. They will replace the segment mid market in the future. Small and medium-sized Austrian companies, which form the backbone of the Austrian economy, will have easy and cost-effective access to the stock exchange. "The new offer is aimed at stock corporations with a number of shareholders in the low double-digit range. The need is there, as our concrete letters of intent show. Some are looking for the trading aspect, some only need a pure listing. This brings order, visibility and the prospect of easier funding for the companies. Depending on the strategy, development into further segments can then follow," explains Christoph Boschan, CEO of the Vienna Stock Exchange and its holding company.

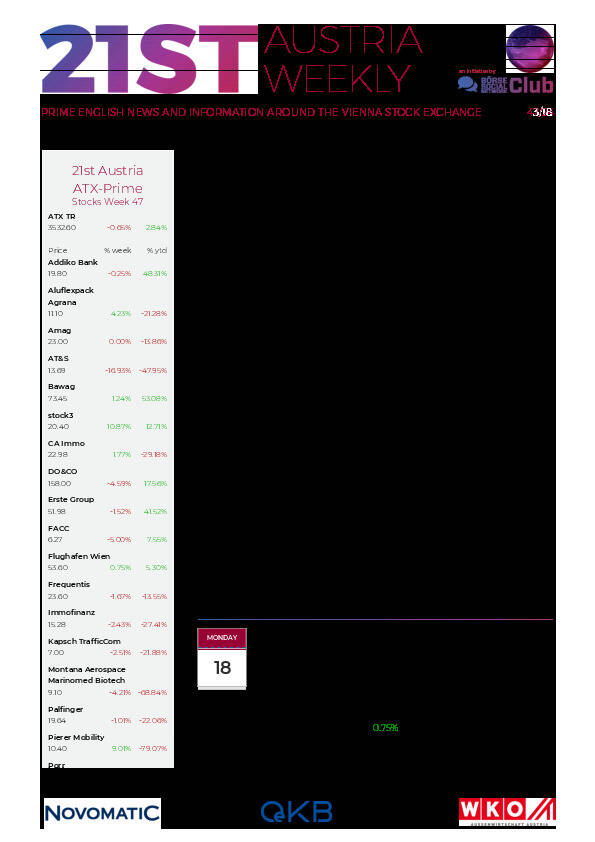

ATX: weekly performance:

UBM: Austrian hotel developing company UBM Development AG announced the issuance of a new bond with a volume of up to Euro 100 mn and the possibility of an oversubscription increase to as much as Euro 120 mn. In connection with this issue, the issuer is offering investors holding the existing 2014-2019 UBM bond (issued in 2014, maturing in 2019), ISIN AT0000A185Y1, an opportunity to exchange these securities for the new 2018-2023 UBM bond by way of a public exchange offer. UBM Development AG plans to use the proceeds of the issue to refinance existing financing facilities of UBM Development AG and to realise new and existing projects, especially in the core markets Germany, Austria and Poland. The coupon of the new 2018-2023 UBM bond is 3.125% p.a. and the term is five years. The exchange offer, which runs from 22 October to 7 November 2018, will be followed by a cash subscription offering for those bonds that have not been exchanged. Interested investors may subscribe the new bonds during a period expected to run from 8 November 2018 to 14 November 2018; the right to close the offering earlier is reserved. The planned value date is 16 November 2018. The exchange ratio is 1 to 1, which means that each 2014-2019 UBM bond with a par value of Euro 500 can be exchanged for one 2018-2023 UBM bond with a par value of Euro 500. In addition, a premium of EUR 10.00 is offered for each exchanged bond.

UBM: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (19/10/2018)

Wiener Börse Party #791: Mundart-Folge mit Wolfgang Fellner, Rudi Fußi, Wien+Bund vs. alle, KÖSt- & KTM-Idee, ausverkauftes Wien-IPO

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, voestalpine, Warimpex, Immofinanz, CA Immo, Addiko Bank, Andritz, Frequentis, AT&S, Zumtobel, OMV, FACC, Uniqa, Strabag, Austriacard Holdings AG, Amag, Cleen Energy, DO&CO, Marinomed Biotech, UBM, Wolford, Oberbank AG Stamm, Kapsch TrafficCom, Agrana, Erste Group, EVN, Flughafen Wien, Palfinger, Österreichische Post, S Immo, Telekom Austria.

Random Partner

Wolftank-Adisa

Die Wolftank-Adisa Holding AG ist die Muttergesellschaft einer internationalen Unternehmensgruppe mit Fokus auf Sanierung und Überwachungen von (Groß–)Tankanlagen und Umweltschutz-Dienstleistungen bei verseuchten Böden und Einrichtungen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten