05.06.2018, 5950 Zeichen

- Italy’s debt sustains a large interest rate shock as long as the budget is kept under control.

- Debt sustainability depends on fiscal discipline and continued primary fiscal surpluses.

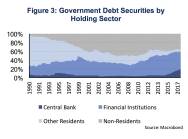

- Public debt is predominantly held by residents; primarily by financial institutions and the central bank.

In 2017, Italy’s government debt reached 131.5 % of GDP which is one of the highest values in the Euro Area. We perform a debt sustainability analysis (DSA), that is, simplified though insightful, based on the formula

where Dt is the debt to GDP ratio, rt is the average annual nominal interest rate paid on government debt, gt is the nominal GDP growth rate and PBt is the primary general government balance in year t [1]. If we assume for a moment that the primary budget (fiscal revenue minus expenditure) is balanced, as long as the nominal GDP growth rate will equal the average nominal interest rate on government debt in the future, the debt to GDP ratio will be held constant at its current level. If the nominal interest rate is higher than the nominal GDP growth rate, debt/GDP is set to rise.

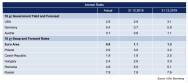

The IMF projects 1.0 % real GDP growth on average until 2023 declining gradually from 1.5 % in 2018 to 0.8 % in 2021 and onward. The GDP deflator assumes annual changes in prices of goods and services averaging 1.4 % during the projection period. Since 2000, the primary fiscal balance of the general government averaged 1.5 % until 2017 (ranging between -1.0 % in 2009 and plus 4.5 % in 2000). In all but two years (2009 and 2010) total government revenue outsized expenditure (excluding interest cost). In the IMF’s forecast (World Economic Outlook), the primary surplus is projected to rise over time from 1.7 % in 2017 to 3.6 % in 2023.

Average interest expenses have been declining to an all-time low in Italy. In 2017, average interest cost – calculated as the difference between the general government deficit and the primary deficit as a percentage of outstanding debt – was 2.8 % decreasing steadily from a peak in 1991/92 at more than 10 %. Assuming the IMF’s forecasts for nominal GDP growth and the primary budget balance (as described above), if the average debt servicing costs remains constantly at 2.8 % per year, then the government debt will decrease to 116.1 % of GDP until 2023 (Figure 1).

It can be seen that this scenario (r = 2.8 %, grey dashed line) is very similar to the IMF’s own forecast (dark blue line) for debt/GDP until 2023. All else equal, if the average debt refinancing cost will be higher than the interest cost of maturing debt, then the total average debt servicing cost will rise above 2.8 % and the debt trajectory will become higher.

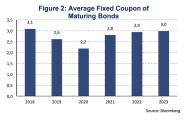

The average debt servicing cost (coupon) of maturing bonds in the rest of 2018 is 3.1 % (Figure 2). If the government would refinance at exactly that rate, the total debt servicing cost would remain constant at 2.8 % (debt/GDP is shown by the grey dashed line in Figure 1), all else equal. If the refinancing rate would be higher than the coupon on maturing debt, than the debt trajectory would be higher. As can be seen, the debt/GDP trajectory for average debt servicing cost of 4 % would still imply a gradual decline until 2023 (dark blue dotted line).

In addition to debt sustainability, the structure of debt by holding sector can be crucial for financial stability. The structure of Italy’s public debt has changed quite significantly. As figure 3 shows, the share of foreign holdings of Italian government debt securities declined during the Euro Area crisis from 50 % in early 2010 to 36 % in 2013 and has stayed constant since then. Italian financial institutions compensated for the declining importance of non-residents, increasing their exposure to the Italian sovereign. At a later stage the Banca d’Italia increased its government bond holdings in line with the ECB’s public sector purchase program (PSPP). Within the PSPP 341.2 bn EUR of Italian debt securities have been bought between March 2015 and April 2018 (Source: ECB).

Italy has the lowest share of non-residents holding government debt securities among its Southern European peers. In February 2018, 35.7 % of government debt securities, which were issued by the Italian government, were held by non-residents (Source: Banca d’Italia). In Spain 41.5 % (Q3 17), Portugal 42.8 % (Q4 17) and Greece 36.9 % (Q3 17) of government debt securities were held by non-residents [2]. On the one hand, a lower degree of non-resident government bond holders is associated with a higher degree of crisis resilience as residents are thought to be more likely to hold on to their domestic government bond holdings. On the other hand, government debt is less diversified which makes domestic financial institutions particularly exposed to sovereign risk.

