21st Austria weekly - AT&S (04/11/2025)

09.11.2025, 1443 Zeichen

AT&S: In comparison to the prior-year period, consolidated revenue of AT&S increased by 6% to € 846 million in the first half of 2025/26 (PY: € 800 million). Adjusted for currency effects, consolidated revenue rose by 11%. Due to a positive volume development, AT&S was able to successfully counter both the ongoing price pressure and negative exchange rate effects during the reporting period. EBITDA improved by 11% from € 157 million to € 175 million ‒ adjusted for currency effects, the increase amounted to 18%. The earnings improvement is primarily due to higher volumes. Despite the positive development, AT&S will continue to intensively pursue its comprehensive cost optimization and efficiency program in order to counter effects such as price pressure and inflation resulting from the persisting difficult market environment. In addition to price pressure, start-up costs in Kulim, Malaysia, and Leoben, Austria, had a negative impact on earnings. The EBITDA margin amounted to 20.6%, exceeding the prior-year level of 19.6%. “Despite massive foreign exchange headwinds and a challenging market environment, we were able to increase revenue and EBITDA and exceeded the half-year forecast,” says AT&S CEO Michael Mertin. AT&S is a leading global manufacturer of high-end IC substrates and printed circuit boards.

AT&S: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (04/11/2025)

Wiener Börse Party #1110: ATX mehr als 2 Prozent tiefer, Verbund gesucht, Andritz vielversprechend und Gabler statt Babler

Bildnachweis

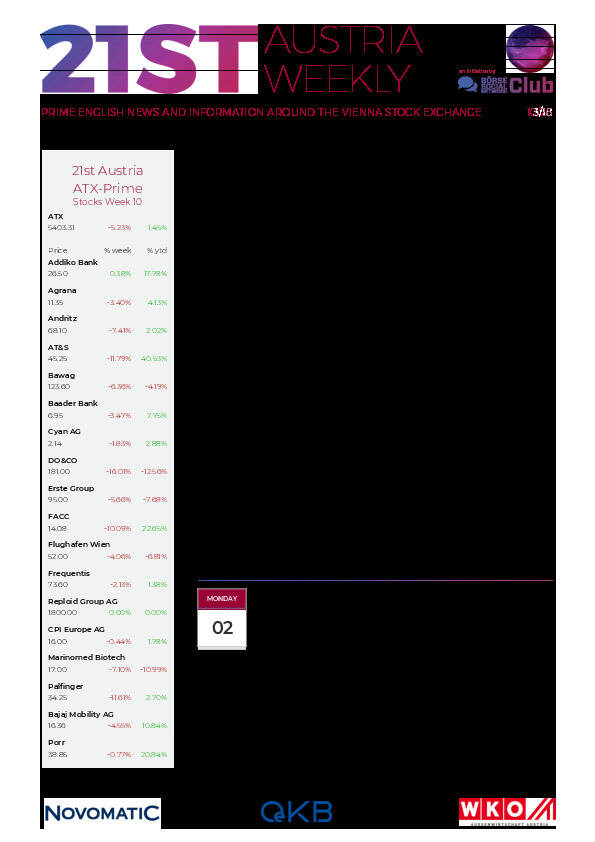

Aktien auf dem Radar:FACC, CPI Europe AG, RHI Magnesita, Austriacard Holdings AG, Agrana, Kapsch TrafficCom, OMV, Verbund, DO&CO, Palfinger, RBI, Strabag, Uniqa, VIG, Mayr-Melnhof, Lenzing, Erste Group, ATX, AT&S, ATX NTR, Bawag, Bajaj Mobility AG, Wienerberger, voestalpine, ATX TR, ATX Prime, Amag, Porr, Polytec Group, Rath AG, SBO.

Random Partner

Deutsche Börse

Als internationale Börsenorganisation und innovativer Marktinfrastrukturanbieter sorgt die Deutsche Börse Group für faire, transparente, verlässliche und stabile Kapitalmärkte. Mit ihren Produkten, Dienstleistungen und Technologien schafft sie Sicherheit und Effizienz für eine zukunftsfähige Wirtschaft.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten