22.01.2018, 5088 Zeichen

CEE: Russia

- Threat of further US sanctions downplayed by market participants

- While the recovery has been weak, several factors support macroeconomic stability.

In August 2017, US President Trump signed the “Countering America’s Adversaries Through Sanctions Act” that instructed the US Treasury department to prepare reports for submission to congress. With respect to sanctions against the Russian Federation, the treasury was asked to report on potential effects of expanding sanctions to include sovereign debt. Furthermore, the report is on sanctions against “parastatal entities” and “senior political figures and oligarchs”. The report from the Treasury department is expected by February to be published and submitted to congressional committees. Based on the report, the congress is going to decide on further sanctions.

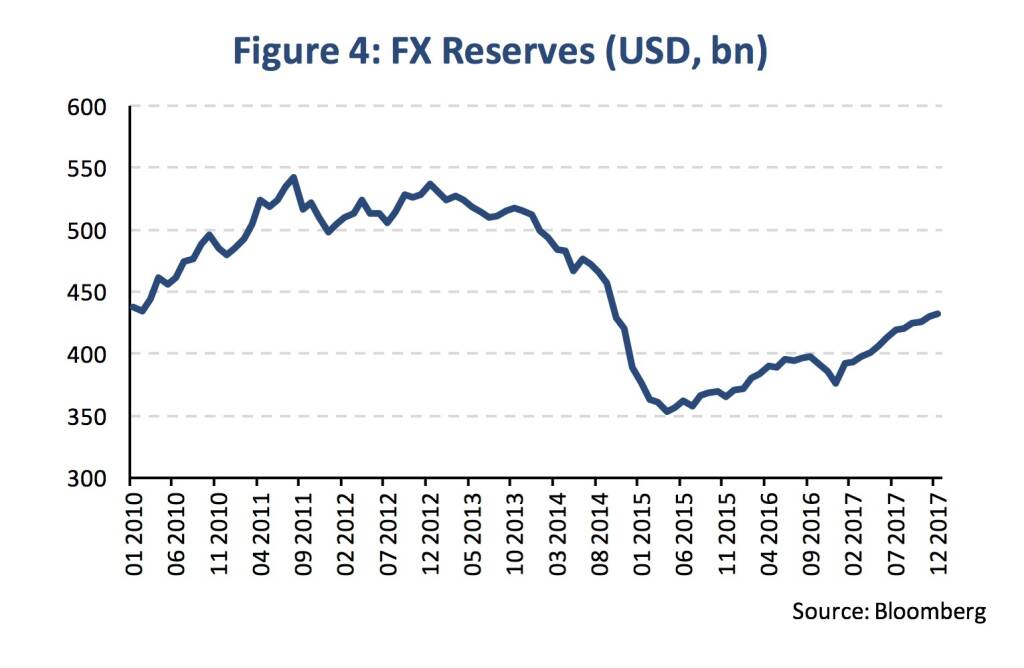

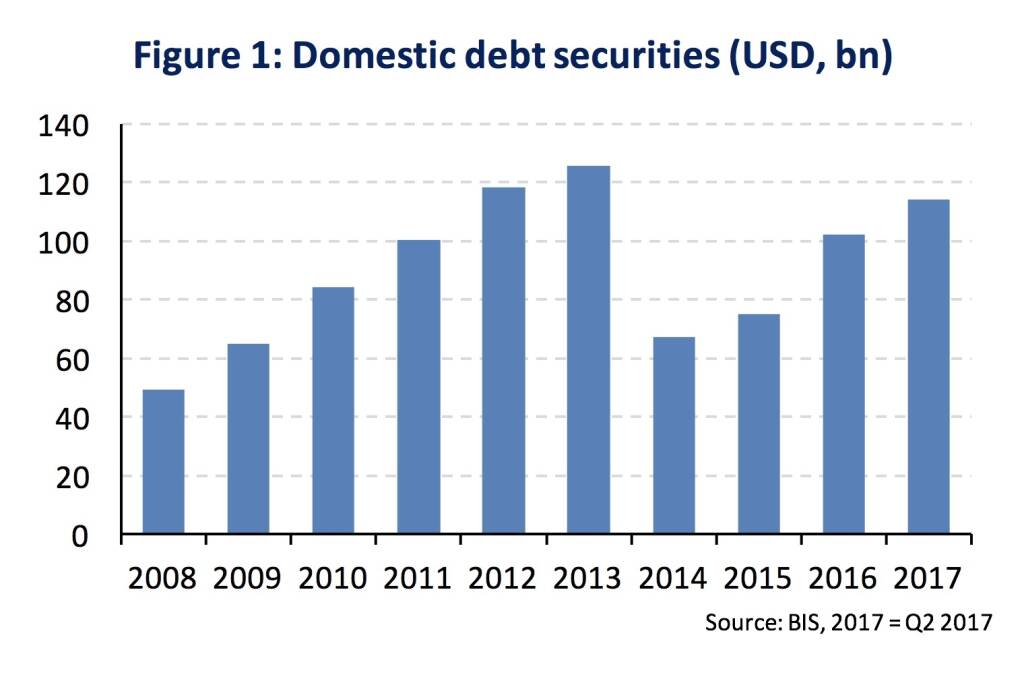

It should be stressed that it is unclear from the current stand point whether sanctions would be extended and to what extent government bonds would be included. US sanctions on government bonds of the Russian Federation could concern the local bond market denominated in ruble (OFZ) and the international Eurobond market. With respect to the OFZ market, market observers discuss two possibilities: A ban could concern new issuance where only a tiny size of the total market would be hit. On the other side, the inclusion of the total outstanding market is considered as a worst-case scenario with severe implications for the economy. Market participants see a very low probability that the OFZ will be subject to a ban. The domestic debt market has grown strongly (Figure 1) and, in November, around 1/3 of the market was held by non-residents abroad (2.2 trn RUB or 38.6 bn USD) according to the Central Bank of Russia (CBR). Though it seems a more likely scenario, a ban of Russian Eurobonds (securities sold in hard currency in the international bond market) might be rather ineffective. Total Eurobond principal repayments amount to 5.9 bn USD in 2018. The total amount outstanding adds up to 37.3 bn USD.

While the recovery of the Russian economy has been weak, a number of factors contribute to increased macroeconomic stability. In Q3 2017, real GDP growth had slowed (1.8 % y/y) compared to the preceding quarter (2.5 %). Economic growth has predominately been driven by the recovery in private consumption (+5.8 % y/y in Q3), while net exports subtracted from GDP growth. Fixed investment is building slowly.

Monthly indicators related to consumers (real incomes and wages, retail sales) and industrial production for December will be released this week. Real wage growth recovered to 5.0 % (y/y) and retail sales rose by 3.0 % (y/y) in November 2017 (3-months average). Reportedly, the government is increasing salaries for civil servants in 2018 (for the first time since 2013) providing support for consumption expenditure. In addition, consumers’ balance sheets gained from the improvement in household lending (+4.9 % y/y in December). Finally, consumer surveys have surged recently (Figure 2).

A jump in the oil price (Brent increased by around 10 % since early December) is associated with higher short-term GDP growth and we have re-calibrated our GDP growth expectation (1.8 % for 2018) accordingly [1]. Additionally, a higher oil price supports the RUB exchange rate.

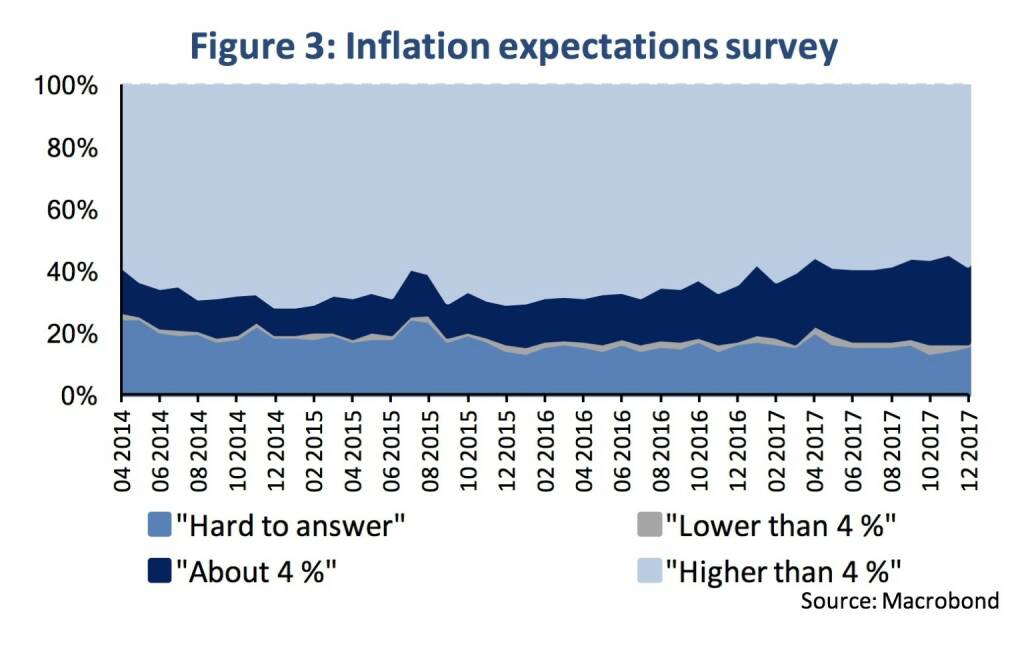

The inflation rate has rapidly been decelerating to a multi-year low (2.5 % y/y in October) helped by a transitory drop in food prices. Against this background, the Central Bank of Russia (CBR) was able to slash the main policy rate to 7.75 % until December (from 10 % in early 2017) to support growth in the economy. Moreover, inflation expectations in the private sector adapted accordingly (Figure 3) and the CBR holds open the prospect of further cuts in the key rate in H1 2018.

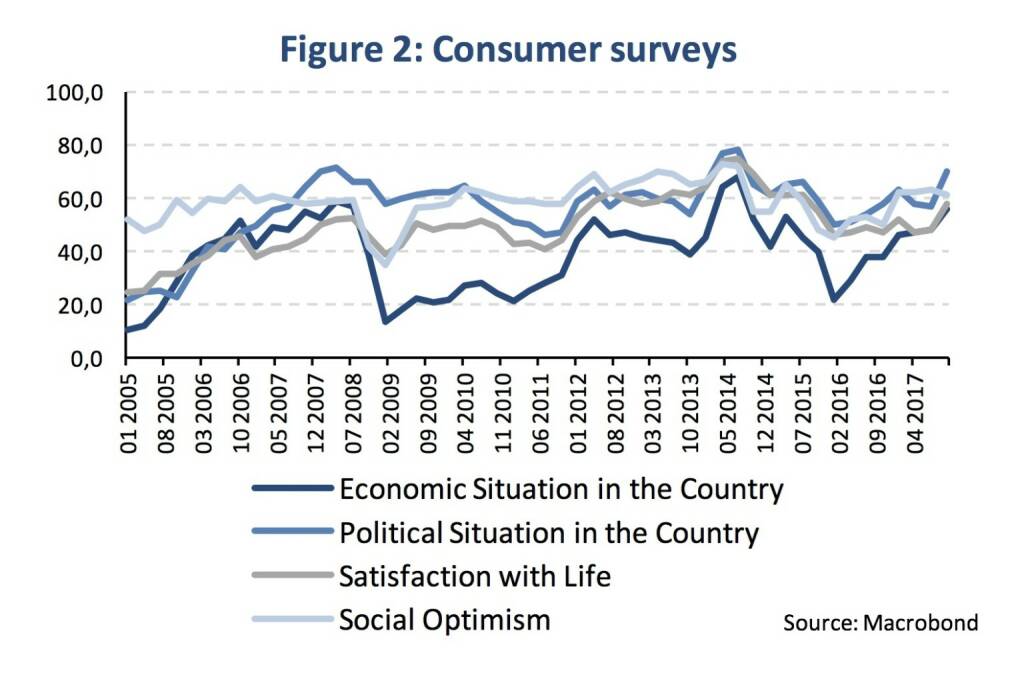

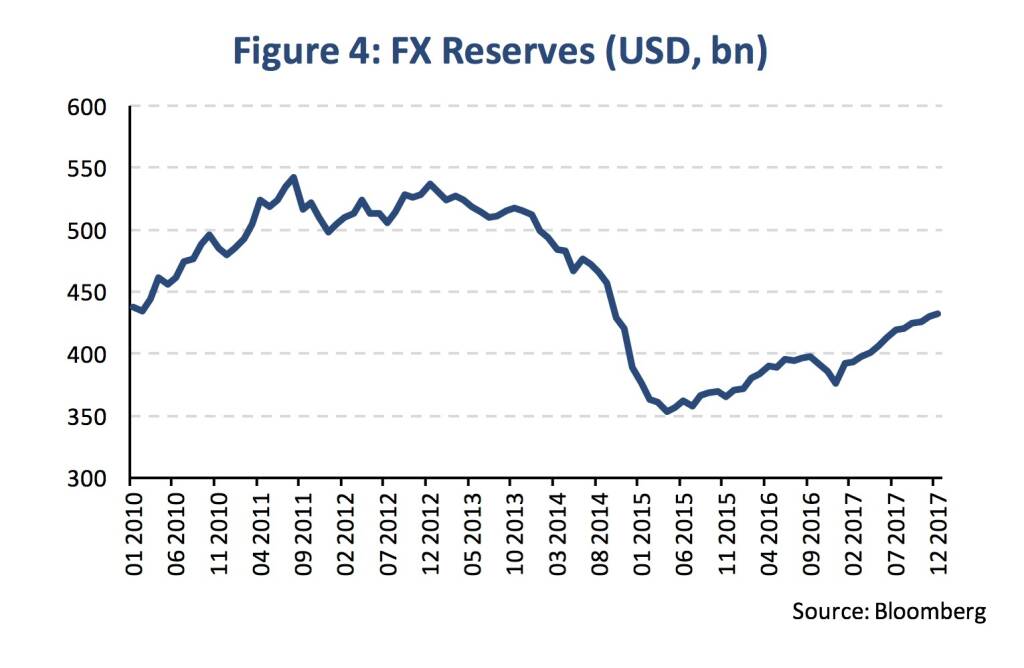

Finally, fiscal policy is set to remain prudent. In November, the 12-months average of the federal budget deficit decreased to 1.8 % after a peak above 3 % in 2016. The new fiscal rule regards any oil & gas income in excess of the one corresponding to a price of oil at 40 USD/bl as unsustainable. Excess oil income is transferred to the National Wellbeing Fund that amounted to 65.2 bn USD in December 2017 (or around 5 % of GDP). Total foreign exchange reserves were rebuilt to 432 bn USD in December (Figure 4). Central bank reserves had slid in 2015 before the CBR had to abandon the ruble exchange rate band and switched to an inflation-targeting regime.

Improving household finances, a higher oil price and short-term oil market expectations, anchored inflation, refilled currency reserves and monetary policy room to maneuver as well as a prudent fiscal stance support the Russian economy against a shock from extended US sanctions.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

[1] For example, a 10 % oil increase is associated with 0.3 % higher GDP on impact in Rautava, J. (2013): “Oil Prices, Excess Uncertainty and Trend Growth, A Forecasting Model for Russia’s Economy, Focus on European Economic Integration Q4/13, OeNB

Wiener Börse Party #755: Wer sichert sich diesen legendären Ö-Pokal, liebe Börsenotierte? Folge gewidmet Hellmut Longin (1934-2024)

Bildnachweis

1.

Domestic debt securities

2.

Consumer surveys

3.

Inflation expectations survey

4.

FX Reserves

5.

