RHI AG / Results of the first half of 2016

RHI AG / Results of the first half of 2016

09.08.2016, 6029 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

6-month report

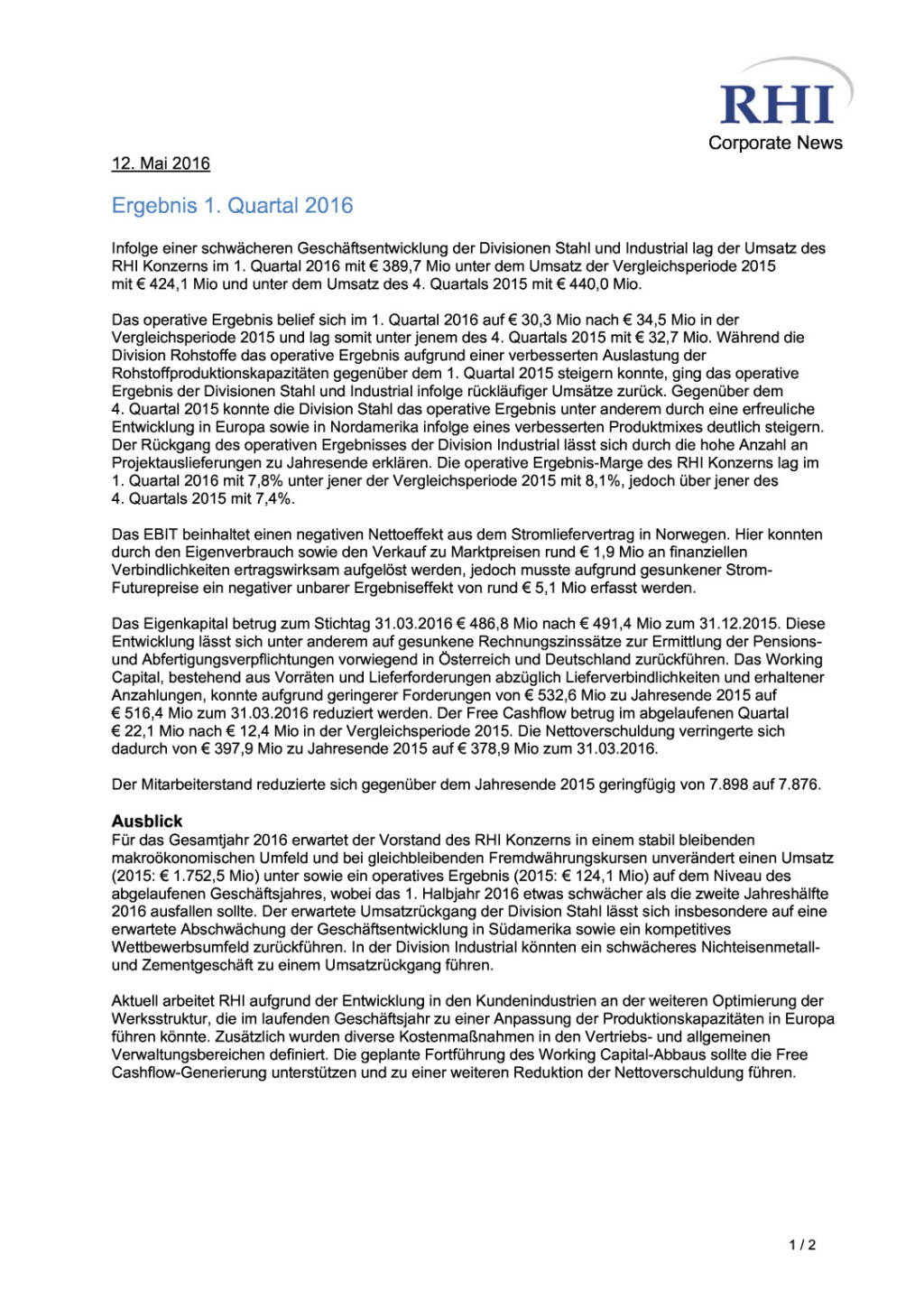

Revenue of the RHI Group was down 8.0% on the comparative period of 2015 and amounted to EUR 830.2 million in the first half of 2016. In the Steel Division, revenue decreased by 5.6% especially due to a weaker business development in South America, Europe and China. In the Industrial Division, the decline in revenue by 14.4% compared with the first half of 2015 is among other things attributable to lower deliveries in the cement/lime, glass and environment, energy, chemicals business units.

The operating EBIT amounted to EUR 70.2 million in the first half of the year. Compared with the first half of 2015, at EUR 68.6 million, this is an increase by 2.3% despite the decrease in revenue. This development is primarily due to a highly satisfactory earnings situation in the Steel Division based on positive product mix effects, better utilization of the production capacities resulting from the increase in sales volume as well as savings in overhead costs. Moreover, the operating EBIT of the Raw Materials Division improved significantly as a result of good capacity utilization at the two Austrian raw material plants, Breitenau and Hochfilzen, which predominantly produce basic mixes for the steel industry, especially for the use in electric arc furnaces, and lower production costs at the plant in Porsgrunn, Norway. In contrast, the operating EBIT of the Industrial Division was lower than in the previous year due to a decline in revenue. The RHI Group's operating EBIT margin rose from 7.6% in the first half of 2015 to 8.5% in the first half of 2016.

EBIT amounted to EUR 68.8 million in the first half of this year and includes a negative earnings effect of EUR 4.6 million from the deconsolidation of the US subsidiary RHI Monofrax, LLC resulting from the sale to the German private equity fund Callista. On the other hand, it also includes a positive net effect from the power supply contract in Norway. Based on own use, the sale at market prices and an increase in electricity future prices, financial liabilities of roughly EUR 3.0 million were reversed and recognized through profit or loss.

