S IMMO AG / Record half-year results

25.08.2016, 7611 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

6-month report

· Significant value increases, particularly in Germany · Revaluation gains realised through sales · Further investments planned in Germany · Profit for the period increases to EUR 85.5m

The first six months of the 2016 financial year were extremely successful for S IMMO. This was largely due to the revaluation gains, which amounted to EUR 106.9m in the first half of 2016. The dynamic growth on the German real estate market was the primary driver of this development. According to Ernst Vejdovszky, CEO of S IMMO AG, "Berlin's residential property market has enjoyed highly dynamic development in recent months. We decided to realise a portion of the value increases achieved in our portfolio by selling around 20% of our space in Germany. This is in line with our cycle-oriented strategy and creates value for our investors."

Development of earnings In the first half of 2016, S IMMO AG's total revenues amounted to EUR 95.3m (HY 2015: EUR 92.2m), an increase over the prior-year figure. The rental income included in this figure reflects the property purchases completed since the beginning of 2015 and came to EUR 58.5m (HY 2015: EUR 54.6m). Gross operating profit from hotel operations declined to EUR 3.5m (HY 2015: EUR 5.0m) due to the overhaul of the Vienna Marriott Hotel, which resulted in a temporary reduction in room occupancy in the first half of the year.

Property management expenses amounted to EUR 31.2m in the first half of the year (HY 2015: EUR 27.0m). The gross profit was EUR 50.5m (HY 2015: EUR 50.7m). EBITDA came to EUR 43.0m in the first half of 2016 (HY 2015: EUR 43.1m). This slight decrease was due to the temporary decline in the profit from hotel operations. Revaluation gains developed very positively, amounting to EUR 106.9m as at 30 June 2016 (HY 2015: EUR 9.7m). In addition to the continued outstanding development in Germany, both Austria and CEE (Hungarian office properties) contributed to this positive result.

Overall, EBIT was up significantly on the previous year at EUR 145.9m (HY 2015: EUR 48.9m). As a result, EBT amounted to EUR 107.3m (HY 2015: EUR 26.9m). The net profit for the period increased to EUR 85.5m (HY 2015: EUR 20.9m). Earnings per share improved once again and came to EUR 1.27 (HY 2015: EUR 0.30).

Capital market S IMMO continues to benefit from the current low interest rates. At the end of May, the share price briefly reached EUR 9.00 for the first time since 2007. Despite the turbulent environment on the stock markets, the S IMMO share closed the quarter at EUR 8.40, a gain of 2.44% (ex dividend) compared with the closing price on 31 December 2015.

S IMMO increased the dividend for its shareholders for the fourth time in a row. The payout for the 2015 financial year was 30 cents per share, which equates to a dividend yield of over 3.6% in relation to the closing price on 31 December

2015. This payment was made on 10 June 2016.

Outlook for 2016 Germany remains an important market for S IMMO. The company bought six properties there at a total price of EUR 9.2m over the first six months of 2016. In addition, purchases amounting to EUR 54.1m for which S IMMO AG will not obtain ownership until after 30 June 2016 were contractually agreed as at the editorial deadline. The company currently sees tremendous potential in office properties in particular. There are also a number of development projects on the agenda: In Bucharest, the development of a promising office property called The Mark is starting. The refurbishment of the Sun Plaza shopping centre is also proceeding according to plan. S IMMO is active on its home market of Vienna as well, including at Quartier Belvedere Central.

According to Friedrich Wachernig, member of S IMMO AG's Management Board, "We are also extremely optimistic for the second half of the year. We are working intensively on development projects and value-enhancement measures across our portfolio. Several hugely busy quarters lie ahead in which we will extend, develop, and optimise our portfolio."

Consolidated income statement for the period 01 January 2016-30 June 2016 in EUR millions / fair value method

01-06/2016 01-06/2015 Revenues 95.3 92.2 thereof rental 58.5 54.6 income thereof revenues from operating 18.4 16.7 costs thereof revenues from hotel 18.3 20.9 operations Other operating income 1.3 1.4 Expenses directly -31.2 -27.0 attributable to properties Hotel operating expenses -14.9 -15.9 Gross profit 50.5 50.7 Income from property 3.9 15.9 disposals Book value of property -3.1 -15.9 disposals Gains on property 0.8 0 disposals Management expenses -8.3 -7.7 Earnings before interest, tax, depreciation and 43.0 43.1 amortisation (EBITDA) Depreciation and -4.0 -3.8 amortisation Results from property 106.9 9.7 valuation Operating result (EBIT) 145.9 48.9 Financing cost -36.4 -22.3 Financing income 1.1 0.7 Results from companies 0 1.0 measured at equity Participating certificates -3.3 -1.4 result Net income before tax 107.3 26.9 (EBT) Taxes on income -21.7 -6.0 Consolidated net income 85.5 20.9 for the period of which attributable to 84.6 19.9 shareholders in parent company of which attributable to non- 0.9 1.0 controlling interests