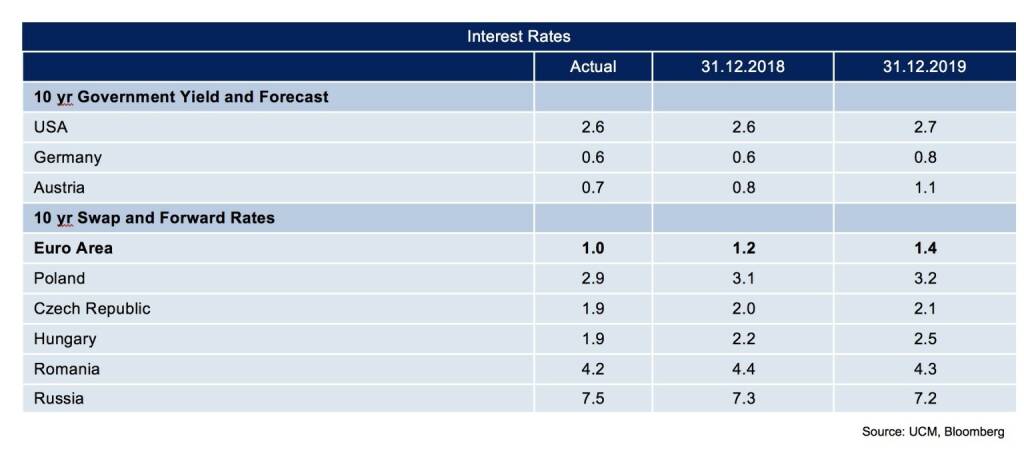

Interest Rates

Aktien auf dem Radar:Addiko Bank, UBM, Agrana, Austriacard Holdings AG, CA Immo, Immofinanz, DO&CO, Bawag, Flughafen Wien, Rosgix, Josef Manner & Comp. AG, Porr, RWT AG, EuroTeleSites AG, Oberbank AG Stamm, Amag, Erste Group, EVN, Österreichische Post, S Immo, Telekom Austria, Uniqa, Verbund, VIG, Wienerberger, Warimpex.

Random Partner

KTM

Die KTM Industries-Gruppe ist eine europäische Fahrzeug-Gruppe mit dem strategischen Fokus auf das globale Sportmotorradsegment und den automotiven high-tech Komponentenbereich. Mit ihren weltweit bekannten Marken KTM, Husqvarna Motorcycles, WP und Pankl zählt sie in ihren Segmenten jeweils zu den Technologie- und Marktführern.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Wiener Börse Party #755: Wer sichert sich diesen legendären Ö-Pokal, lie...

» Börse Social Depot Trading Kommentar (Depot Kommentar)

» Börsegeschichte 9.10.: voestalpine, AT&S, Kapsch TrafficCom, Kürzel-Rota...

» In den News: UBM, VAS AG, Research zu Flughafen Wien, Palfinger, Baader ...

» Nachlese: Gunther, Christoph Weißenbäck, Erwin Hameseder (Christian Dras...

» Börsenradio Live-Blick 9/10: DAX hält die 19.000, Conti deutlich erholt,...

» Börse-Inputs auf Spotify zu u.a. SAP, AI, Christoph Weißenbäck, Palantir...

» Börsepeople im Podcast S15/06: Christoph Weißenbäck

» ATX-Trends: Immofinanz, CA Immo, Palfinger ...

» Wiener Börse Party #754: ATX verliert, wie schwach ein Nebenwerte-ATX (v...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A3C5E0 | |

| AT0000A2UVV6 | |

| AT0000A36WK2 |

- Strabag: Kernaktionäre gehen nach Rasperia-Verkau...

- Wiener Börse: ATX am Mittwoch fester

- Wiener Börse Nebenwerte-Blick: RWT legt knapp 15 ...

- Wie RWT AG, Josef Manner & Comp. AG, Porr, Addiko...

- Wie EVN, Andritz, Bawag, Immofinanz, CA Immo und ...

- Dow Jones-Mover: Boeing, Cisco, Travelers Compani...

Featured Partner Video

Pyro-Idioten und echte Weltklasse

Das Sporttagebuch mit Michael Knöppel - 23. September 2024 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch Twitter: @Sporttagebuch_

Das Sporttagebuch mit Michael Knöppel -...

Books josefchladek.com

Landfall

2018

TBW Books

Misplacements

2023

Self published

Gabriele Basilico

Gabriele Basilico Essick Peter

Essick Peter Mikael Siirilä

Mikael Siirilä Shōji Ueda

Shōji Ueda Dominic Turner

Dominic Turner Futures

Futures Hans Hollein

Hans Hollein