Q2/2016 In the second quarter of 2016, the RHI Group's revenue rose to EUR 440.5 million, up 13.0% on the previous quarter. This increase is primarily attributable to significantly higher contributions to revenue from the Steel Division, especially in Europe, Africa and the CIS region, and from the environment, energy, chemicals and nonferrous metals business units.

The operating EBIT rose from EUR 30.3 million in the first quarter of 2016 to EUR 39.9 million in the past quarter, which was among other things due to better utilization of the production capacities resulting from the increase in sales volume. In addition, the operating EBIT of the second quarter of 2016 is influenced by positive currency effects resulting from the devaluation of the euro. The operating EBIT margin of the RHI Group thus improved from 7.8% in the first quarter of 2016 to 9.1% in the past quarter.

Working capital decreased for the fifth consecutive quarter and amounted to EUR 495.1 million at June 30, 2016 after EUR 532.6 million at the end of the year

2015. The decline by EUR 37.5 million is attributable to both lower inventories and lower trade receivables.

Net cash flow from operating activities amounted to EUR 76.7 million in the first half of 2016 after EUR 64.9 million in the same period of 2015. After the deduction of cash flow from investing activities of EUR (17.1) million in the first half of the year, free cash flow amounted to EUR 59.6 million after EUR 62.8 million in the first half of 2015. Net debt declined from EUR 397.9 million at the end of the year 2015 to EUR 373.9 million at June 30, 2016 despite the dividend payment of EUR 29.9 million.

Outlook Despite the challenging market environment, the Management Board of RHI AG is increasing the outlook due to the positive earnings development in the first half of the year. Consequently, an operating EBIT margin of roughly 8% is expected for the full year 2016, which corresponds to an increase by roughly one percentage point compared with the previous year.

Due to the development in the customer industries, RHI is currently working on further optimizing the plant structure, which could lead to an adjustment of production capacities in Europe in the current financial year. In addition, different cost measures have been defined in the sales and general administrative departments. The planned continuation of the reduction of working capital should support the generation of free cash flow and lead to a further reduction of net debt.

in EUR million 1H/16 1H/15 Delta 2Q/16 1Q/16 Delta Revenue 830.2 902.0 (8.0)% 440.5 389.7 13.0% EBITDA 100.6 102.5 (1.9)% 57.4 43.2 32.9% EBITDA margin 12.1% 11.4% 0.7pp 13.0% 11.1% 1.9pp Operating EBIT 1) 70.2 68.6 2.3% 39.9 30.3 31.7% Operating EBIT margin 8.5% 7.6% 0.9pp 9.1% 7.8% 1.3pp EBIT 68.6 68.6 0.0% 41.5 27.1 53.1% EBIT margin 8.3% 7.6% 0.7pp 9.4% 7.0% 2.4pp

Profit before income tax 62.9 63.0 (0.2)% 39.1 23.8 64.3% Profit after income tax 38.9 44.6 (12.8)% 24.1 14.8 62.8%

1) EBIT before expenses from derivatives from supply contracts, impairment and restructuring effects

The report on the first half of 2016 is available for download on the RHI website: www.rhi-ag.com / Investor Relations / Financial Reports

end of announcement euro adhoc

company: RHI AG Wienerbergstrasse 9 A-1100 Wien phone: +43 (0)50213-6676 FAX: +43 (0)50213-6130 mail: rhi@rhi-ag.com WWW: http://www.rhi-ag.com sector: Refractories ISIN: AT0000676903 indexes: ATX Prime, ATX stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/1644/aom

Börsepeople im Podcast S22/17: Thomas Hahn

RHI Letzter SK: 0.00 ( 0.00%)

Bildnachweis

Aktien auf dem Radar:VIG, Kapsch TrafficCom, UBM, EuroTeleSites AG, Flughafen Wien, Palfinger, ATX, ATX Prime, ATX TR, ATX NTR, Bawag, Andritz, Mayr-Melnhof, Telekom Austria, RBI, voestalpine, SBO, Frequentis, Pierer Mobility, BKS Bank Stamm, Oberbank AG Stamm, Warimpex, Amag, EVN, CPI Europe AG, Lenzing, Österreichische Post, RHI Magnesita, Deutsche Telekom, Allianz, Fresenius.

Random Partner

Novomatic

Der Novomatic AG-Konzern ist als Produzent und Betreiber einer der größten Gaming-Technologiekonzerne der Welt und beschäftigt mehr als 21.000 Mitarbeiter. Der Konzern verfügt über Standorte in mehr als 45 Ländern und exportiert innovatives Glücksspielequipment, Systemlösungen, Lotteriesystemlösungen und Dienstleistungen in mehr als 90 Staaten.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Fear of missing out bei wikifolio 25.12.25: Nvidia

- wikifolio Champion per ..: Simon Weishar mit Szew...

- Wie 3D Systems, Snowflake, Under Armour, Vivendi,...

- Wie Valneva, Alibaba Group Holding, JinkoSolar, P...

- Wie Nike, Merck Co., Walt Disney, Caterpillar, 3M...

- Fear of missing out bei wikifolio 24.12.25: Nvidia

Featured Partner Video

Wiener Börse Party #1052: ATX TR nach Rekord 50 heute etwas leichter, gute Phase für RBI, VIG und Uniqa, Opening Bell Petra Heindl

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse. Inh...

Books josefchladek.com

Dimma Brume Mist

2025

Void

Zur neuen Wohnform

1930

Bauwelt-Verlag

Ció Prat i Bofill

Ció Prat i Bofill Oliver Gerhartz

Oliver Gerhartz John Gossage

John Gossage Adriano Zanni

Adriano Zanni Marjolein Martinot

Marjolein Martinot Sasha & Cami Stone

Sasha & Cami Stone Allied Forces

Allied Forces