Overall, it can be concluded that Italy’s public debt to GDP is not likely to further increase based on higher refinancing costs. However, this is conditional on fiscal discipline and continued primary fiscal surpluses in the years ahead. The IMF’s projection of primary fiscal surpluses is ambitious though necessary to significantly reduce the public debt to GDP ratio and revert the accelerated indebtedness following the global financial crisis.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

[1]The equation can easily be derived from Auerbach, A. (1994): “The U.S. Fiscal Problem: Where We Are, How We Got There and Where We’re Going”, NBER Macroeconomics Annual 9, Stanley Fischer and Julio Rotemberg (eds.) and is a simplified version of the IMF’s DSA framework; see IMF (2013): “Staff Guidance Note for Public Debt Sustainability Analysis in Market-Access Countries”, May 6, 2013

[2]Data used for cross-country comparisons are based on the Bruegel dataset on sovereign bond holdings: Merler and Jean Pisani-Ferry, Who’s afraid of sovereign bonds, Bruegel Policy Contribution 2012|02, February 2012.

Wiener Börse Party #885: ATX etwas schwächer, Wienerberger goes Erste Campus, UBM am Österreichischen Aktientag

Bildnachweis

1.

Debt sensitivity to interest rates

2.

Average Fixed Coupon of Maturing Bonds

3.

Government Debt Securities by Holding Sector

4.

Interest Rates

5.

debt sustainability analysis formula

Aktien auf dem Radar:Frequentis, Porr, VIG, Addiko Bank, Pierer Mobility, RHI Magnesita, ATX Prime, ATX TR, Verbund, CA Immo, EVN, CPI Europe AG, Strabag, ATX, Bawag, Rosgix, Agrana, OMV, Telekom Austria, Uniqa, Kostad, Österreichische Post, DO&CO, Erste Group, FACC, Kapsch TrafficCom, Palfinger, Polytec Group, RBI, Rosenbauer, SBO.

Random Partner

Do&Co

Als Österreichisches, börsennotiertes Unternehmen mit den drei Geschäftsbereichen Airline Catering, internationales Event Catering und Restaurants, Lounges & Hotel bieten wir Gourmet Entertainment auf der ganzen Welt. Wir betreiben 32 Locations in 12 Ländern auf 3 Kontinenten, um die höchsten Standards im Produkt- sowie Service-Bereich umsetzen zu können.

>> Besuchen Sie 60 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Österreich-Depots: Jahresplus ausgebaut (Depot Kommentar)

» Börsegeschichte 16.4.: Extremes zu CPI Europe, Verbund (Börse Geschichte...

» Nachlese: Marco Reiter, Wolfgang Matejka (audio cd.at)

» PIR-News: News zu Flughafen Wien, FACC (Christine Petzwinkler)

» Spoiler: UBM am Österreichischen Aktientag (Christian Drastil)

» Wiener Börse Party #885: ATX etwas schwächer, Wienerberger goes Erste Ca...

» Wiener Börse zu Mittag leichter: VIG, EVN und Frequentis gesucht

» ATX-Trends: Strabag, Porr, AMAG ...

» LinkedIn-NL: Klar brauchte ich auch eine #actionfigur und wer hat schon ...

» Börse-Inputs auf Spotify zu u.a. Wolfgang Matejka, Marco Reiter, Donald ...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse: ATX am Mittwoch leicht im Plus

- Wiener Börse Nebenwerte-Blick: Frequentis legt 7,...

- Cleen Energy wird geschlossen - Delisting von Wie...

- Wie Kostad, Frequentis, Pierer Mobility, Porr, RH...

- Wie Österreichische Post, Telekom Austria, VIG, C...

- Österreich-Depots: Jahresplus ausgebaut (Depot Ko...

Featured Partner Video

Song #64 (teilweise spoken): When I met you - kennt irgendjemand diese Nummer oder ist die von meinem 17jährigen Ich?

Am Super Me Sunday auf audio-cd.at erzähle ich nun auch nach und nach meine musikalischen Wurzeln. Denn ja, im egoth-Verlag wird 2025 ein Buch über mich mit ca. 350 Seiten erscheinen. Dies zum Fanb...

Books josefchladek.com

Murmurings of the Skin

2024

Void

Islands of the Blest

2014

Twin Palms Publishers

Aircraft

1935

The Studio

Vic Bakin

Vic Bakin Xiaofu Wang

Xiaofu Wang Yoshi Kametani

Yoshi Kametani Robert Longo

Robert Longo Dan Skjæveland

Dan Skjæveland