Earnings per share (in 1.27 0.30 EUR)

Key data on properties 30 June 2016 Portfolio properties number 228 Total useable space millions of m2 1.3 Gross rental yield % 6.2 Occupancy rate % 93.3

Apparent mathematical errors may be the result of rounding errors caused by software.

end of announcement euro adhoc

company: S IMMO AG Friedrichstraße 10 A-1010 Wien phone: +43(0)50100-27550 FAX: +43(0)050100-927559 mail: office@simmoag.at WWW: www.simmoag.at sector: Real Estate ISIN: AT0000652250 indexes: ATX Prime, IATX stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/3109/aom

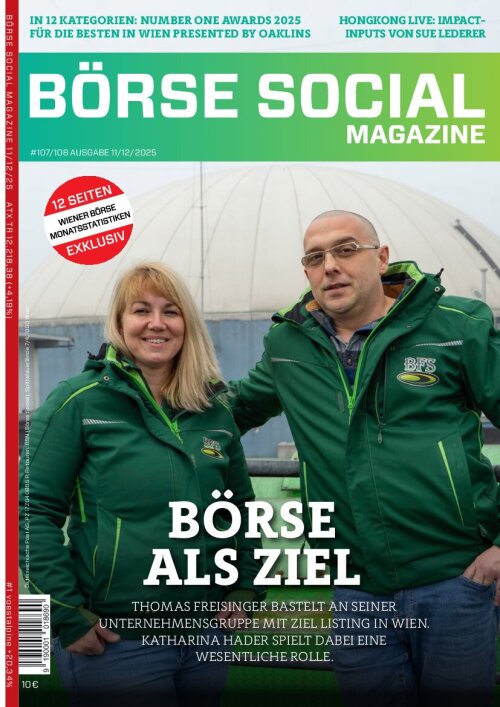

Wiener Börse Party #1076: ATX deutlich im Minus und wieder beim Ultimo-Wert, nur UBM im Plus, PIR 2026 mit begleitendem neuem wikifolio

S Immo Letzter SK: 0.00 ( 0.00%)

Bildnachweis

Aktien auf dem Radar:Amag, Polytec Group, Verbund, Kapsch TrafficCom, Semperit, Frequentis, Wienerberger, Mayr-Melnhof, Palfinger, ATX, ATX Prime, ATX TR, FACC, Pierer Mobility, Porr, ATX NTR, Erste Group, EVN, CPI Europe AG, Lenzing, Addiko Bank, Agrana, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, RHI Magnesita, Wolford, Österreichische Post.

Random Partner

UBS

UBS bietet weltweit finanzielle Beratung und Lösungen für private, institutionelle und Firmenkunden als auch für private Kundinnen und Kunden in der Schweiz. UBS mit dem Hauptsitz in Zürich hat eine weltweite Präsenz in allen wichtigen Finanzmärkten.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse: ATX geht 1,3 Prozent schwächer aus ...

- Wiener Börse Nebenwerte-Blick: Gurktaler am besten

- Wie Addiko Bank, Semperit, Agrana, Gurktaler AG S...

- Wie Wienerberger, Lenzing, voestalpine, DO&CO, AT...

- Österreich-Depots: Schwächer (Depot Kommentar)

- Börsegeschichte 20.1.: Extremes zu FACC, Polytec,...

Featured Partner Video

BörseGeschichte Podcast: Michael Lielacher vor 10 Jahren zum ATX-25er

Der ATX wurde dieser Tage 35. Rund um "25 Jahre ATX" haben wir im Dezember 2015 und Jänner 2016 eine grossangelegte Audioproduktion mit dem Ziel einer Fest-CD gemacht, die auch auf Audible als Hörb...

Books josefchladek.com

City Lux

2025

Ludion Publishers

Schtetl Zürich

2001

Offizin Verlag

New York 1969

2014

Ishi Inc.

Os Americanos (first Brazilian edition)

2017

Instituto Moreira Salles

Thonet

Thonet Henrik Spohler

Henrik Spohler Niko Havranek

Niko Havranek Pia Paulina Guilmoth & Jesse Bull Saffire

Pia Paulina Guilmoth & Jesse Bull Saffire Dominique Lapierre, Jean-Pierre Pedrazzini, René Ramon

Dominique Lapierre, Jean-Pierre Pedrazzini, René Ramon Krass Clement

Krass Clement