21st Austria weekly - AT&S, Verbund (31/07/2025)

03.08.2025, 2011 Zeichen

AT&S: Microelectronic company AT&S reported results for the first quarter: In comparison to the prior-year quarter, consolidated revenue increased by 14% to € 399 million in the first quarter of 2025/26 (PY: € 349 million). Adjusted for currency effects, consolidated revenue rose by 19%. Due to a positive volume development, AT&S was able to successfully counter both the ongoing price pressure and negative exchange rate effects during the reporting period. EBITDA improved by 9% from € 65 million to € 71 million ‒ adjusted for currency effects, the increase amounted to 24%. EBIT fell from € -8 million to € -16 million. The net loss for the period decreased from € -34 million to € -56 million. “We assume that we will continue to operate in a price-sensitive market; therefore, we will consistently pursue our previously successful efficiency programs. We will counter the challenges of the geopolitical situation and the new dynamic markets with continuous risk and opportunity assessments, and a fast and agile portfolio of measures,” CEO Michael Mertin explains.

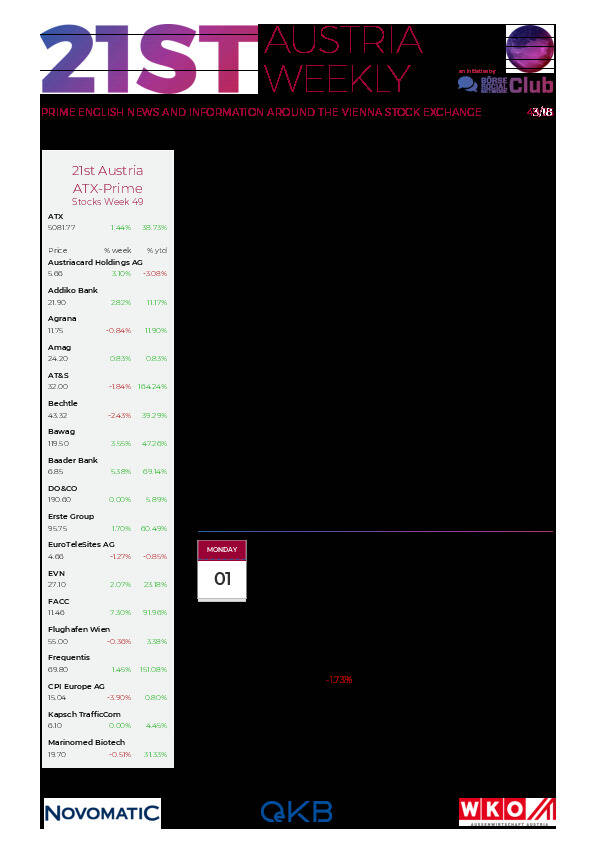

AT&S: weekly performance:

Verbund: Austrian based utility company Verbund’s earnings in quarters 1–2/2025 fell significantly below the previous year’s level due to a considerable decline in electricity production from hydropower. EBITDA was down by 19.8% year-on-year to €1,413.0m. The Group result dropped 11.8% to €802.7m, and the Group result after adjusting for non-recurring effects declined by 22.3% year-on-year to €783.6m. The hydro coefficient for the run-of-river power plants fell to 0.76, or 36 percentage points below the comparative prior-year figure (1.12) and 24 percentage points below the long-term average. However, earnings performance was positively impacted by the higher level of average sales prices achieved for own generation from hydropower, which increased by €3.9/MWh to €117.2/MWh.

Verbund: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (31/07/2025)

kapitalmarkt-stimme.at daily voice: Warum agieren Stiftungsvorstände nur so aktienfern? Und wie wird man eigentlich Stiftungsvorstand?

Bildnachweis

Aktien auf dem Radar:VIG, FACC, RBI, Pierer Mobility, Austriacard Holdings AG, Rosenbauer, DO&CO, Palfinger, Warimpex, Kapsch TrafficCom, Frequentis, Gurktaler AG Stamm, Oberbank AG Stamm, Amag, Flughafen Wien, Österreichische Post, Strabag, Telekom Austria.

Random Partner

CPI Europe AG

Die CPI Europe AG ist ein börsenotierter gewerblicher Immobilienkonzern, der seine Aktivitäten auf die Segmente Einzelhandel und Büro in sieben Kernmärkten in Europa (Österreich, Deutschland, Tschechien, Slowakei, Ungarn, Rumänien und Polen) fokussiert. Zum Kerngeschäft zählen die Bewirtschaftung und die Entwicklung von Immobilien.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten